Solana [SOL] clears the $23 hurdle- Is a retest of $26 likely?

![Solana [SOL] clears the $23 hurdle- Is a retest of $26 likely?](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x800-45.png.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Solana is set to launch “Saga,” a mobile device touted by the developers as a “premium Android phone for web3 users.”

- SOL could attempt to retest the supply zone of $26 – $27.12 if the bullish sentiment persists.

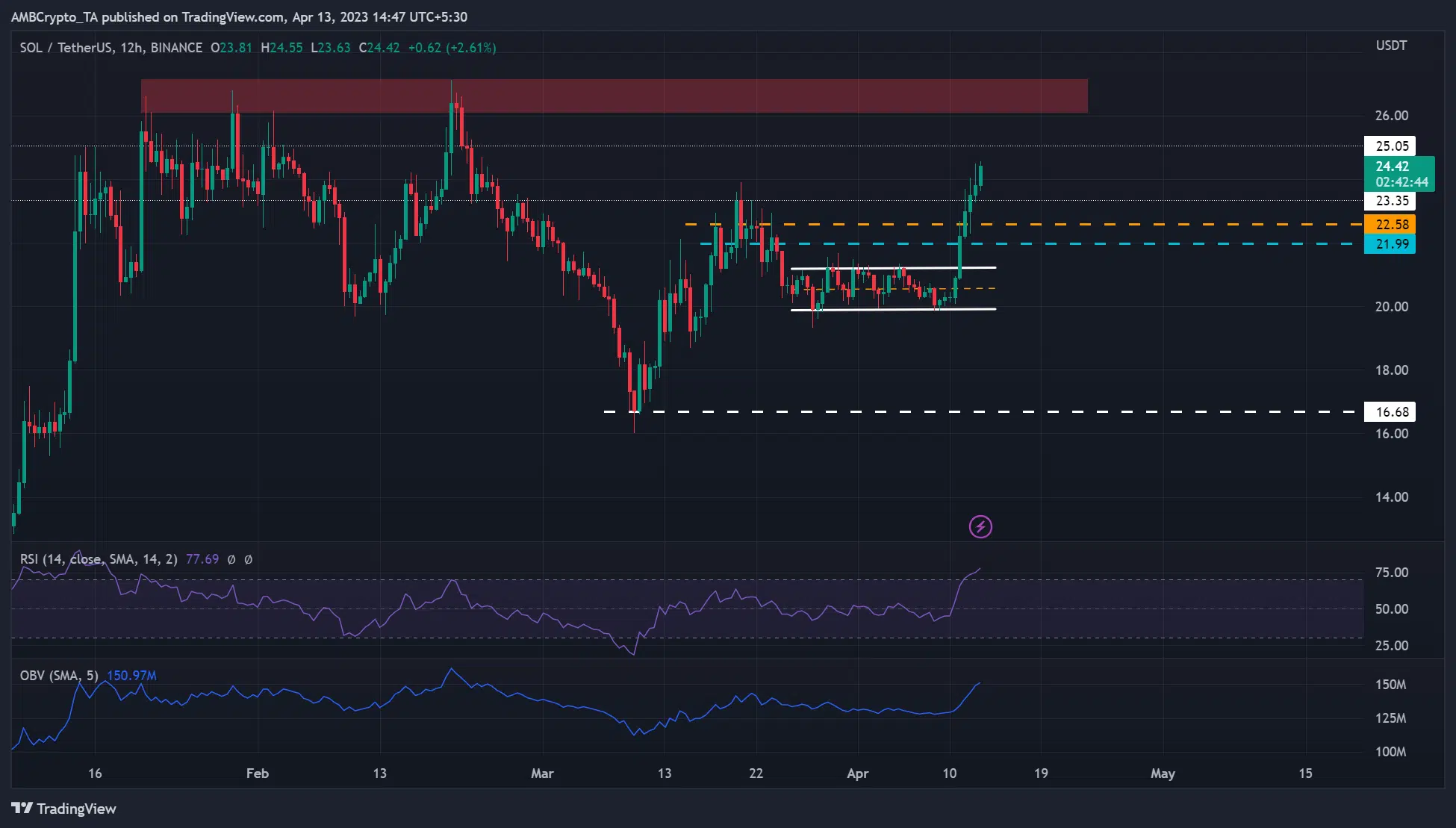

Solana [SOL] broke out of its $19.98 – $21.26 range and cleared the bearish order block of $23.35. The move has embellished bulls to seek higher targets – especially the supply zone.

Read Solana [SOL] Price Prediction 2023-24

Meanwhile, Solana is set to launch “Saga,” a mobile device touted by the developers as a “premium Android phone for web3 users,” on April 13, 2023.

It will include Seed Vault, Saga Pass, and dApp store, amongst other features. Will the new development affect SOL’s long-term prospects with Bitcoin [BTC] above $30K?

Join us live for the official Saga launch event on April 13!

Streaming live at 10am PT / 1pm ET / 5pm UTC on the following platforms

Twitter: @solanamobile and @solana

YouTube: https://t.co/0WR0HdjEy4

Website: https://t.co/0IrLKAkqzi pic.twitter.com/HR2AFRnn8V— Solana Mobile ?1️⃣3️⃣ (@solanamobile) April 11, 2023

Will the $26 supply zone attract sellers?

In its first leg of recovery, SOL appreciated from $16.68 but formed a bearish order block (OB) at $23.35. The bearish OB set SOL into a short pullback, followed by a slightly extended price consolidation between $19.98 – $21.26.

Following BTC’s breakout, SOL registered an upswing and second leg of recovery, clearing a range resistance of $21.99 – $22.58 and a bearish order block of $23.35.

SOL could attempt to retest the supply zone of $26 – $27.12 if the bullish sentiment persists. But bulls must clear another obstacle at $25.05 to gain more leverage to hit the supply zone. However, SOL may see heightened selling pressure after hitting the above level.

Bears could sink SOL to $25.05 or the previous bearish order block of $23.35 after hitting $26. The supply zone of $26 – $27.12 has been persistent, blocking further uptrend in January, February, and March. These levels could act as short-selling targets in such a downswing scenario.

At press time, the RSI rose sharply and slid into the overbought zone, highlighting increased buying pressure. But the overbought condition also makes SOL ripe for price reversal. The OBV (On Balance Volume) surged, too, showing an increase in demand for SOL in the past few days.

CVD spot surged; long/short ratio had a marginal difference

How much are 1,10, 100 SOLs worth today?

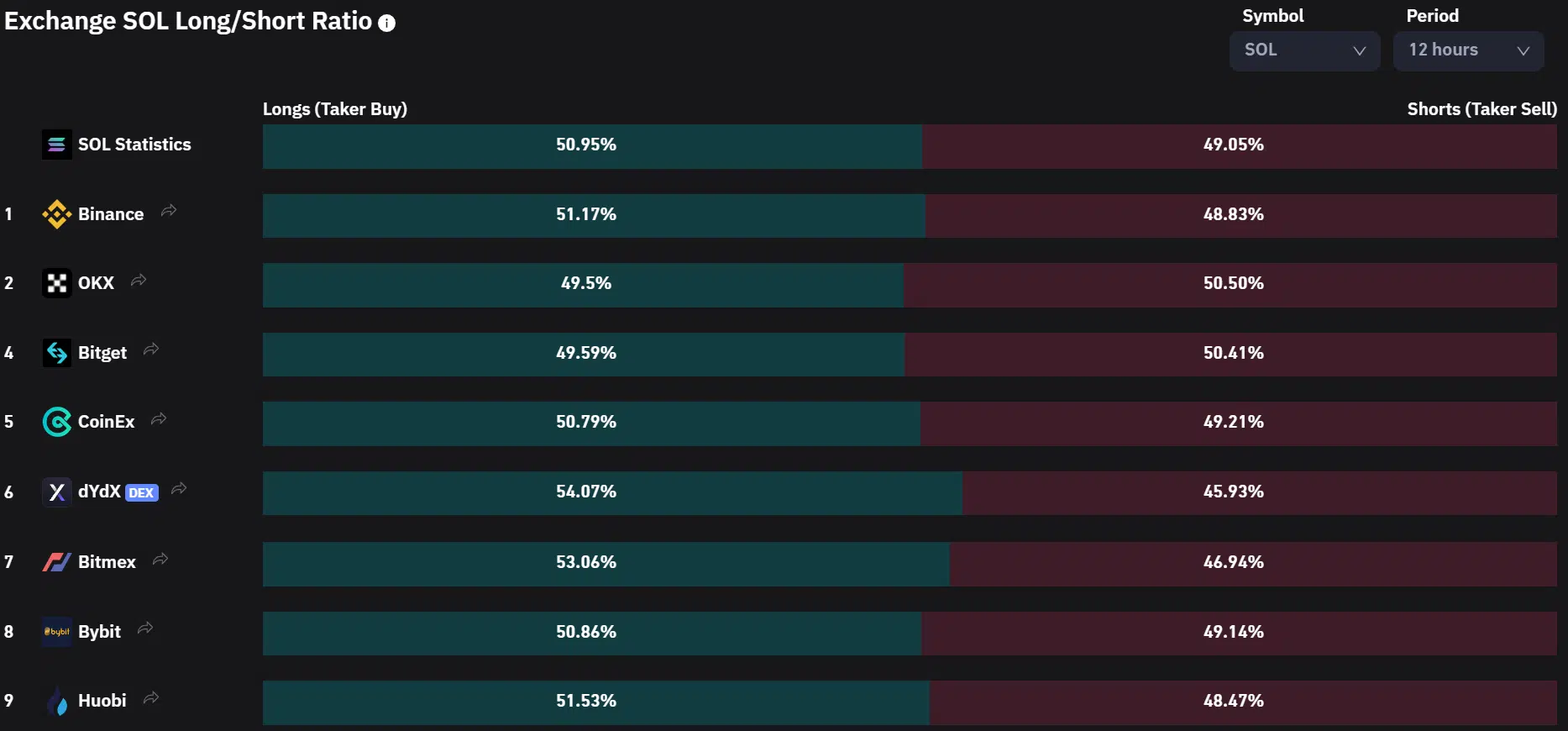

According to Coinglass, the long/short ratio showed longs had the marginal edge on the 12-hour timeframe – it shows an almost neutral structure and prospects for the SOL.

However, $2.2 million of short-positions have been liquidated in the past 24 hours, according to Coinalyze. On the contrary, about $1.6M worth of long positions have been wrecked.

The trend reinforces a bullish sentiment. In addition, the rising CVD (Cumulative Volume Delta) Spot shows sellers had more influence at press time.