Solana price prediction – Mapping SOL’s short-term targets for traders

- Despite SOL’s recent gains, the altcoin is still down 20% over the past month

- Trading volume seemed steady, meaning traders are waiting to see what happens before making big moves

Solana’s price has bounced back over the last 24 hours, but traders are still unsure about what comes next. At the time of writing, SOL was trading at $138 on the charts, up by 5.87%.

Despite its recent gains, however, the altcoin was still down 20% for the month – A sign that the market has been shaky.

Solana’s price bounced back from $128.49, flashing some short-term strength. Even so, it’s now struggling to break $140 – A level where sellers keep pushing it down. If SOL moves above $140 and stays there, it could mean traders are turning more positive.

Solana’s market struggles – Will the rally continue?

While there have been some signs of recovery, other metrics hinted that it may be too soon to say anything. Here, it’s worth pointing out that Solana’s trading volume shot up by 130.42% to $3.33 billion, meaning more people are buying and selling.

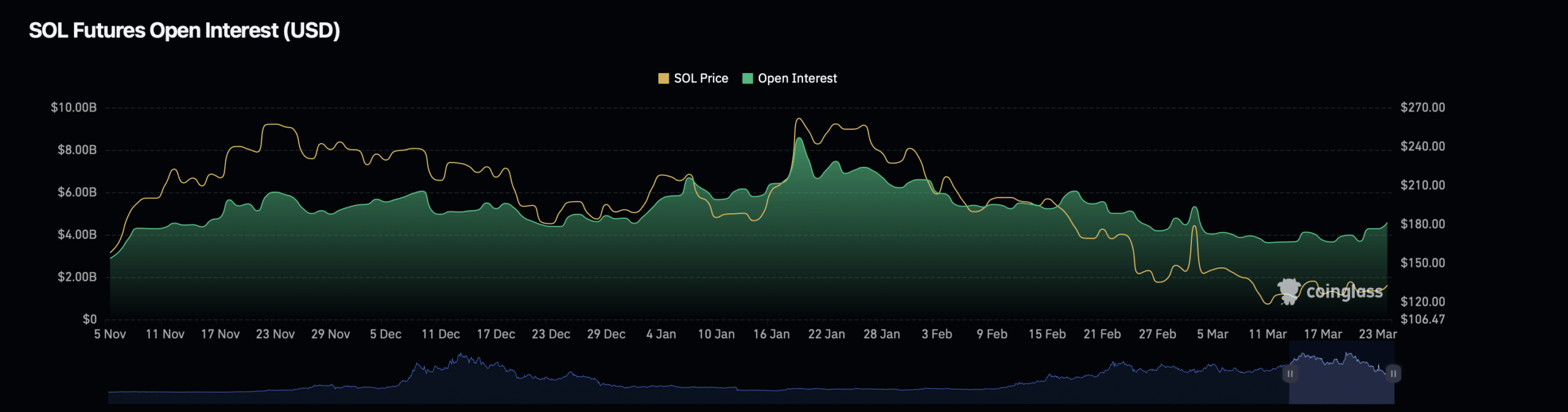

At the same time, Coinglass data revealed that more traders are betting on Solana’s future price. The total money in Solana Futures is now $5.25 billion, up 11.01%. This means that more people are taking risks with leveraged trades.

This hike in Open Interest can either support further price growth or trigger sharp corrections if liquidation events occur.

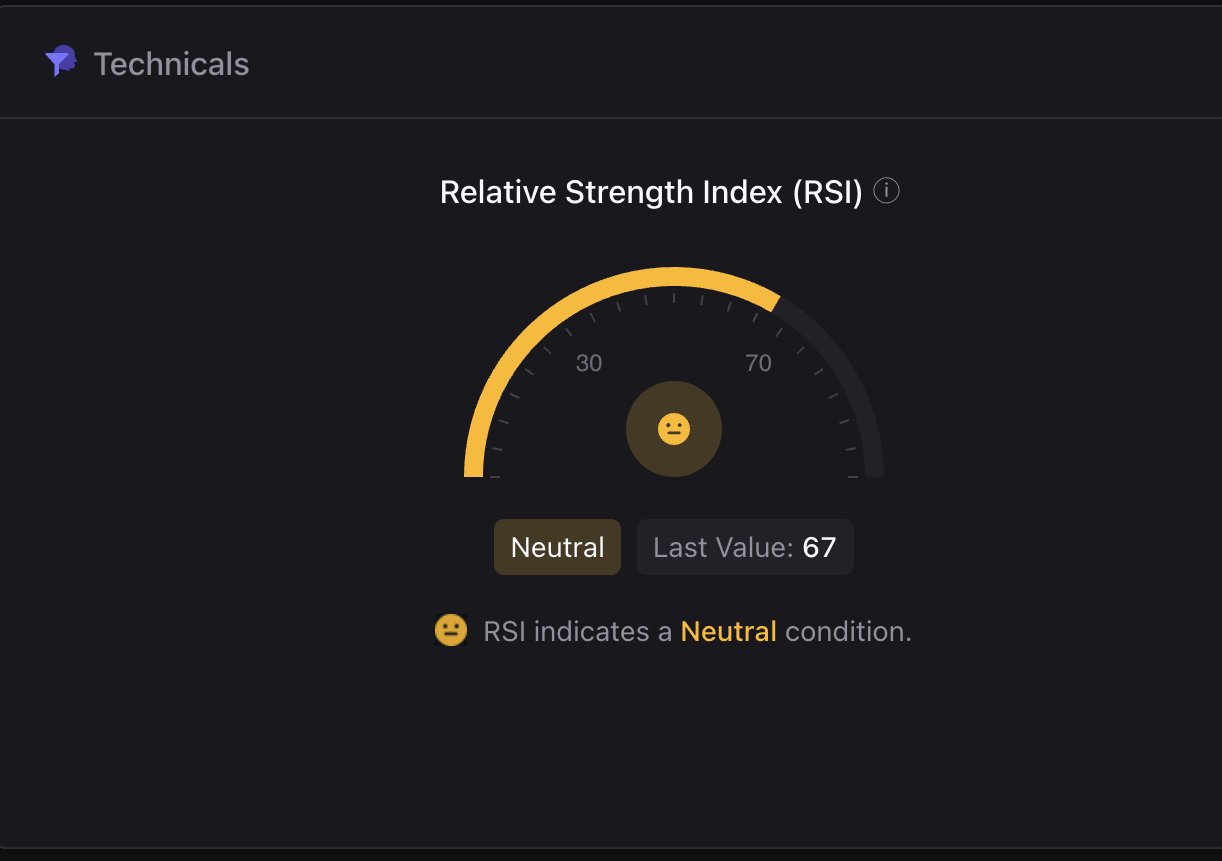

Meanwhile, CryptoQuant indicated that SOL’s RSI stood at 67, placing SOL in a neutral zone. While the token may not yet be overbought, it has been approaching levels where selling pressure could increase.

If the RSI (a measure of how fast the price is moving) goes over 70, it might mean Solana is overbought, which could lead to a small drop. However, if the RSI stays the same or moves down, the price might just take a break before making its next move.

Are Solana’s active users supporting the price?

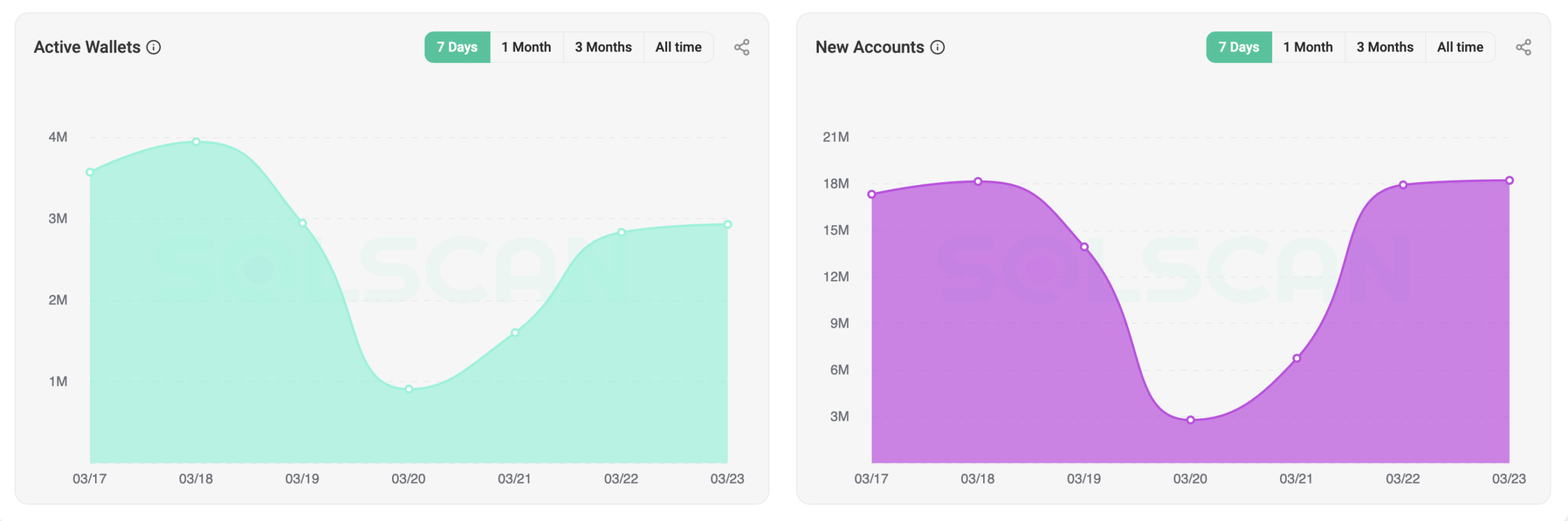

One big factor in Solana’s price is how many people are using the network. Over the past week, the number of active wallets dropped to 1 million on 20 March, before jumping back up to 3 million by 23 March.

More users could mean more demand, which might help keep the price strong.

Similarly, new wallet creation dropped significantly around 19-20 March, but rebounded over the last few days.

What’s next for SOL?

For Solana to keep going up, it needs to break past $140 on the back of strong trading volume. The 130% jump in trading volume is a good sign, but if buyers slow down, SOL might struggle to stay at this level and it could drop again.

If traders stay active, the RSI keeps rising, and more people use Solana, the price could keep climbing towards the next resistance level.

The next few days are important. Solana will either hold strong or face selling pressure that pushes it back down.