Solana

Solana price prediction: Will the third move towards $190 be lucky for SOL bulls?

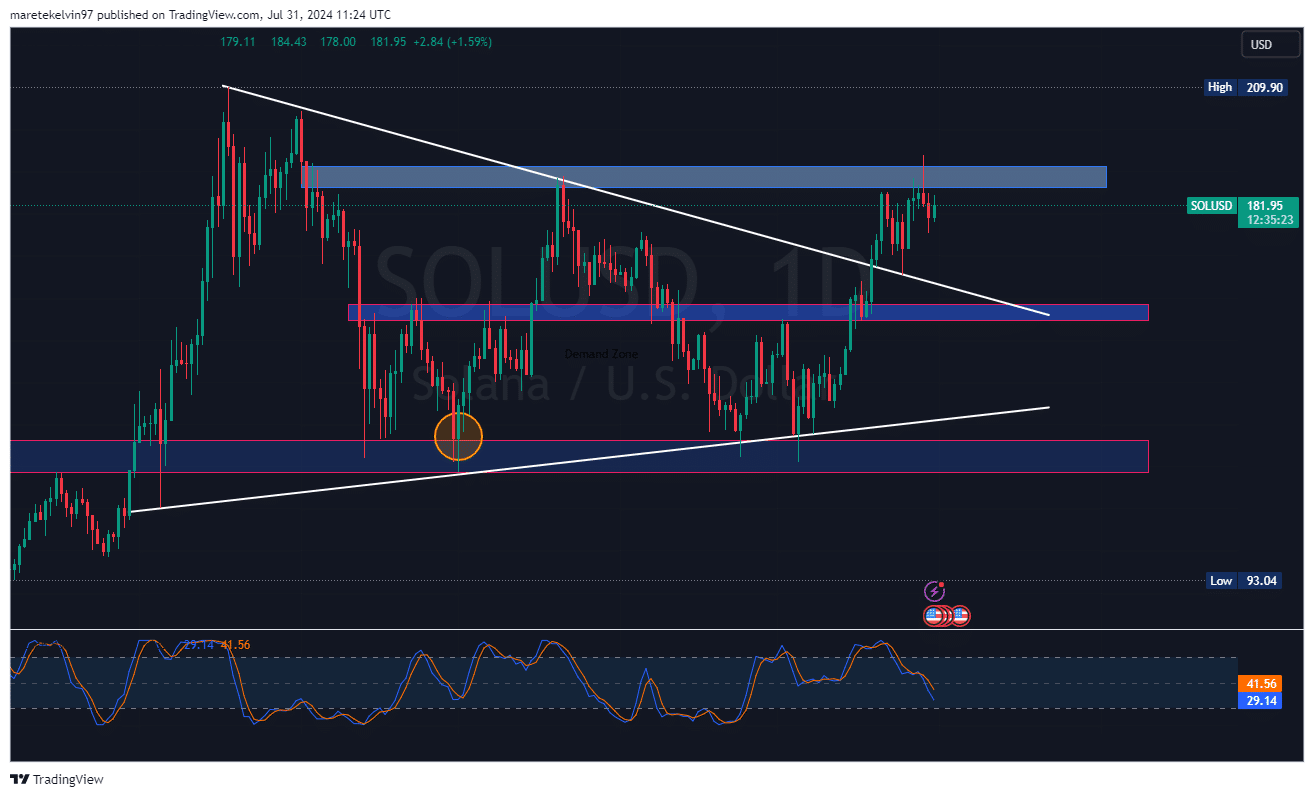

Solana is building bullish momentum towards the $190 key resistance level.

- Solana was rejected twice at the $190 resistance level.

- Metrics indicated mixed signals.

Solana [SOL] has been making waves in the crypto world, but its latest movements around the $190 mark have made traders extremely worried.

$190 is considered to be a very important barrier for Solana. It has failed to overcome it twice this week. Will the third time be lucky for bulls looking to make an impact?

Sellers have become active every time the price reaches this area, pushing it back down. This level is significant-both from a technical and a psychological perspective—as demonstrated by continuous rejections.

The $190 resistance level has proven to be a tough barrier.

What the metrics have in store

AMBCrypto analyzed Coinglass’ liquidation heatmap data.

Analysis of the data showed that there was huge potential for liquidation as prices near $190; possibly leading to a higher level of volatility due to the closure of these positions.

At the same time, the Funding Rate painted a mixture of sentiments in the market.

While there are some exchanges that have positive Funding Rates, others have turned negative, indicating uncertainty among Solana investors.

AMBCrypto further analyzed the SOL’s Long/Short Ratio Chart via Coinglass, which showed a recent spike.

This suggested that Solana bulls were taking control of the market in the short term. If the momentum is enough to break above the resistance level, then the market tone may change to bullish.

The path ahead for Solana

The crypto community waits eagerly as Solana nears the $190 resistance level for the third time.

Realistic or not, here’s SOL’s market cap in BTC’s terms

From AMBCrypto’s analysis, Solana has seen a number of indicators displaying conflicting signals, although bullish momentum was gathering ample force at the time of this writing.

While bullish momentum continued to build, mixed signals from various indicators could make the outcome uncertain.