Solana posts losses over the past week, but here’s why buyers are interested

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The higher timeframe market structure remained bullish.

- Demand is likely to be seen on a dip to $22.7.

Solana traded within a range formation. Longer-term investors have reasons to be cautious- the asset rests beneath an immense level of resistance at $26. SOL posted enormous gains in January.

Could a pullback be necessary before the next move upward? Lower timeframe analysis showed that $23.5 and $22.5-$22.7 are important to support levels to watch out for.

Read Solana’s Price Prediction 2023-24

Bitcoin also traded above an important zone of support in the $22.3k area. If BTC and SOL are able to defend the outlined levels of support, it was likely both assets will see gains. How high can Solana shoot, if it does breach $26?

Solana falls beneath $23.5- will $20 be next, or $26?

The range that Solana has traded within since mid-January can hold answers for both the bulls and the bears. This range extended from $20.4 to $26.6. The mid-point was at $23.5 and acted as resistance in recent hours of trading.

Therefore, bulls looking to long Solana could be rewarded for their patience. A move back above $23.5-$23.7 on the lower timeframes would be a start.

Even then, the $24 mark is expected to see sellers once more. Hence, buyers can look to wait for a breach of $24 and its retest as support before buying.

Is your portfolio green? Check the Solana Profit Calculator

The entire region from $26-$27 is resistance as well. Any buys from the $24 area can look to take profit there. The $26 zone, in particular, served as support from May to November. Furthermore, there was a bearish breaker that extended up to $29.5.

Owing to the constriction of SOL beneath a hugely significant level at $26 over the past two weeks, a breakout upwards is likely to be volatile.

A surge above $29.5 could be quick. In that scenario, the next band of resistance lies at the daily bearish order block in the $35 area. It extended from $34-$38.8.

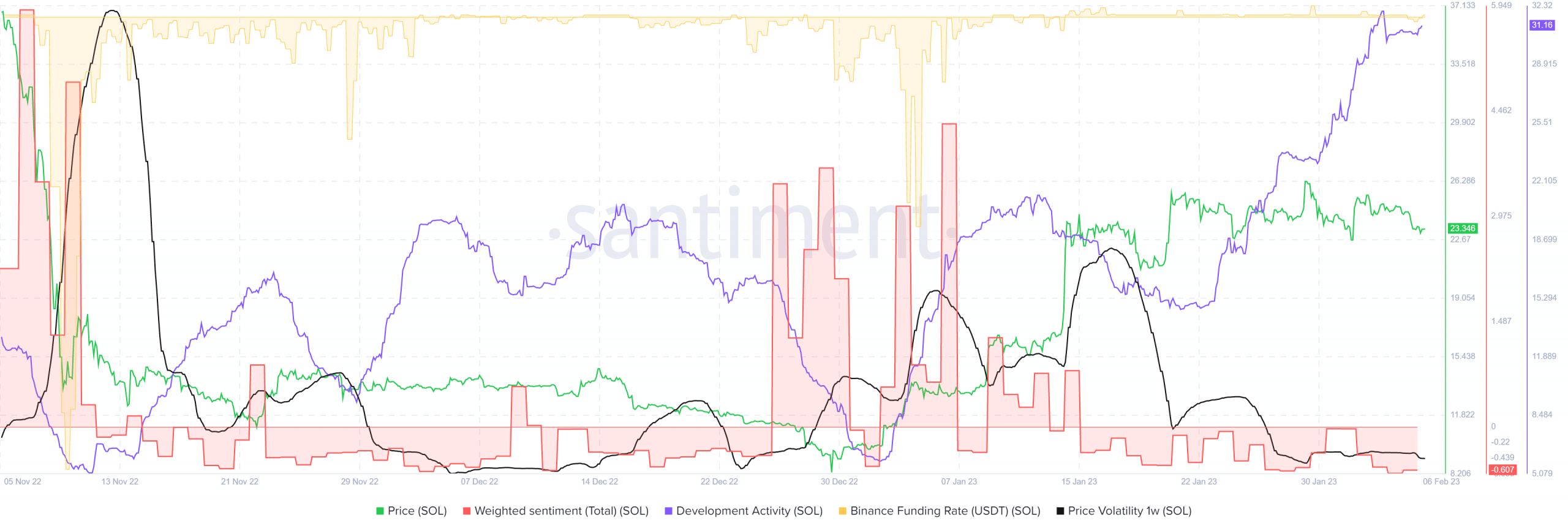

The fall in price volatility indicates a major move is likely to follow

Source: Santiment

A violent expansion follows an extended period of constriction. However, the price of Solana has not been constricted for a long period. The range formation itself is only a month old. The fall in the 1-week price volatility indicates that whether Solana leans bearish or bullish, a sharp move is not far away.

The funding rate picked itself back above the zero level after the losses over the weekend. On the other hand, the weighted sentiment was negative. The rising development activity will give heart to long-term investors. Even during the sell-off in mid-December, this metric did not slack.