Solana onboards new protocol that will allow users to trade real…

- Solana’s newest protocol to offer exposure to real estate.

- Assessing SOL’s short-term potential relative to current market conditions.

Last year’s bear market was a big wake-up call for blockchain networks. It revealed the need to focus on real-world utility and many networks have aligned themselves to explore opportunities within traditional industries.

Solana is the latest one to follow this trend with its push toward the real estate market.

Read Solana [SOL] price prediction 2023-2024

Solana recently confirmed that a new protocol called Parcl just launched on its network. The protocol is a real estate derivatives protocol and is the first of its kind to grace the Solana blockchain.

Just like any other market, prices in the real estate market move up and down depending on demand.

1/? Parcl is the first real estate derivatives protocol, built on @solana — giving you access to global real estate markets

Parcl is launching to select Solana communities that bring immense value to the ecosystem. To gain access, claim your #SOLmate NFThttps://t.co/YY4QNzsSJx

— Parcl ? (@Parcl) February 15, 2023

The new development on Solana will allow derivatives traders to trade derivatives tracking the real estate market. This introduces the possibility of fractional purchases plus the benefits of not having to purchase the underlying assets. In other words, investors can easily get in and out of a position in the market.

This development has the potential to not only boost the utility of the Solana blockchain but also to attract more users.

A potential benefit of the derivatives approach is the ability to execute leverage long and short positions. Enough demand will boost network utility and support the value of SOL in the long term.

SOL’s short-term performance

SOL’s long-term prospects look quite promising especially now that the network is embracing real-world projects. Short-term performance still favors the bulls as has been the case in the last few days. SOL’s price action was up by 19% at its $23.58 press time price.

Although SOL is currently headed for a retest of January resistance levels, the MFI indicates that money is flowing out.

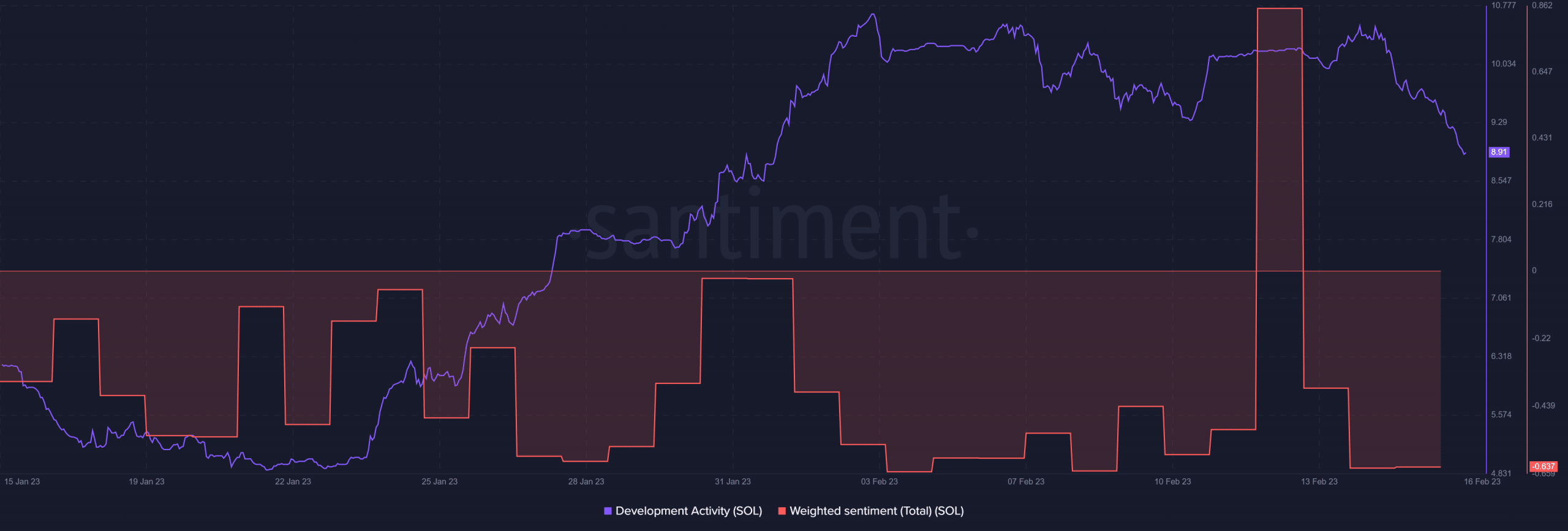

Solana has experienced a significant increase in development activity since the start of the month. However, the development activity has slowed down significantly, especially in the last 24 hours. This may dent investors’ sentiment, thus limiting SOL’s short-term potential.

How many are 1,10,100 SOLs worth today?

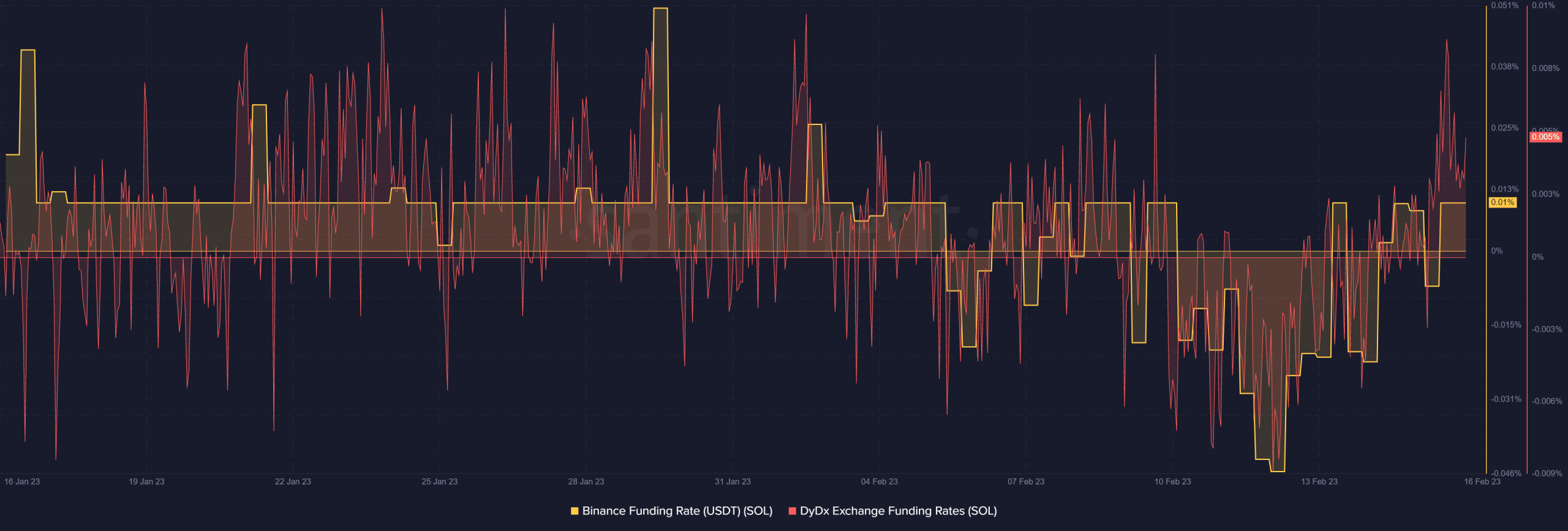

Speaking of market sentiment, Solana’s weighted sentiment dipped to its 4-week lower range this week. On the other hand, the derivatives segment indicates a recovery in derivatives demand for SOL this week. Both the Binance and DYDX funding rates have been on an upward trajectory since 12 February.

In summary, the weighted sentiment and development activity may lend speculative favor to the bears. However, the current market conditions reveal that there is still healthy demand for SOL. In addition, the new protocol highlights Solana’s efforts to boost its DeFi performance.