Solana’s price – How a $160 breakout can help SOL hit $190

- Solana has been extremely volatile over the past month.

- It has bounced from one extreme to the other of a large range, which could help swing traders’ decision-making.

Solana [SOL] saw its first spot ETF approved in Brazil in August and should be launched within a maximum of three months.

This could pave the way for SOL spot ETF approval and trading in other economic superweights like the U.S. and the UK.

Solana also has the lead in the DePIN sector with 78 projects, more than other blockchain networks. Moreover, it was the preferred blockchain for development, and could be pushing past Ethereum [ETH] on this front.

The SOL/ETH price made a new all-time high, further encouraging bulls.

Bullish confluence for Solana

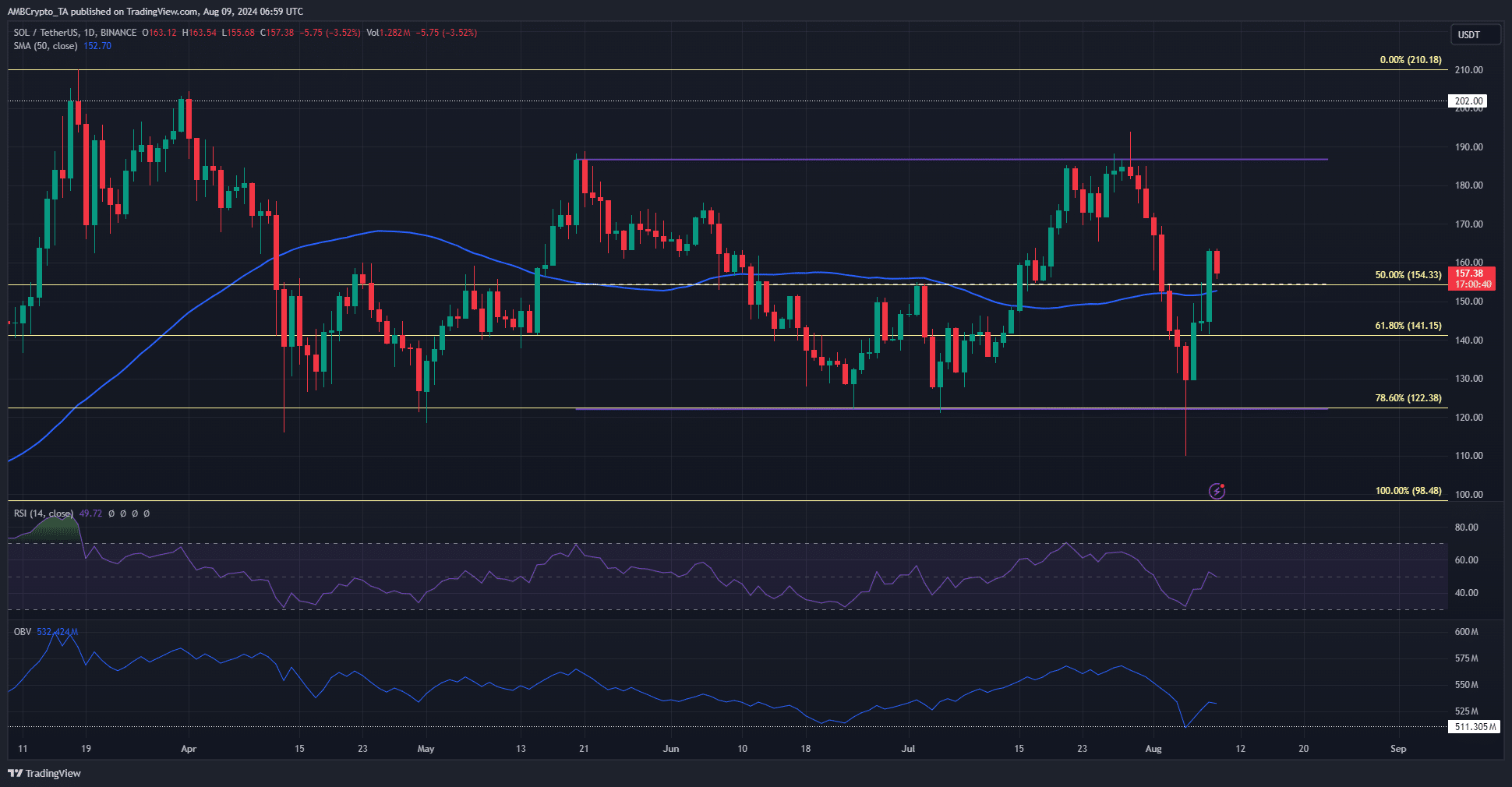

Since May, Solana has traded within a range that extended from $122 to $186, with the mid-point at $154. At press time, the price of Solana was above the mid-range resistance.

Moreover, the 50-day moving average was also breached by the recent move to $160.

The RSI was hovering just below neutral 50, showing a momentum shift was about to occur. However, the OBV reflected the range formation, bouncing from a multi-month support.

This was an indication that buyers were not dominant in recent months. In the coming days, a move to the $190 resistance zone is expected.

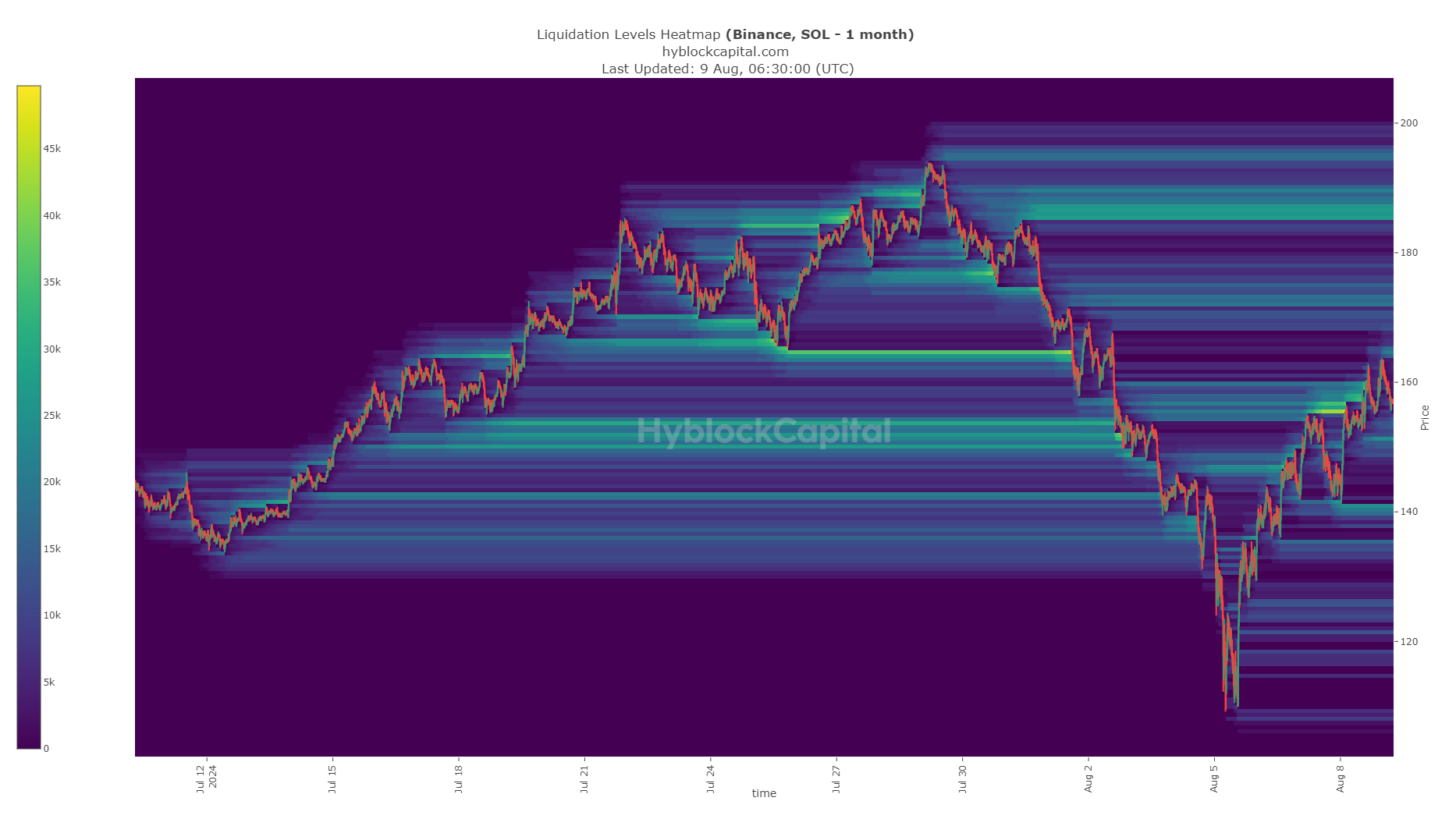

Liquidity clusters underline two potential reversal spots

Source: Hyblock

Is your portfolio green? Check out the SOL Profit Calculator

The 3-month lookback period showed that $164 is likely the next short-term target. Beyond that, the $171-$174 and $185-$189 regions are the next magnetic zones. The latter is a bigger liquidity pool.

Given Solana’s tendency to bounce between the extremes of the range, swing traders can take the $154 retest as a buying opportunity, targeting $185-$189.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.