Solana may not hit $200 this cycle, even with bullish signs – Why?

- SOL has claimed a victory over its rivals with a 10% weekly surge.

- However, this doesn’t guarantee a break from consolidation.

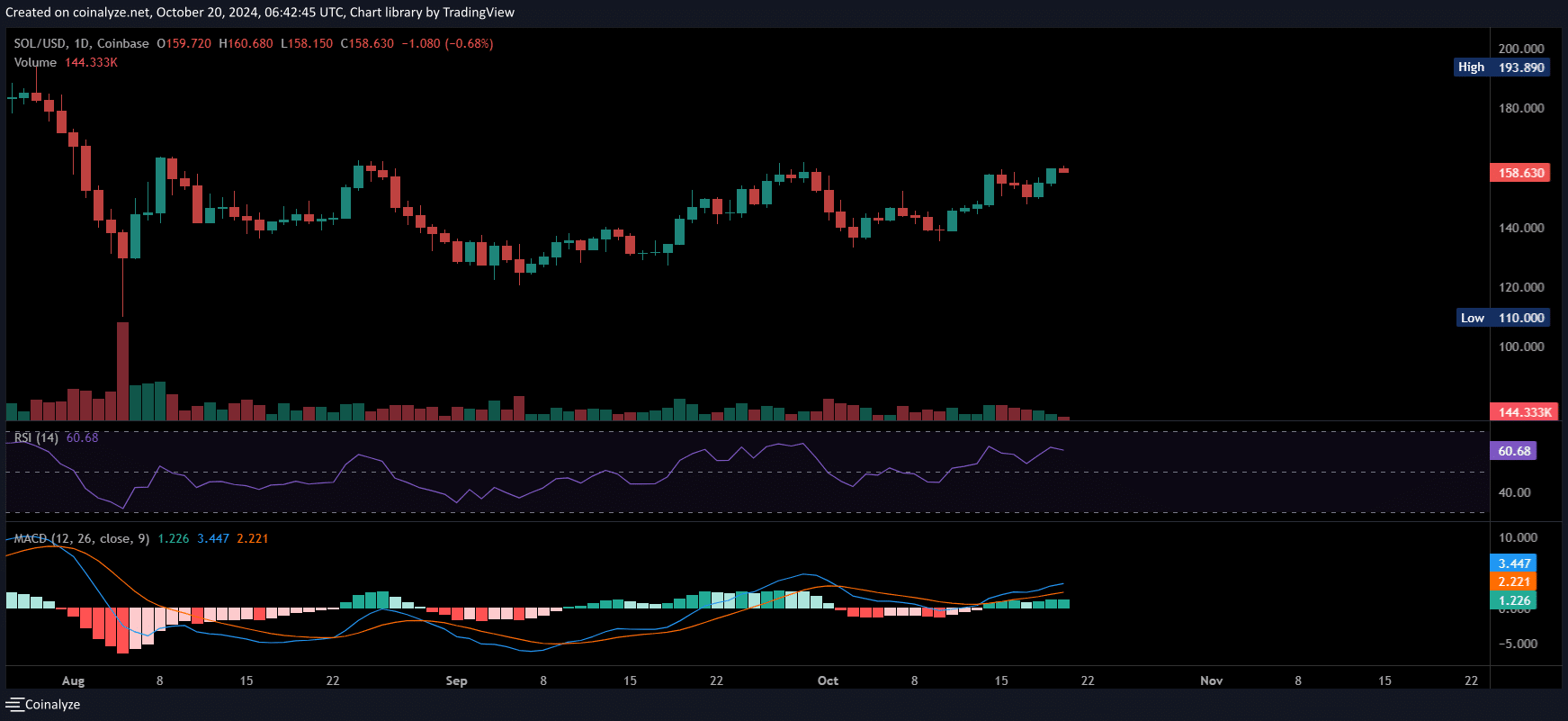

Solana [SOL] has surged nearly 10% this week, bringing it close to the critical $160 resistance level – one it has struggled to break, facing rejection four times in the past three months.

All eyes are now on SOL, as a decisive break above $160 could set the stage for a rally toward the coveted $200 benchmark.

The significance of $160

Solana has been trading in a tight range of $110 to $160 since late July, after closing near $190. Despite Bitcoin’s two bull cycles during this period that pushed it past $66K, SOL has seen minimal capital influx.

Yet, the bulls have shown resilience, preventing SOL from dropping to a new local low. Still, this determination may not be enough to spark an imminent breakout.

To make a real move, SOL needs to break free from this consolidation by overcoming the $160 resistance.

The nearly 10% weekly gain adds to the optimism, especially since SOL has been outperforming many of the top altcoins.

As a result, analysts at AMBCrypto are wondering: could investors be ready to shift capital from BTC to SOL? If that happens, we might just see Solana take off.

Interest in SOL is brewing, but there’s a catch

Built on the idea of being an “Ethereum killer,” Solana has developed a mechanism capable of achieving faster transactions, currently processing over 3,000 TPS.

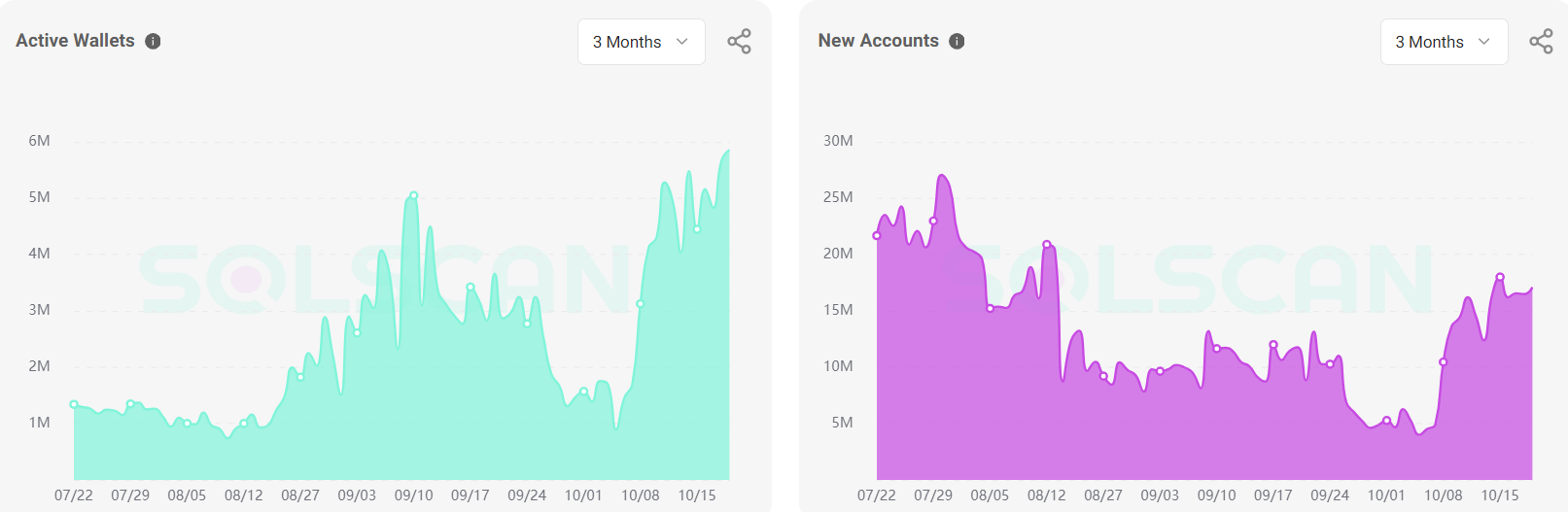

Additionally, after a sloppy end to the September cycle, marked by a dramatic drop in active wallet count from nearly half a million to 800,000 in just two weeks, October has seen a surge in liquidity.

During this time, active wallets reached an ATH.

Surprisingly, despite these milestones, SOL’s price has not reacted as expected. One possible explanation could be a lack of aggressive accumulation by traders, who may not view the current price as a potential bottom.

If this trend doesn’t reverse, the chances for a rebound may falter, marking the fifth consecutive time the $160 resistance remains unchallenged.

An AMBCrypto report highlighted the growing activity in the futures market, with open interest (OI) experiencing a sharp increase to $2.45 billion, establishing a bullish outlook for SOL.

However, this trend also presents a challenge, making SOL more vulnerable to sudden derivative swings that could erode all the gains made over the past week as liquidations get triggered.

Is your portfolio green? Check out the SOL Profit Calculator

Overall, SOL is at a crucial crossroads. Although the recent bullish momentum has kept SOL in the green, it may not be long before the price retraces and consolidates.

This potential pullback is largely due to a lack of aggressive buying from investors, who seem hesitant to view the current price levels as an attractive entry point. Therefore, caution is warranted.