Solana soars: How GIGA, POPCAT, and WIF fueled the surge

- Solana reached a major milestone as the top DEX by volume, with meme tokens leading buys.

- A new trend in SOL memes could further strengthen their dominance.

Solana [SOL] surged 8% at the start of September’s second week, trading at $135 at press time. The surge was likely driven by an increase in top holder positions in several meme tokens, fueled by its strong memecoin community.

Notably, three major memecoins have attracted significant attention from large investors. Could this be the key to a potential price rally for SOL?

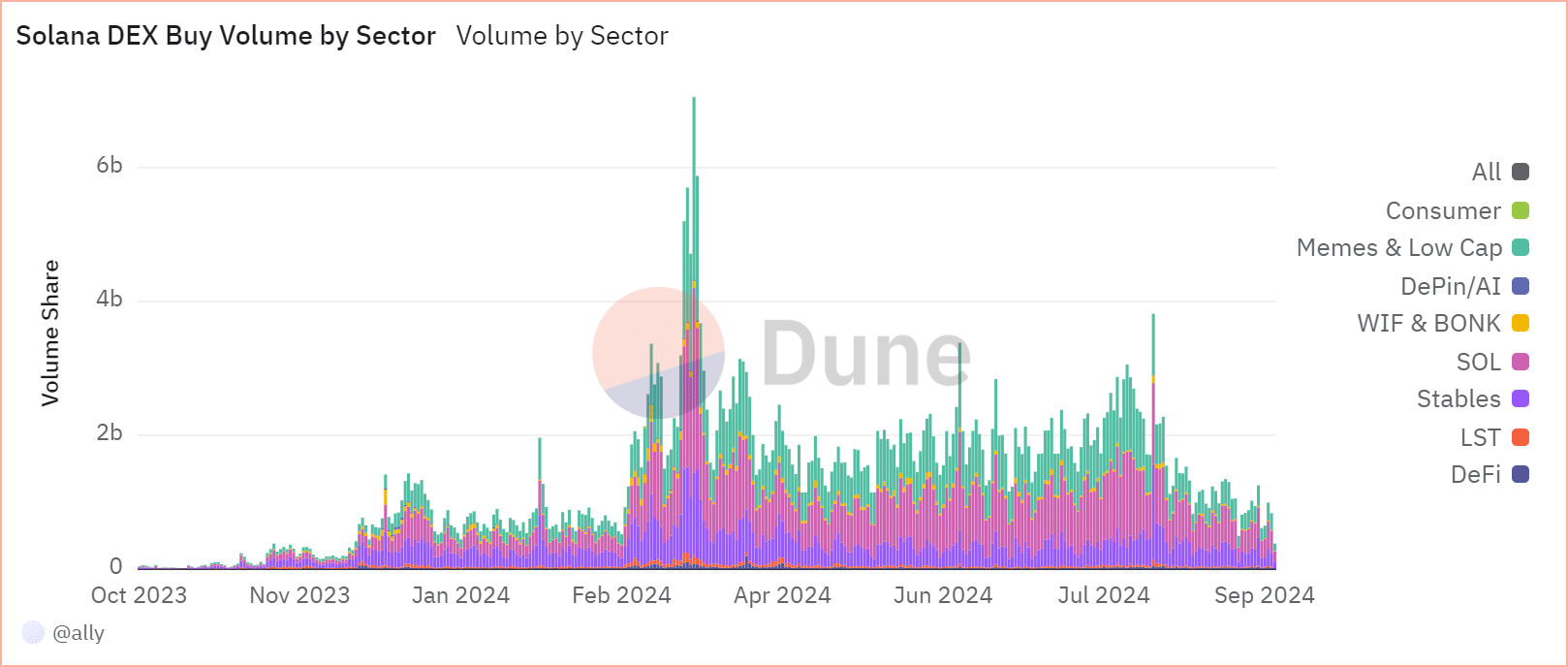

Solana leads the way in DEX volume

Solana recently achieved an impressive milestone, overtaking competitors to become the leading blockchain in decentralized exchange volume.

Earlier this year, SOL overtook BNB and Base, and now leads with a staggering 378% difference, boasting $3.2 million in volume compared to Base’s $670K. Moreover, Solana is the only chain with a DEX trader count exceeding one million.

According to the chart below, memes and low-cap tokens have dominated the buy volume, peaking at $2 billion in mid-March. This surge coincided with a bull rally that pushed SOL above the $200 mark.

Since then, buy volume has dropped approximately 94% to $110 million, but the dominance of these tokens has persisted.

In short, memecoins help SOL hedge against Bitcoin’s volatility, attracting both large and short traders.

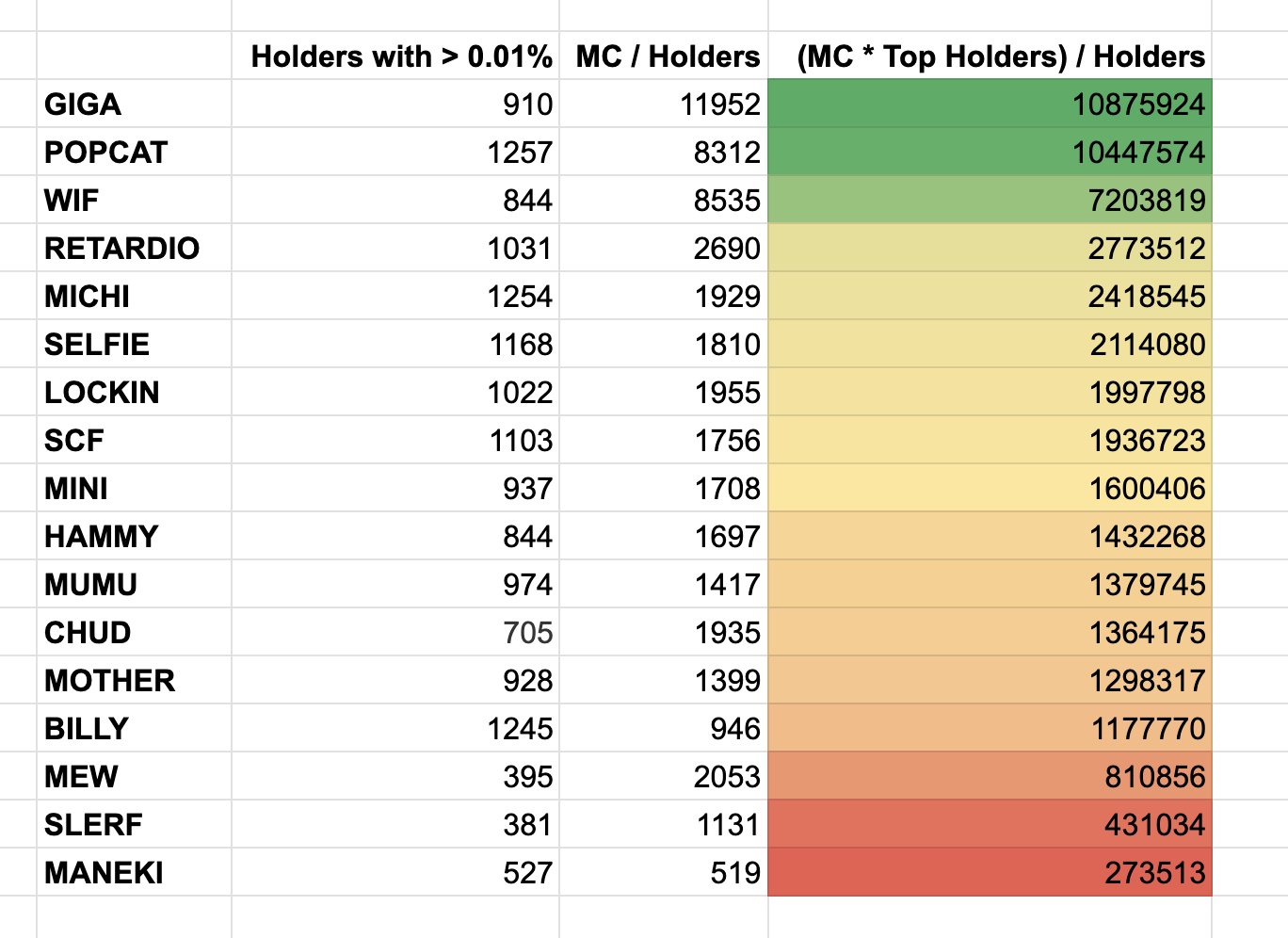

Meanwhile, a new trend is emerging: a prominent analyst has highlighted how Solana memecoins are driving top holder decentralization.

Put simply, some major meme tokens are achieving more equitable distribution among holders, with each significant holder owning around 0.1% of the total supply. The question is – How is this helping SOL?

Reduced monopoly mitigates risk

Despite last week’s downturn, strong memecoins on Solana continue to grow steadily among diamond hands, as evidenced by the chart below.

With GIGA leading the chart with 10.8 million holders, and POPCAT close behind with 10.4 million, the difference in top holder count is minimal, marking a negligible 3% difference.

Additionally, even distribution of large holdings reduces centralization risk, preventing disproportionate influence on the token price.

Furthermore, a decentralized distribution can attract a broader base of participants, spiking SOL value.

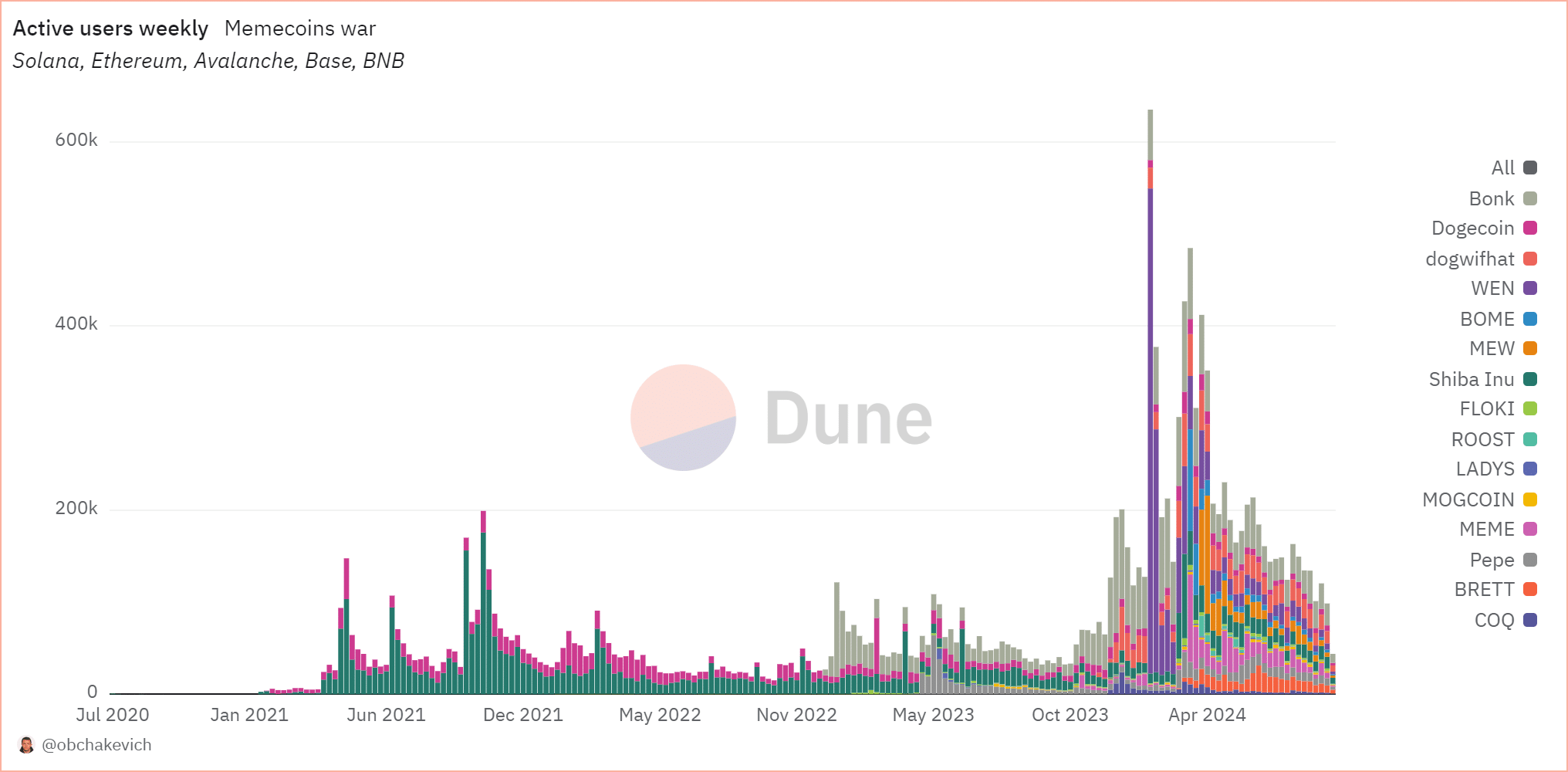

As shown earlier, memecoins significantly influence SOL. Some traders use them as a cheap alternative, while others commit with long-term faith.

This is further supported by holders see Solana memecoins as long-term investments, with BONK leading weekly activity and WIF following.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Given the volatility of these memecoins and their strong consumer base, reduced monopoly helps SOL mitigate risks during market downturns, especially those triggered by BTC swings.

Overall, if the bears drive the market down, SOL faces less risk from its memecoin hub, as top holders are less likely to sell, absorbing the volatility.