Solana prices dive 42% within a week, will there be a quick recovery

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Solana registered large losses in the market in recent days.

- The lower timeframes showed extreme volatility and risk-averse traders can stay away from SOL in the coming days.

Another day, another market-wide nuke. Welcome to the crypto space, where a 25% price drop genuinely represents a long-term buying opportunity. The argument behind a Solana recovery is the degree of decentralization of the network. Development activity was at six-month highs as well, according to Santiment data.

Realistic or not, here’s SOL’s market cap in BTC terms

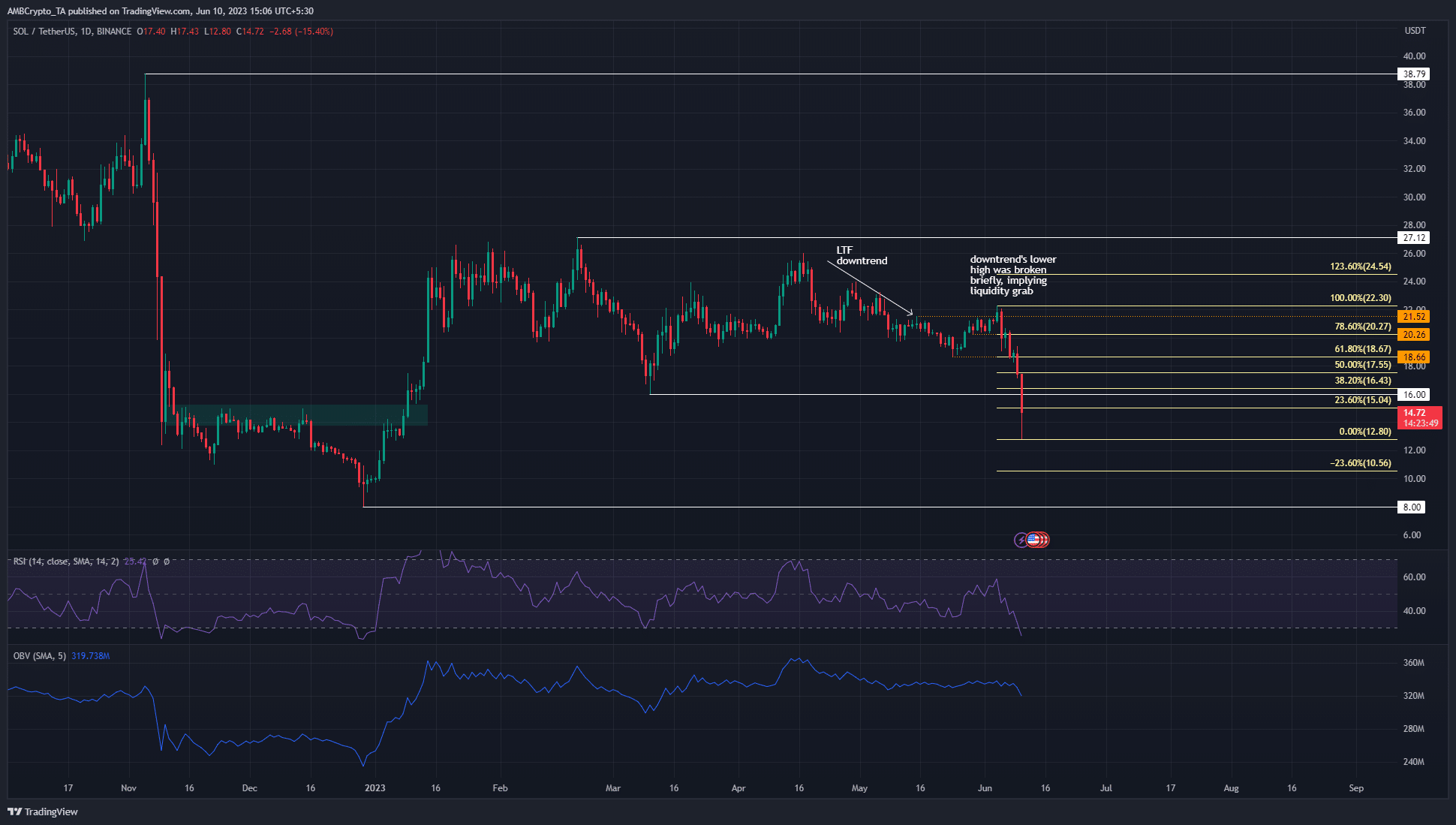

Yet, the technical structure was bleak for the bulls on the higher timeframes. Solana has been in a lower timeframe downtrend since late April. Can the bulls defend the support zone at $14.8 or will further bad news drag the market lower?

November’s resistance can serve as support for SOL- but it could be a temporary respite

After huge news like the SEC branding SOL a security, the market is likely to take a while to assess the true damage done. If the market concludes that the initial sell-off was an overreaction, prices will eventually climb higher.

This was a possibility, but the why and how of market movement are beyond technical analysis. From a technical standpoint, we find that the $13.8-$15.3 zone was a strong resistance back in November, during the FTX implosion. It was breached during the early 2023 rally.

Hence, it was likely to act as support on the way down. Yet it was still highly likely that Solana could test the $10.56 level and possibly drop to 1-digit prices like December 2022. The RSI and OBV showed intense bearish pressure.

The Fibonacci retracement levels highlighted $16.4, $17.55, and $18.67 as places where a Solana bounce could end. The $16 level represented a significant low from March, and could be retested before another downward move.

Long liquidations fuel downward surge

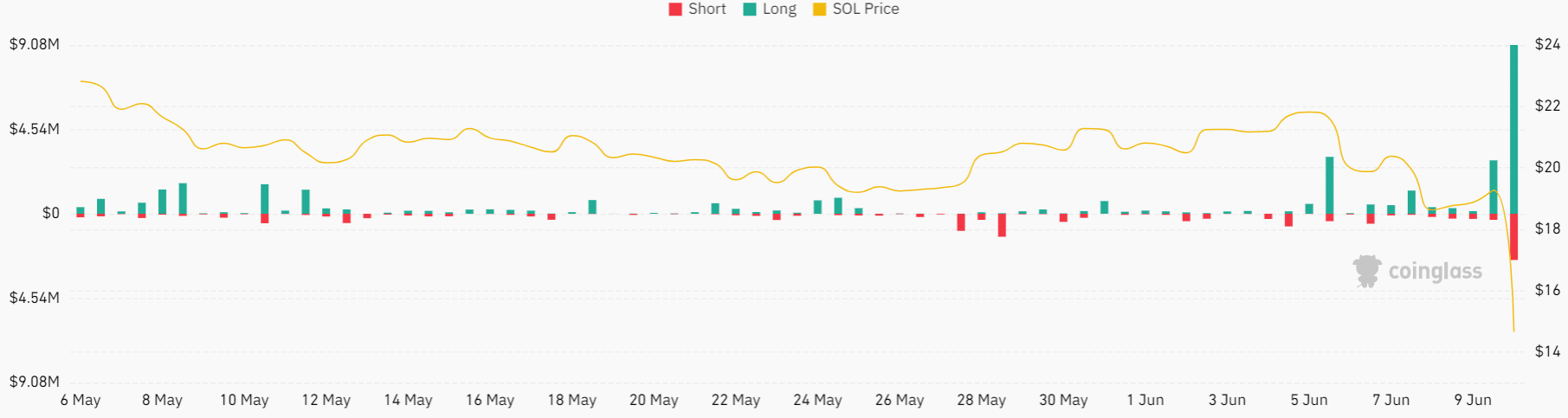

Source: Coinglass

Coinglass liquidation data showed that the previous 24 hours saw liquidation of $15.03 million worth of positions. $11.95 million worth of positions were long, highlighting that the buyers faced most of the pain in recent hours, as expected.

Across the market, this figure stood at $385.88 million in both directions, which could rise further. After such a steep fall, it was possible that prices bounced back quite a distance without much demand.

Is your portfolio green? Check the Solana Profit Calculator

Moreover, it was a weekend, which meant the liquidity was likely lower. Hence, late bears must be extremely cautious. The move downward has likely occurred and passed, and sellers can wait for a bounce to the significant former support levels.