Solana: How U.S. elections could shape SOL’s trajectory in Q4

- U.S. political developments to play a role in defining the crypto market trajectory in Q4 and beyond.

- SOL and other unproven cryptocurrencies will likely lag ETH and BTC under Harris’s presidency.

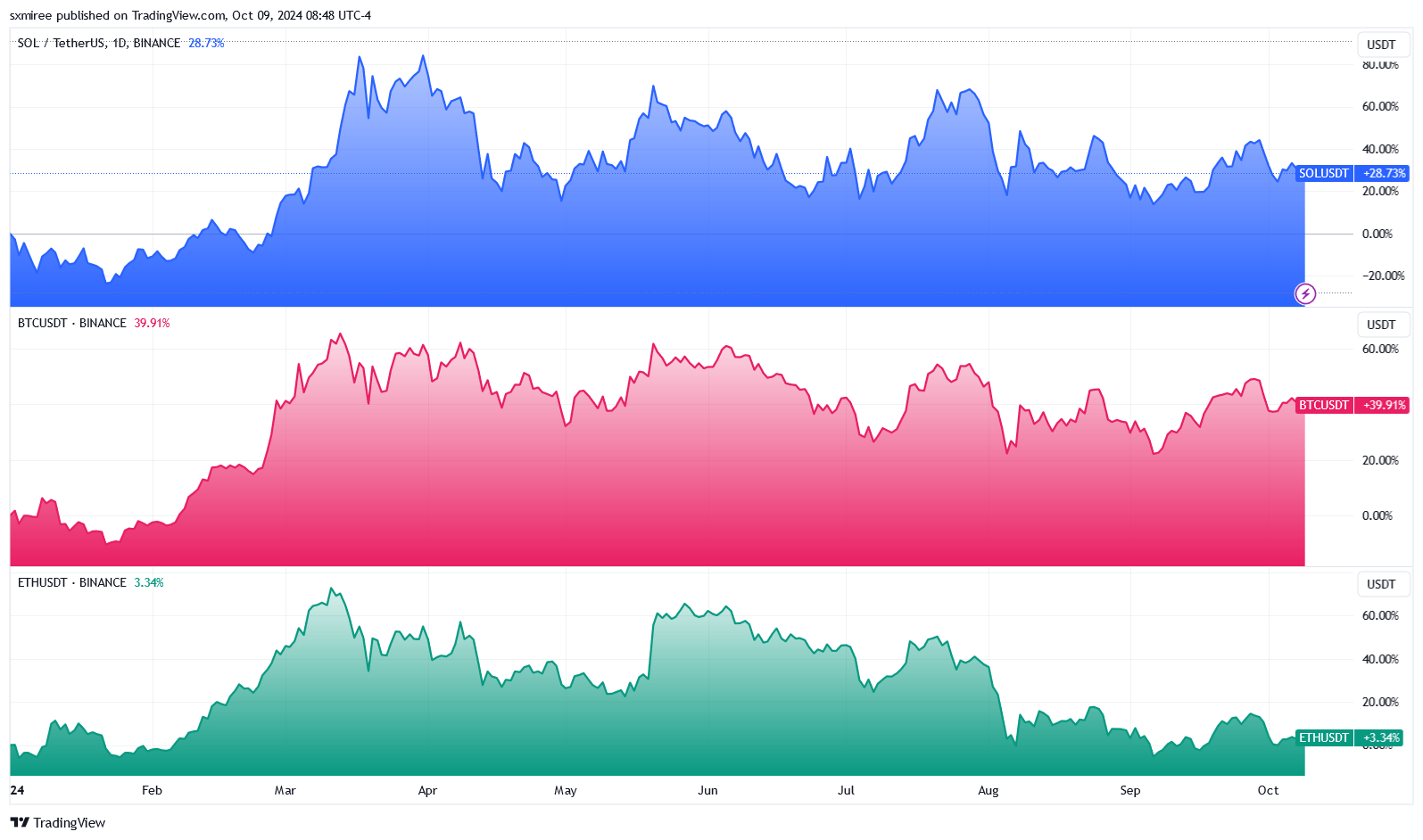

Solana [SOL] has been among the best-performing cryptocurrencies this year, starting the year trading at around $105 before skyrocketing to over $200 in March. Despite losing some traction since then, SOL is up 40% so far this year and could be set for more gains in Q4.

A report compiled by Standard Chartered analysts this week highlighted SOL as one of the cryptocurrencies that could thrive if Republican candidate Donald Trump wins the November U.S. Presidential election.

The analysts, led by the global head of digital assets research, Geoffrey Kendrick, opined that Solana will outperform both Bitcoin and Ethereum in 2025.

In line with this view, the report backed a potential five-fold growth for SOL price by the end of next year. The bank analysts pointed to a more favorable regulatory environment entailing friendlier policies under a Trump administration among the key bullish drivers.

Though the bank expects cryptocurrencies to remain resilient regardless of the election outcome, the report noted that SOL will trail BTC and ETH in spot market performance under Kamala Harris as U.S. President.

The analysts argued that the two leading cryptocurrencies will fare better even in a stricter regulatory landscape owing to their established infrastructure and institutional adoption.

Fundamental analysis paints a mixed picture

While ongoing political developments could play a pivotal role in shaping the SOL price trajectory, on-chain metrics don’t necessarily support the bullish view.

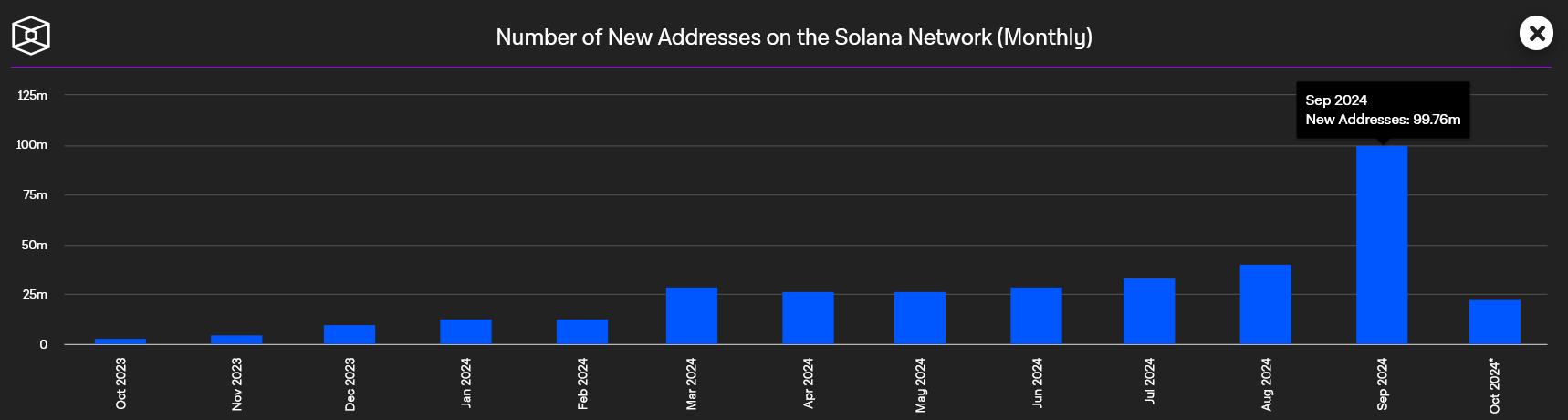

Data from The Block’s Solana dashboard shows the Solana network recorded a staggering 99.76 million new monthly addresses in September, marking a record high.

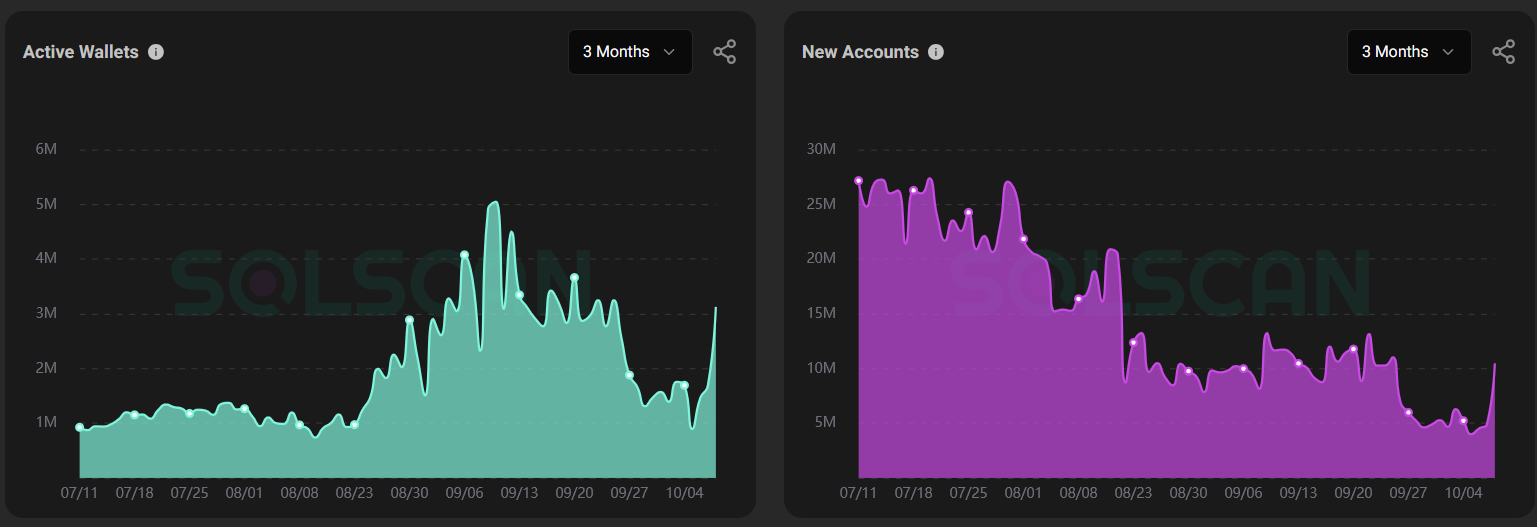

However, according to data from Solscan Explorer, the network has seen a drop in the number of active wallets in the last three weeks after peaking at 5.047 million on September 10.

At the same time, new accounts have also been trending downward in the past two months.

This contrasting trend, which indicates a waning demand among market participants, raises questions about the sustainability of the recent growth in addresses.

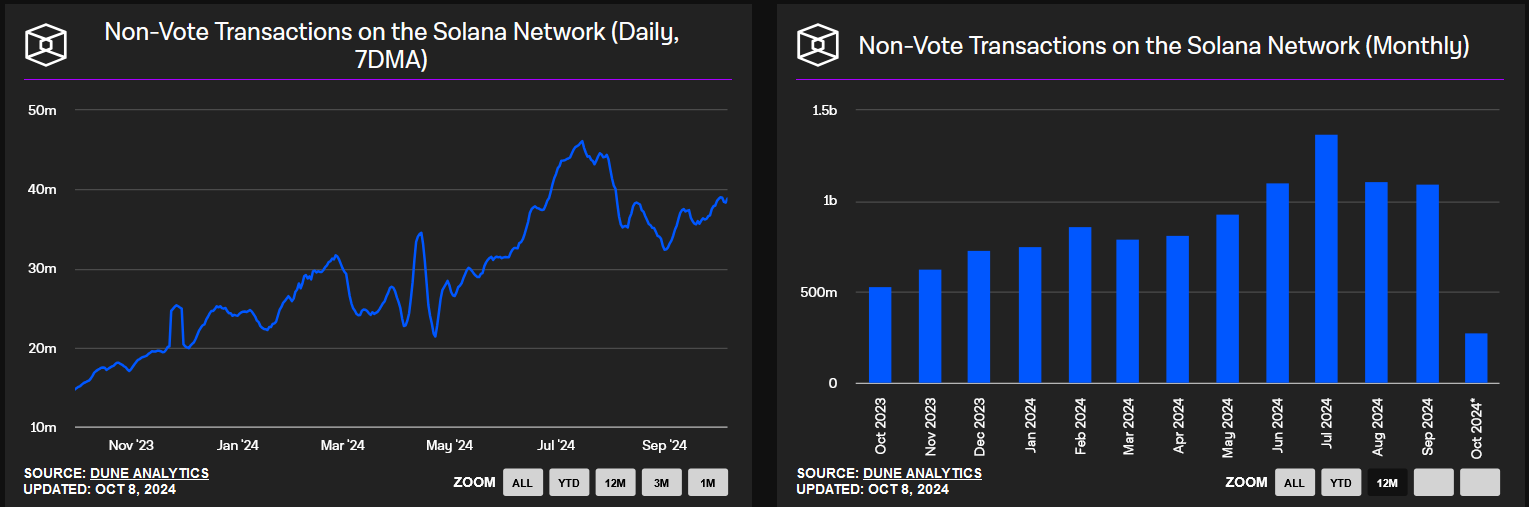

On the other hand, the daily non-vote transactions on the Solana network have also been declining since reaching 46.11 million on July 16. Notably, the daily non-vote transactions figure has remained below 40 million since August 4.

This decline is further reflected in the aggregated monthly non-vote transactions, confirming a slowdown in network activity despite the surge in addresses.

Read Solana’s [SOL] Price Prediction 2024–2025

SOL/USDT technical analysis

Solana (SOL) was trading at $143 at the time of writing, conforming to its recent price action in a narrow range between $120 and $162 since August 5, when the price printed a wick below $110.

Zooming out on TradingView’s SOL/USDT chart, the pair has continued ranging inside a unique pennant pattern that has been coiling for nine months. This flag pattern suggests a significant price movement could be on the horizon in the current quarter.