Solana market cap soars to $117B: Is SOL on track to cross $400 now?

- A recap of the key observations and growth drivers behind Solana’s impressive success.

- Why SOL has a clear chance at rocketing above $400.

There is no doubt that Solana [SOL] has been the most favorite blockchain for many this year. But can it hold on to this lead in 2025, and will it be enough to send its native coin above $400?

Recent analysis placed Solana in the lead as the blockchain ecosystem with the highest global traffic share. In other words, it was the most preferred blockchain network of 2024.

This achievement has paid off handsomely for the Solana network.

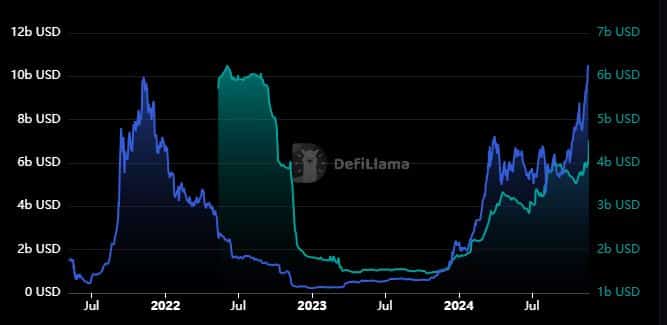

One of the most notable ways is that its total value locked (TVL) not only recovered to 2021 highs, but the TVL recently topped at $10.57 billion on the 19th of November, which marked its new ATH.

Solana’s TVL has also been on an uptrend, and it recently crossed above $4.5 billion. This growth trajectory may continue following the latest integration of Sky Protocol’s USDS stablecoin into the Solana ecosystem.

This move should not only boost the network’s liquidity but also encourage more DeFi activity.

What are the odds of a $400 price tag for SOL?

SOL had a $237 press time price at press time. For context, the cryptocurrency traded at $56 exactly 12 months prior, which puts into perspective just how far it has come during that time.

Nevertheless, Its bullish momentum and recovery in the second half of 2024 and especially in the last three months are notable.

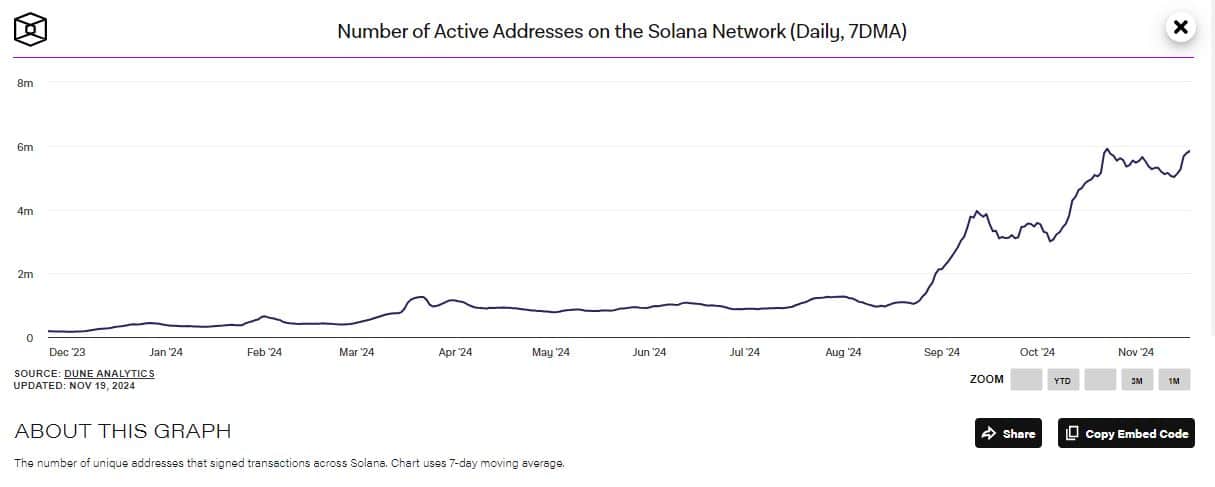

Organic demand has been a major contributor to SOL’s performance and is therefore tied to robust utility in the network. This tracked with the robust address activity observed during the last three months.

The network had less than 1 million daily active addresses during its slowest days in August.

Solana daily active addresses have since soared to above 5.7 million addresses. This was an important observation because it underpins the budding organic demand for SOL.

An outcome that is encouraging to retain and institutional investors, and one that could fuel more demand for the cryptocurrency in the coming months.

Solana has also been rising up the ranks and currently holds the 4th spot in the list of the largest crypto projects/coins by market cap. This was after recently dethroning BNB chain from the position.

Solana’s market cap peaked at $117.15 billion on Monday. It could be on track to dethrone USDT and enter into the top 3 if it maintains the strong growth trajectory.

Based on the above findings and the driving factors behind Solana’s performance, it was clear that SOL has a decent chance at rallying above $400 by the peak of the current cycle.

Read Solana’s [SOL] Price Prediction 2024–2025

On the other hand, nothing is written in stone, and it is possible that liquidity rotation may favor other projects.

If SOL fails to benefit from that rotation, then the chance of attaining the aforementioned price tag might be limited.