Altcoin

Solana: NFT ecosystem declines while SOL struggles, more inside

- Solana ranked second on the list of blockchain by total NFT sales volume.

- SOL’s reaction was negative and so was its performance on the metrics front.

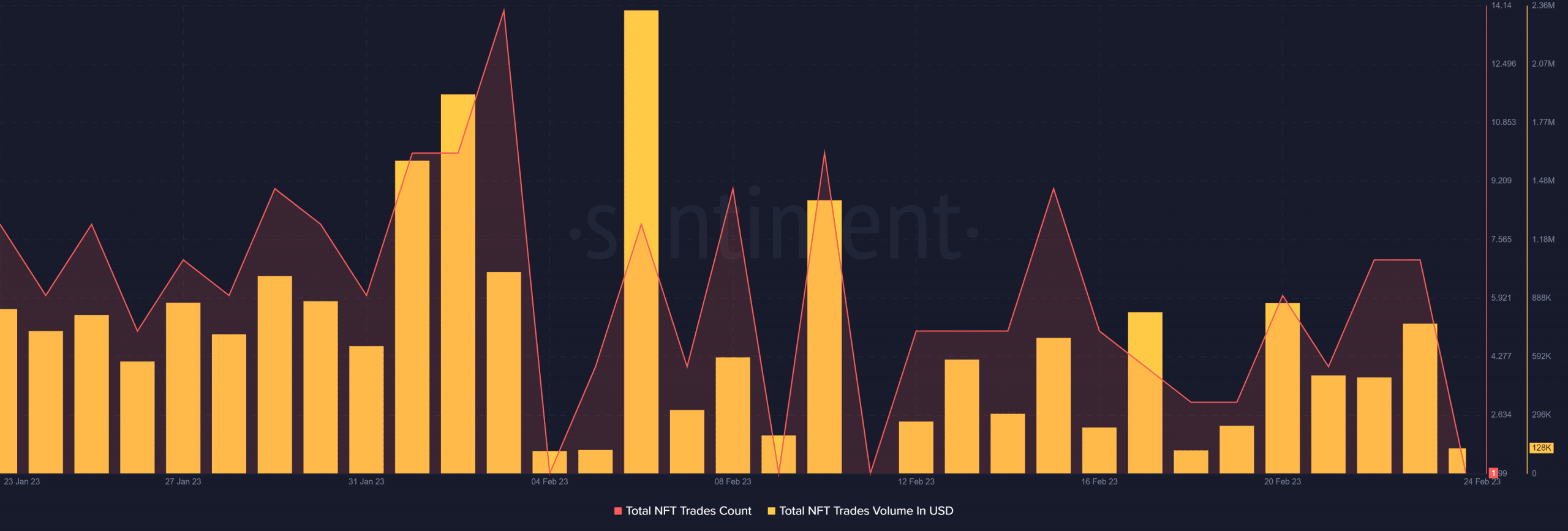

Solana’s [SOL] Non-fungible Token [NFT] ecosystem flashed concerning signals over the last week as it registered a decline. According to Dune Analytics, Solana NFT Marketplace’s daily active users have been on a constant decline since the first week of February. The same trend was shown in Santiment’s chart as Solana’s total NFT trade count and trade volume declined in the last 30 days.

Read Solana’s [SOL] Price Prediction 2023-24

Interestingly, despite registering a decline, Solana remained just behind Ethereum [ETH] in the list of the top blockchains in terms of NFT sales in the last 30 days, with a sales volume of $97 million.

Top 10 Blockchains by NFT Sales Volume Last 30D ?

? $ETH

@ethereum

? $SOL @solana

? $MATIC @polygon$IMX @Immutable$ADA @Cardano$FLOW @flow_blockchain$BNB @binance@Arbitrum$RON @Ronin_Network$WAXP @WAX_io@cryptoslamio #Solana $SOL pic.twitter.com/ixqKCMREbf— Solana Daily (@solana_daily) February 22, 2023

However, in a spot of good news, Solana Mobile announced that it would soon launch a new application that has the potential to fuel the Solana NFT ecosystem’s growth. Solana Mobile launched Minty Fresh, an NFT minting app that allows anyone to seamlessly mint NFTs from their Saga.

SOL is not responding though

While the aforementioned update gave hope for growth in the NFT space, SOL, however, did not respond to it. According to CoinMarketCap, SOL registered a price decline of over 2.8% in the last 24 hours, and at the time of writing, it was trading at $23.78 with a market capitalization of $8.9 billion.

Is your portfolio green? Check the Solana Profit Calculator

A look at SOL’s on-chain metrics gave even more reasons for concern. For instance, SOL’s Binance and DyDx funding rates declined in the last few days, suggesting less demand from the derivatives market. SOL’s development activity also went down over the past week, which was a negative signal for the network.

Not only that, but SOL’s weighted sentiment remained consistently negative, reflecting the investors’ lack of confidence.