Solana’s next price target – Here’s where SOL’s price is heading next!

- The 1-day market structure looked bearish.

- Solana’s performance against Ethereum and heightened demand were bullish signs.

Solana [SOL] saw increased transaction activity on-chain and short-term bullish impetus that propelled prices above $120.

However, the presence of a strong supply zone around $140 meant that the bulls would have a tough task to initiate a true long-term recovery.

The Solana network outpaced the Ethereum [ETH] one on multiple fronts. The SOL/ETH pair made new highs, and SOL saw elevated inflows compared to the Ethereum network, among others. Could these factors be enough to drive a sustained price rally?

Increased buying pressure gives SOL investors hope

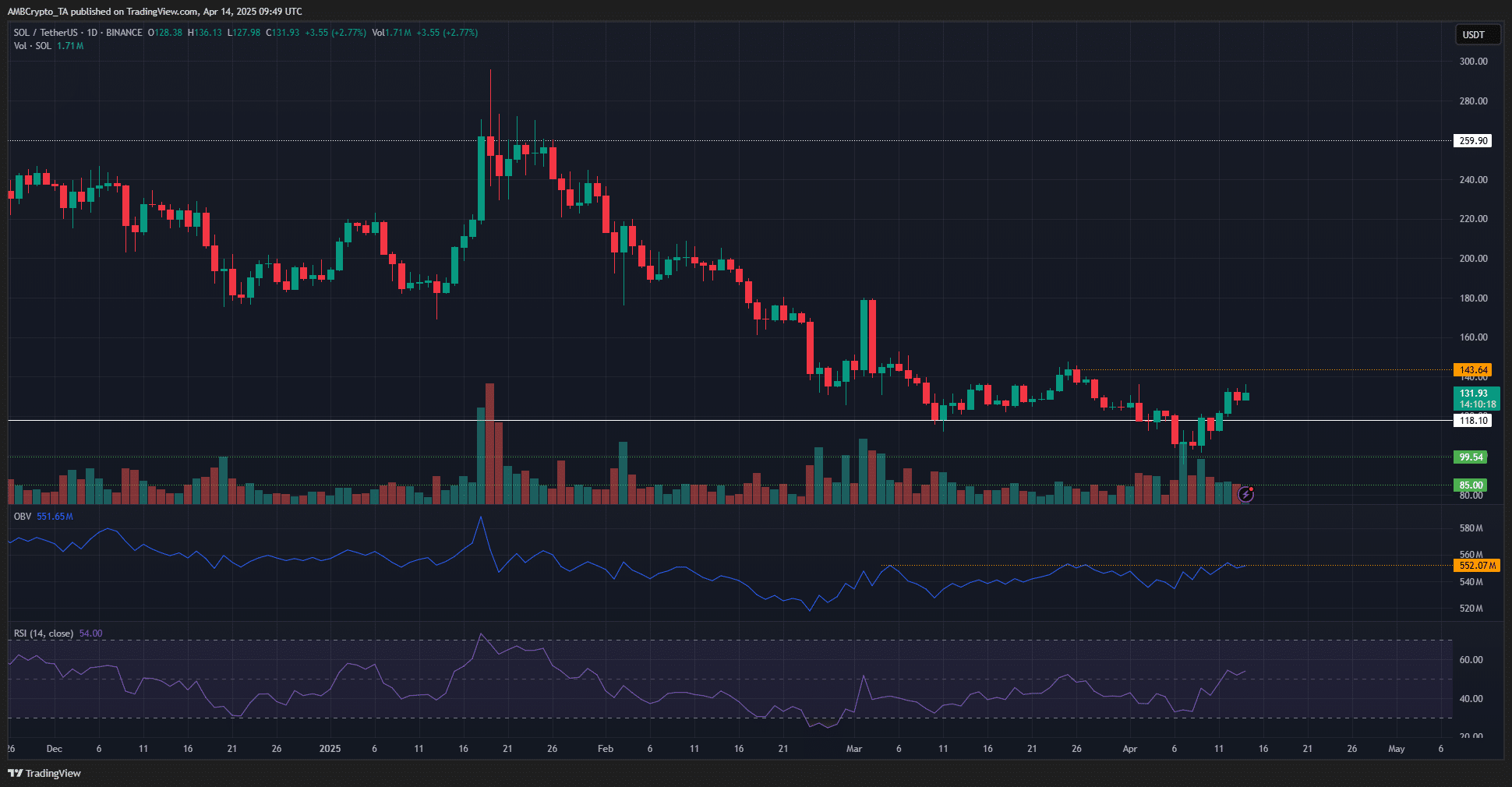

The $143 level marked the lower high of the downtrend of the past three months. This was the level that needed to be breached to flip the 1-day market structure bullishly. There were early signs that this outcome would be achieved over the next week or two.

The RSI climbed above neutral 50 to mark a bullish momentum shift. It was still early, but it had stayed above 50 for three days, the longest period since January. Additionally, the OBV was challenging the highs set in early March.

Back then, the price of Solana was around $180. Therefore, it indicated rising buying pressure, which could propel prices beyond $143. However, until it does, traders and investors can remain cautious.

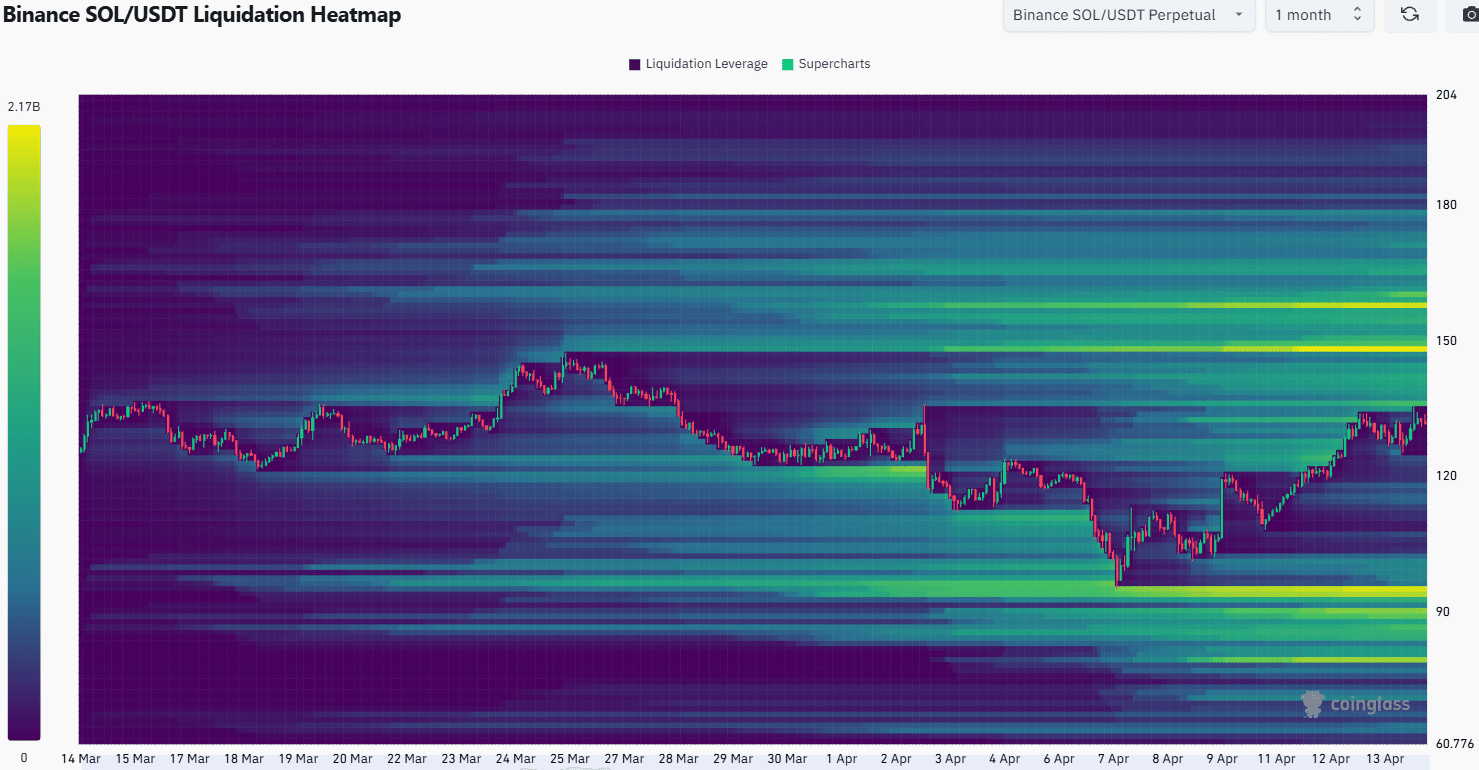

Source: Coinglass

The liquidation heatmap, with a 1-month look back period, highlighted $150 and $158 as the most significant magnetic zones nearby. These levels contained over $2 billion in liquidations. The $136-$142 range also formed a considerable liquidity cluster.

Further south, a notable liquidation pocket was observed at $95. However, its distance makes it unlikely to be a short-term price target. Based on the heatmap and technical indicators, a move toward $150-$160 appears probable in the coming days.

Whether bulls can hold the $140 level as support and maintain their position remains uncertain.

Success at this level could signal the start of a bullish trend, contingent on a Bitcoin [BTC] recovery and positive sentiment in the broader crypto market.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion