Solana offers bullish movement, but buyers remain cautious

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bullish optimism returned as Solana recovered from recent price dips.

- Rising Open Interest strengthened short-term bullish conviction.

Solana [SOL] rode the market’s bullish wave to recover from its recent losses and maintain its uptrend. This came after sellers attempted to flip Solana bearish after a price rejection at the $29 resistance level.

Read Solana’s [SOL] Price Prediction 2023-24

The confluence of the bullish order block and support level at $22 provided a base for buyers to rebound from the bearish price action. With Bitcoin [BTC] trading above $29k and looking bullish, SOL could extend its gains in the short term.

Bullish order block critical to bullish rebound

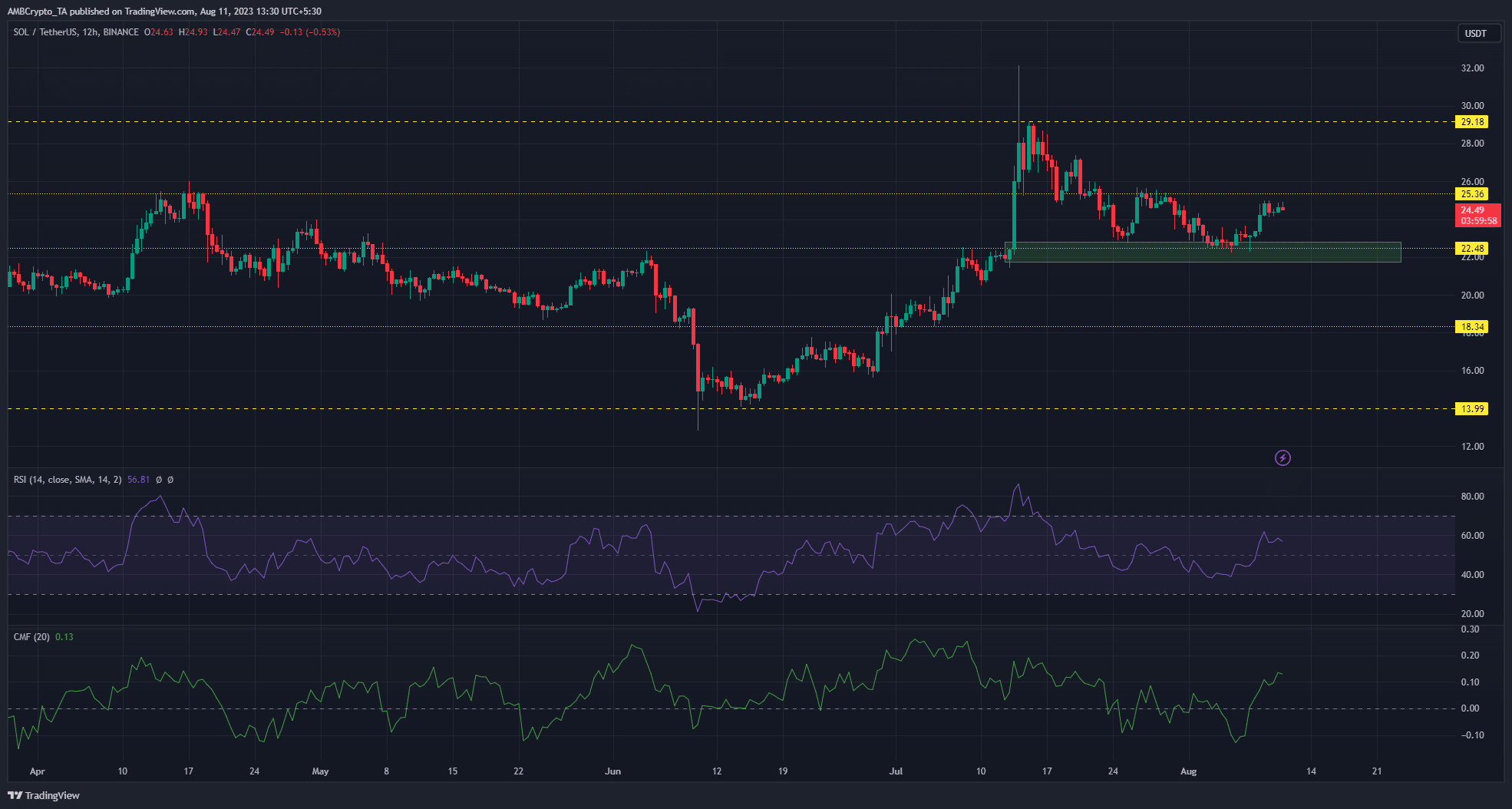

SOL’s retracement from the $29 price level took the altcoin to the bullish order block (OB) of $22. The long-term outlook for Solana highlighted the bullish order block as a critical level if the bulls were to halt the bearish slide and continue the uptrend.

Thus, rallying from the bullish OB has put buyers in good stead. However, a price hurdle lies in the path of further gains. The $25.3 resistance level withstood the previous bullish rally on 26 July and it could pose a familiar challenge to buyers again.

Flipping the level to support could be dependent on BTC maintaining its bullish advance. A pullback to the $29k level would hurt Solana’s chances of pushing past this resistance level. If bulls are able to flip the level, the $27 to $29 price levels could serve as near-term targets.

However, another price rejection at the $25.3 resistance level would see SOL fall into a range formation between $22 to $25.

Meanwhile, the RSI and CMF indicators reiterated the rising bullish sentiment with readings of 58 and +0.13, respectively.

Open Interest responds to price uptick

Is your portfolio green? Check out the Solana Profit Calculator

The Open Interest (OI) data for Solana trended higher on the one-hour timeframe. According to data from Coinalyze, the OI rose by $16 million over the past 24 hours. This revealed a bullish conviction in the futures market.

Similarly, the funding rate was strongly positive, further highlighting the bullish sentiment on the lower timeframes. If SOL successfully closes above $25.3 on the H4 timeframe, it could translate to significant bullish gains in the short term.