Solana

Solana outpaces Ethereum with booming NFT trades: What about SOL?

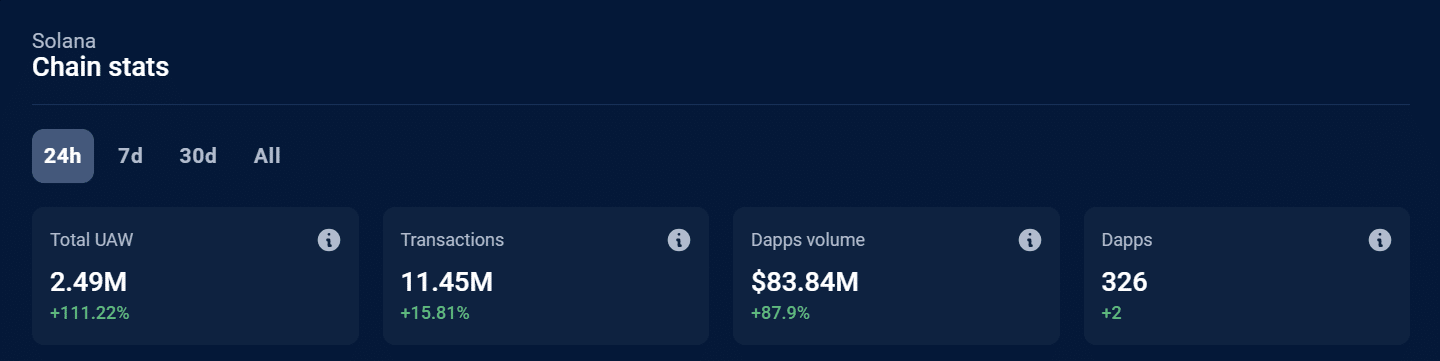

Solana’s daily unique active wallets have jumped by 111% to 2.49M.

- DApp volumes on Solana have jumped by 87% in the last 24 hours per DappRadar.

- The growth comes amid an influx in NFT trading volumes on the platform.

The Solana [SOL] blockchain has seen an over 87% increase in decentralized application (DApp) volumes, likely driven by rising activity on the Tensor non-fungible token (NFT) marketplace.

Data from DappRadar showed that in the last 24 hours, volumes on Solana reached $83 million. Solana was the top gainer by DApp volumes among the top five largest layer 1 blockchains.

The gain is significant given that within the same period, Ethereum [ETH], which is the largest blockchain by DApp volumes, saw a 30% decline. Nevertheless, Ethereum continues to dominate the DApp industry, with $4.56 billion in volumes.

The surge in Solana’s network activity also coincides with an increase in user numbers. Solana’s unique active wallets have jumped by 111% to 2.49 million, while transactions are up 15% to more than 11 million.

NFTs drive Solana’s network growth

NFTs appear to be behind the rise in Solana blockchain volumes.

Magic Eden, the largest NFT marketplace on Solana, has posted an over 600% increase in volumes.The Tensor NFT marketplace also saw a 95% surge in volumes, with the number of users on the marketplace rising by nearly 60%.

The growth comes after Solana NFTs saw $79 million in NFT sales in August, ranking it as the second-largest blockchain by this metric.

How is SOL performing?

Despite the significant growth of the Solana network, SOL price is struggling amid waning demand. Buying pressure remains weak as seen in the Chaikin Money Flow (CMF) indicator, which has a negative value.

However, this index has created a higher high, showing that buyers have been flocking back to the market. It needs to cross over to the positive region to confirm the uptrend.

The weak uptrend is also seen in the Moving Average Convergence Divergence (MACD) line, which is below the signal line. The MACD histogram bars are also red, further showing that bears remain in control.

SOL has tested the support level at $129 several times. For bulls to remain in control, the token needs to hold levels above this price.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Conversely, if the uptrend continues, SOL needs to break the next resistance level at $142 for the price to continue gaining.

Not all protocols created on Solana are gaining. Data from DeFiLlama showed a 12% decline in Total Value Locked (TVL) over the past week. SOL’s TVL has dropped from $5.48 billion to the current $4.8 billion.