Solana network usage hits record highs – Will this help SOL reach $200?

- Solana daily active addresses have jumped to record highs amid rising DeFi activity.

- Solana DeFi TVL has also reached a 34-month high of $6.48 billion.

Solana [SOL] has gained by 7% in the last seven days and 16% in the last two weeks to trade at $165 at press time.

While the bullish trend across the broader cryptocurrency market aided SOL’s recovery, network growth has also been a catalyst behind the recent gains.

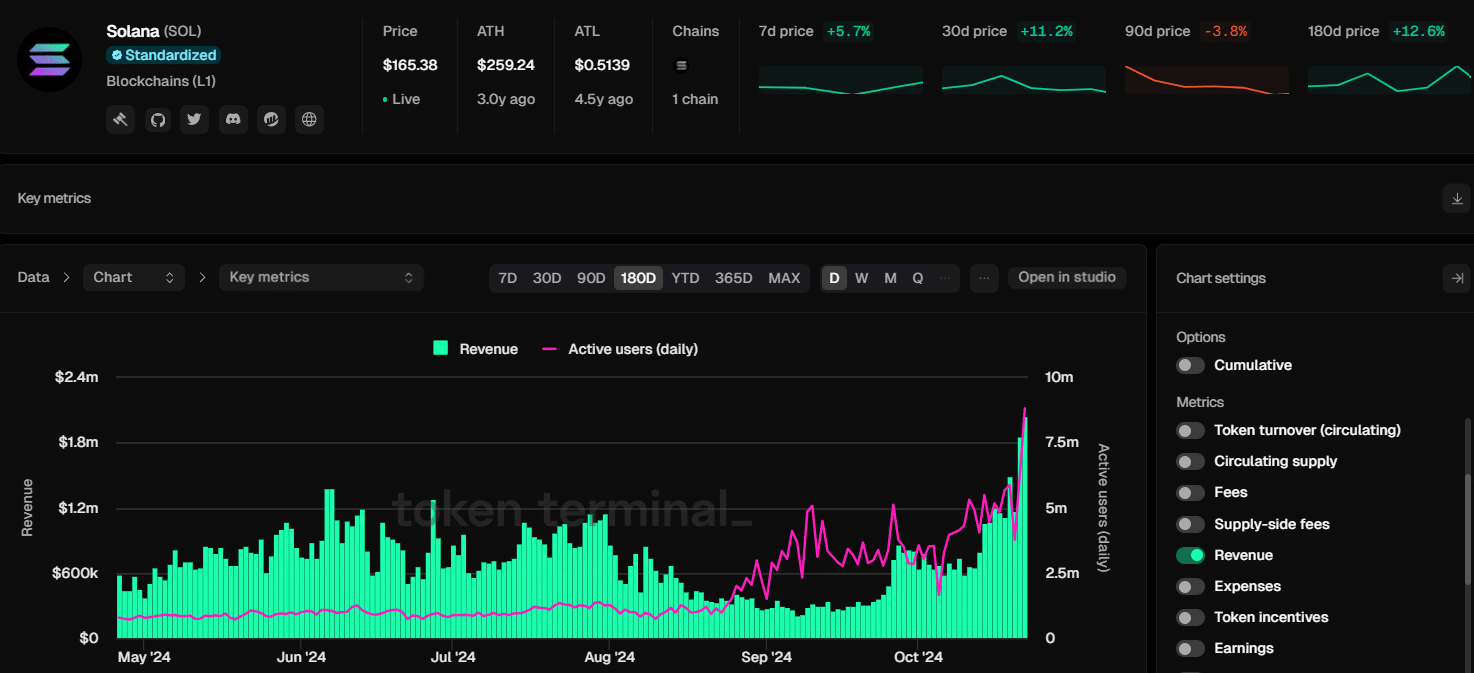

Data from Token Terminal shows that Solana’s daily active addresses have been on a gradual rise, and currently stand at all-time highs.

This shows positive sentiment towards Solana as users trade SOL or interact with the decentralized applications (dApps) created on the blockchain.

The daily revenues on Solana also recently spiked to $2M, the highest level in six months, underscoring the rising demand for the blockchain.

Will Solana flip Tron by DeFi TVL?

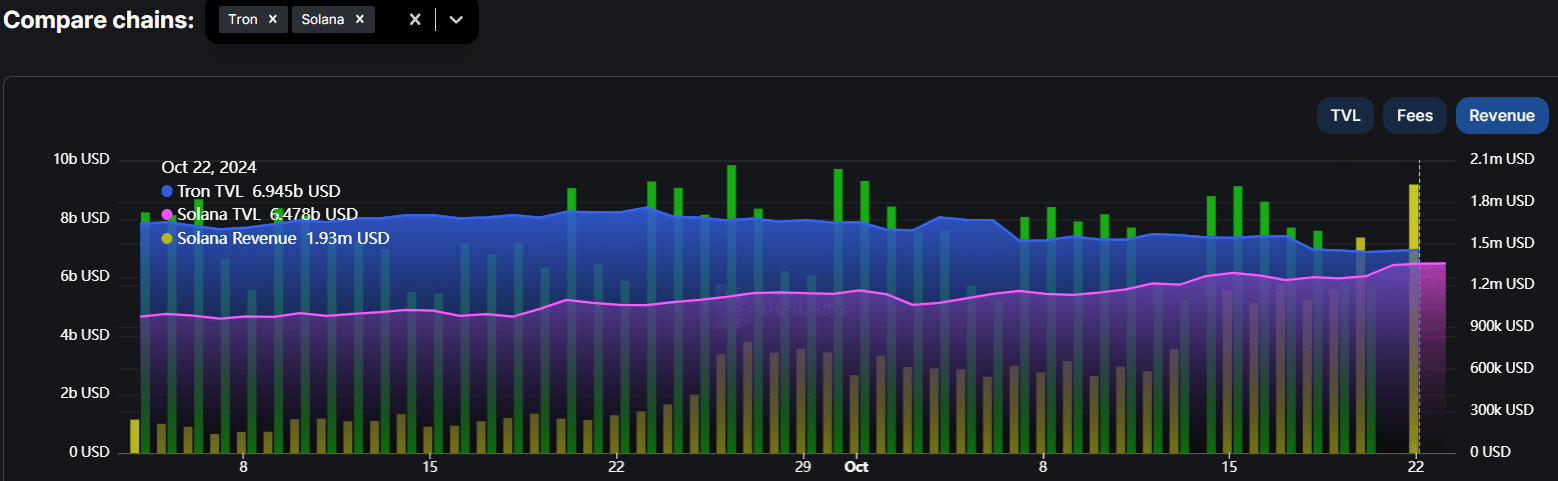

One of the sectors where the Solana network is seeing rising usage is decentralized finance (DeFi). Data from DeFiLlama shows Solana’s DeFi Total Value Locked (TVL) is at a 34-month high of $6.48 billion.

At the same time, Tron (TRX) TVL has dropped to $6.94 billion. If Solana’s TVL continues to increase, the network could flip Tron and become the second-largest blockchain by this metric.

Solana DeFi revenues have also increased to the highest level since March, further showing rising usage.

The growth of a blockchain network is often viewed as bullish and could fuel a price rally. Furthermore, several technical indicators show that despite the recent pullback, SOL’s uptrend is gaining strength.

Technical indicators show bullish signs

At its current price, SOL is 36% shy of its all-time highs, and several bullish signs are aligning that could see SOL break $200 and aim for a new record high.

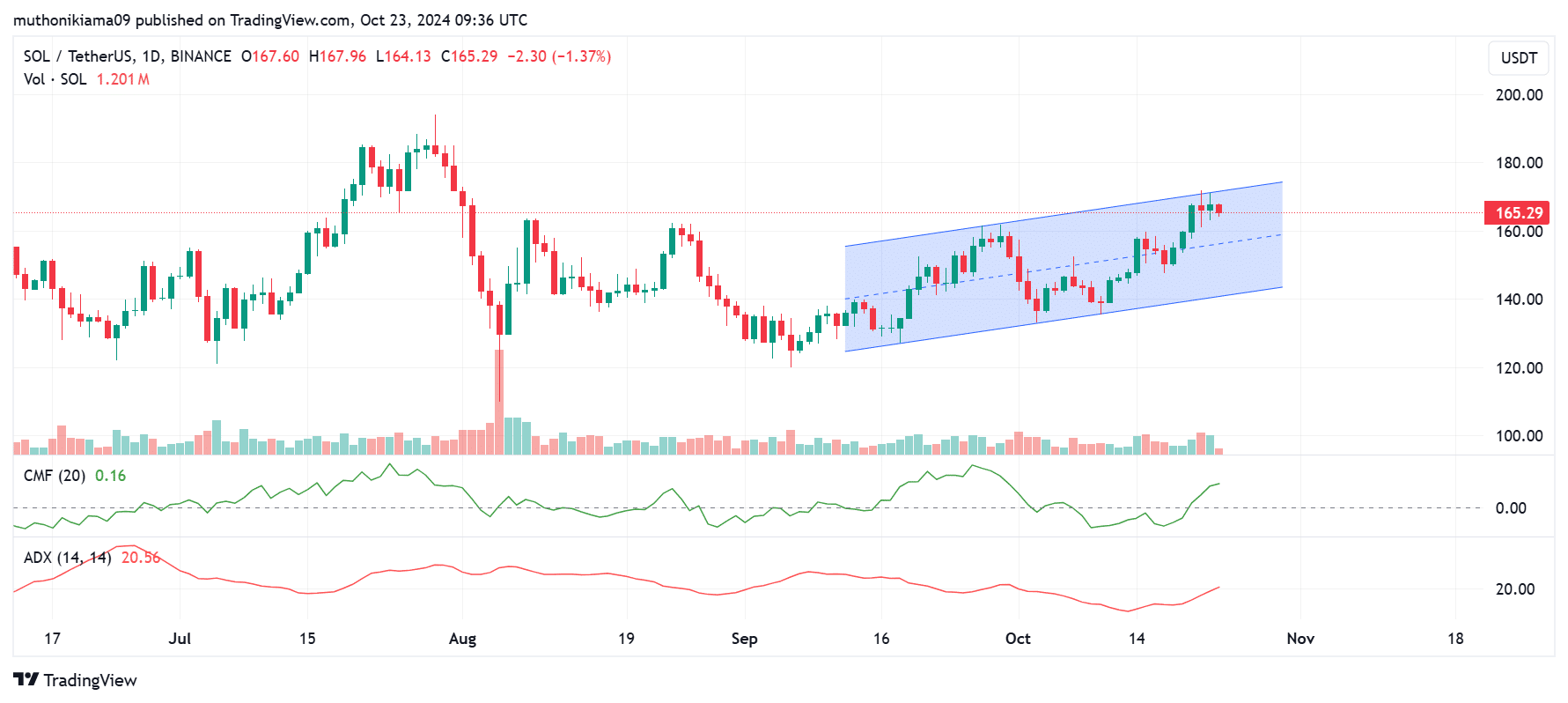

Solana is trading within an ascending parallel channel on the one-day chart, which confirms that a bullish trend is in play.

The altcoin is also facing resistance at the upper trendline showing that sellers booked profits when Solana approached this level.

The Chaikin Money Flow (CMF) is not only positive but has also made a sharp move north. This shows strong bullish momentum as capital inflow to Solana is high.

The Average Directional Index (ADX) is also sloping upwards, an indication that the uptrend is gaining strength.

As these bullish signals align, SOL could aim for the next resistance level at $171. If it flips this level, SOL will have broken out from the ascending parallel channel, paving the way for more gains.

Read Solana’s [SOL] Price Prediction 2024–2025

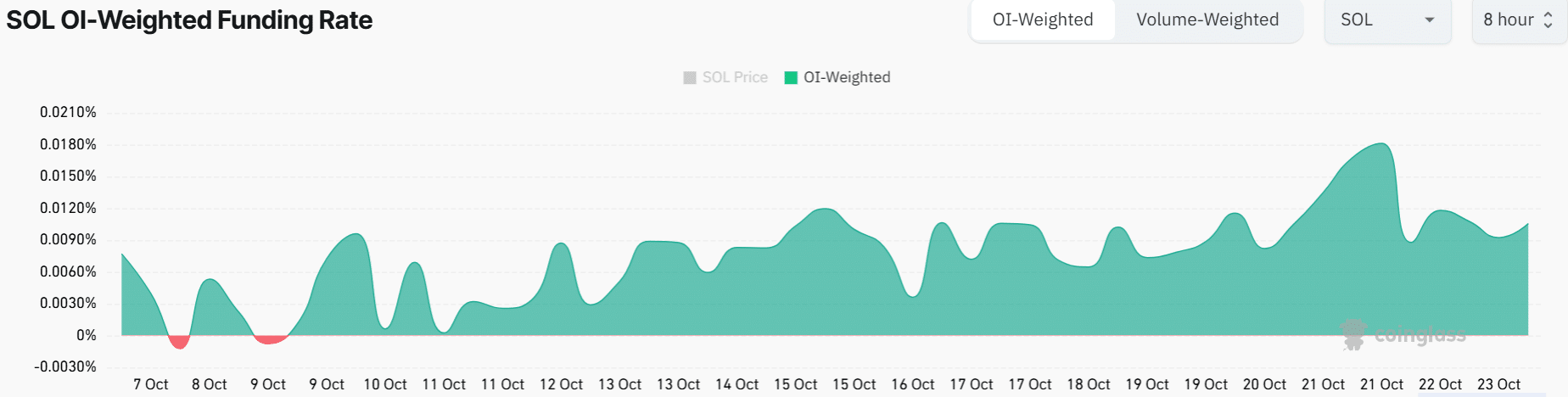

The bullish signs have also drawn the attention of long traders, as Solana Funding Rates have been positive for two weeks.

This shows that long buyers are willing to pay a fee to maintain their positions, which reinforces the bullish thesis.