Solana price prediction: What’s next as SOL stalls below $150?

- SOL has been consolidating below the 200-day Moving Average.

- Whales have placed nearly $3.5M sell orders for SOL at $150 at the time of writing.

After the bull trap seen in early August, Solana’s [SOL] price has remained eerily stable. It has failed to mount above $150 and has been consolidating below the level for over a week.

The altcoin has remained bearish on the price charts, with the recent withdrawal of U.S. spot SOL ETF filings further denting sentiment.

Given that it’s one of the top darlings of this market cycle, what’s next for the altcoin?

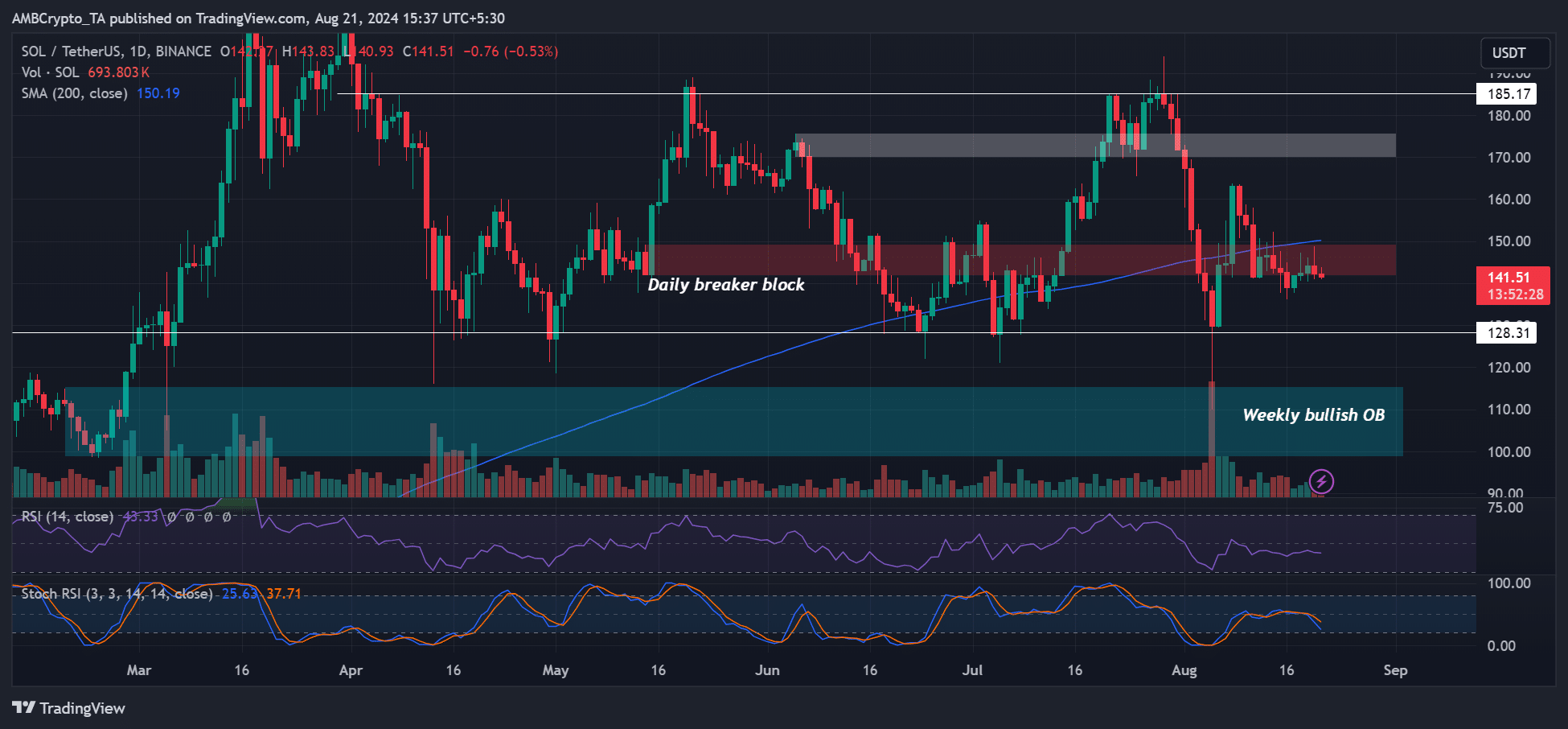

SOL struggles below 200-day SMA

On the daily chart, the $150 was an intense short-term sell pressure for SOL. Notably, the 200-day SMA (Simple Moving Average) and a daily breaker block (red) aligned at $150.

Put differently, the $150 was a crucial supply zone in the short-term.

In fact, SOL has struggled below this confluence level for over a week. This meant that $150 has been critical for taking profits, especially for long-term holders with unrealized gains.

Put differently, sellers had market leverage on SOL at the time of writing.

As shown by the sideways movement of the RSI (Relative Strength Index) below average level, the flat demand further illustrated the sellers’ edge.

SOL: A short-seller’s paradise?

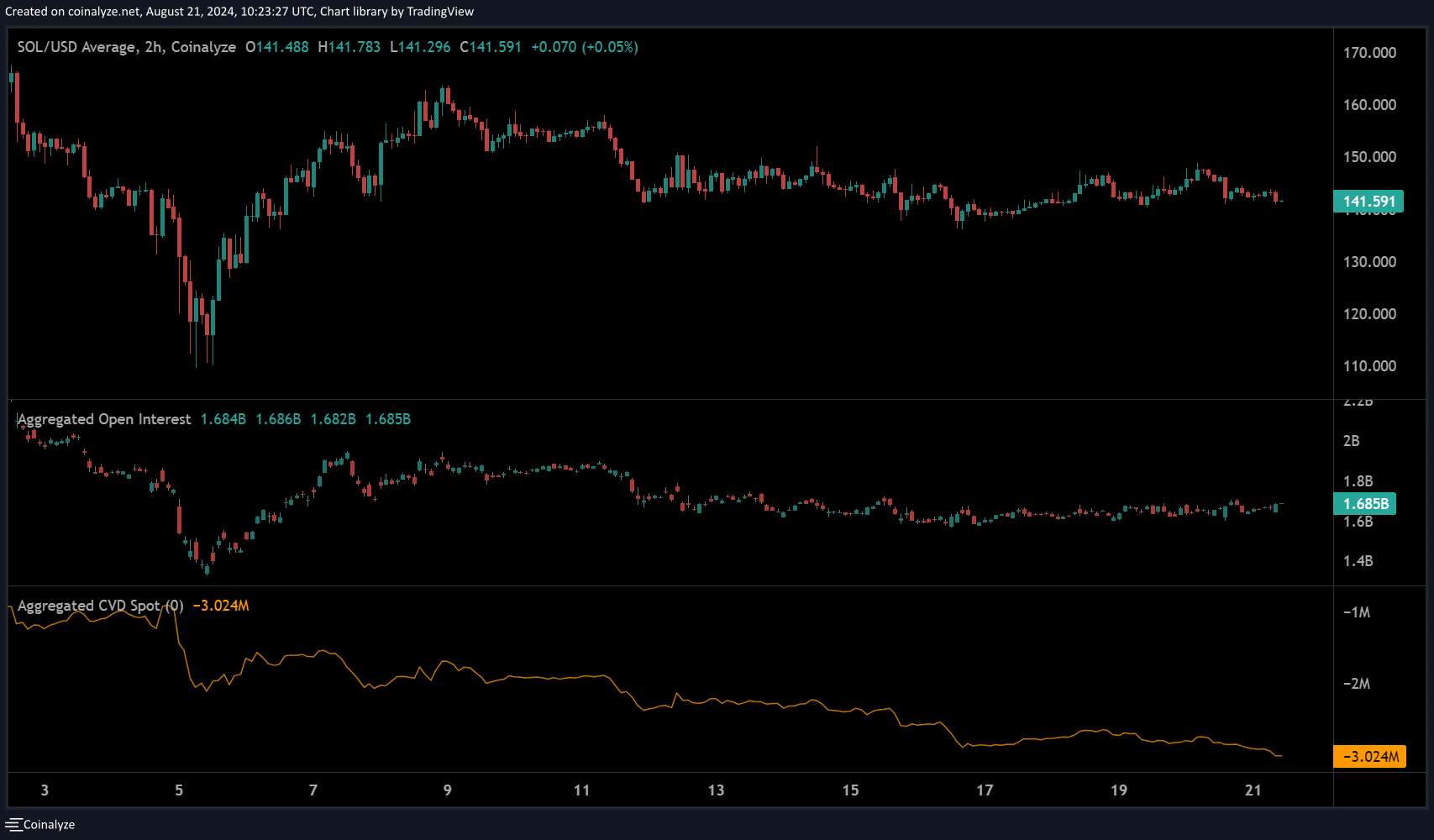

The spot CVD (Cumulative Volume Delta), which tracks buy vs. sell volume across exchanges, declined in August.

The downward trend indicated that SOL had been overwhelmingly under sell-side pressure—a perfect set-up for a short-seller’s paradise.

In the meantime, SOL’s Open Interest (OI) rates have been flat, suggesting that even the demand for the altcoin in derivatives markets has stagnated in the past few days.

This also means a neutral market sentiment; as such, SOL’s price could go in either direction.

However, unless Bitcoin [BTC] reclaims $60K and rallies further, the $150 was the crucial hurdle for SOL to clear in the short term.

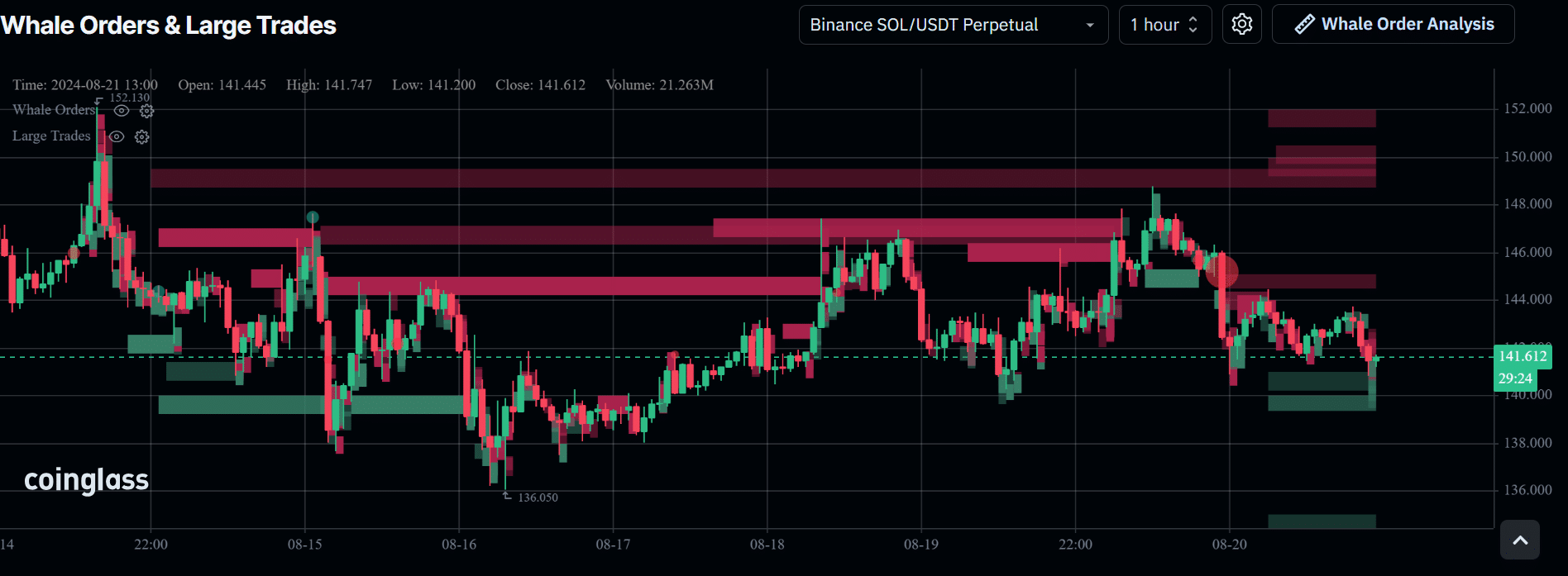

AMBCrypto’s evaluation of Coinglass’ whale order analysis revealed that, in the past 24 hours, about $3.5 million SOL was placed for sale at $150 (the sale wall marked in red).

Read Solana’s [SOL] Price Prediction 2024-2025

Another sell order was placed at $152, reinforcing that the 200-day SMA was a massive supply zone.

On the lower side, a $1M buy order for SOL was placed between $139 and $140. In short, SOL’s price could be constricted between $140 and $150 in the short term.