Solana [SOL]: Is a retest of $25 area likely? Well, yes, only if…

![Solana [SOL]: Is a retest of $25 area likely? Well, yes, only if...](https://ambcrypto.com/wp-content/uploads/2023/01/shubham-s-web3-uNP6X3Ec9jk-unsplash-1-e1674809829701.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- SOL could aim at a critical selling pressure zone if BTC aims at $23.3K.

- SOL’s development activity improved, boosting investors’ confidence.

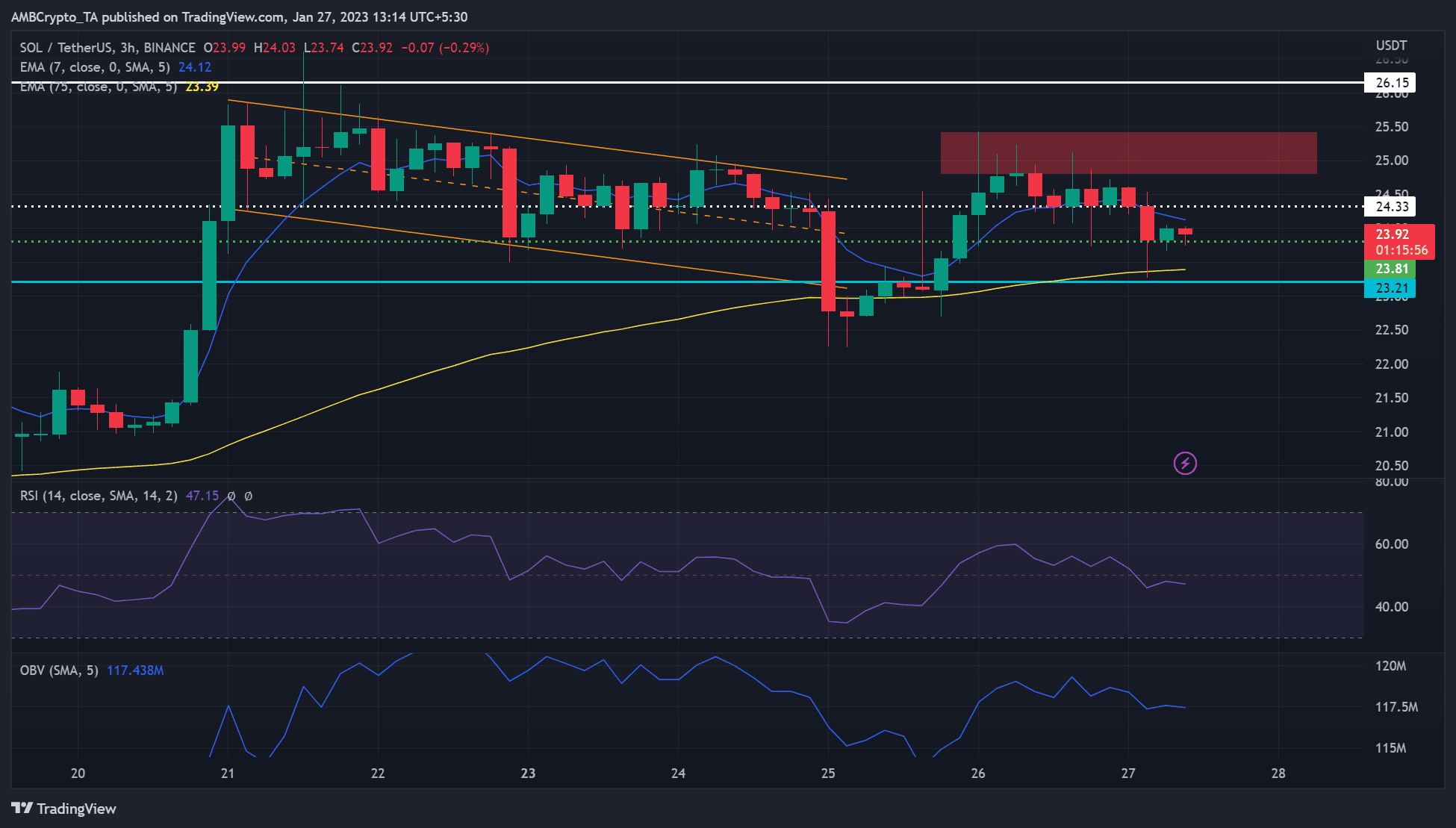

Solana [SOL] dropped below the $24.33 level after Bitcoin [BTC] fell to $22.5K. SOL bulls found a steady hold at $23.81 and tried to launch a recovery.

At press time, SOL’s value was $23.92, while BTC struggled to hover above the $23K zone. However, BTC could aim at $23.3K and pull SOL to this crucial supply zone.

Read Solana [SOL] Price Prediction 2023-24

Can bulls attempt to reach the selling pressure zone at $25?

Bitcoin [BTC] dropped to $22.5K but rebounded to $23.0K at press time. A move toward the $23.3K level could tip SOL bulls to target the selling pressure zone (red) of $25 in the next few hours. But bulls must clear the hurdle at $24.33 to move upwards.

Alternatively, bears could overwhelm the market and push SOL below the immediate support level of $23.81. Such a drop would invalidate the above bullish bias.

Besides, the Relative Strength Index (RSI) was below 50-equilibrium as trading volumes declined, which could further give bears more leverage to devalue SOL in the short term.

Is your portfolio green? Check out the SOL Profit Calculator

But such a downtrend could settle at $23.21 and offer bulls another chance to inflict a recovery. Therefore, investors should track BTC price action to gauge whether bears or bulls will reign in the next few hours.

SOL’s development activity increased, boosting investors’ confidence

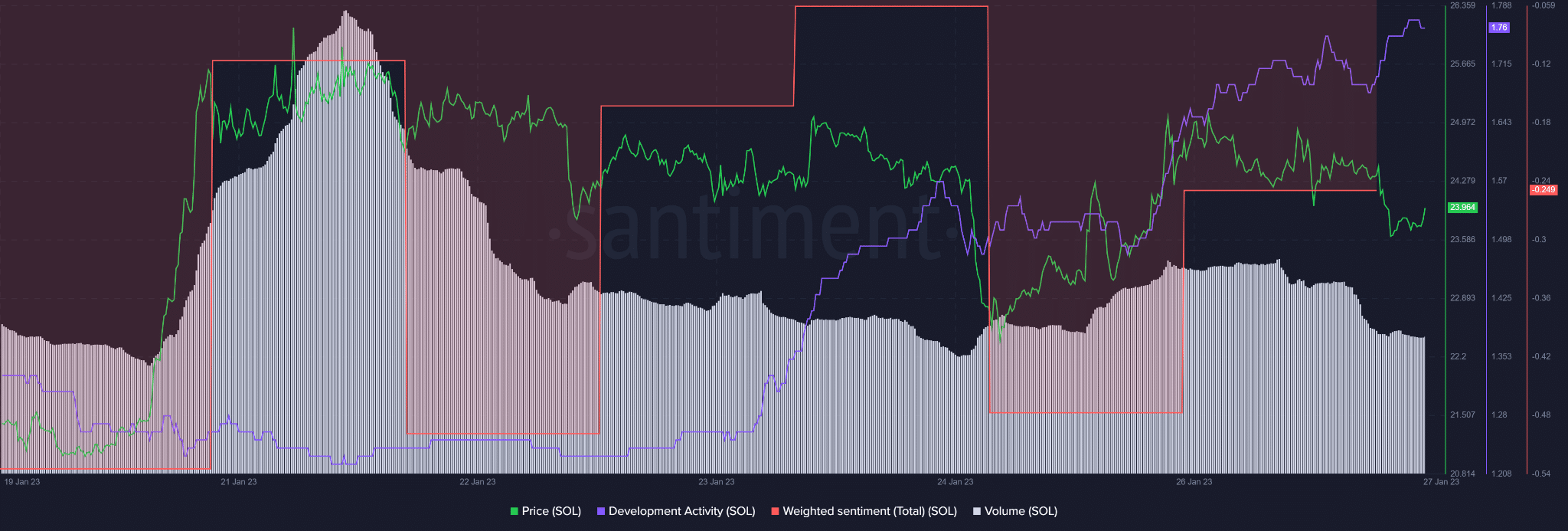

As per Santiment data, SOL’s development activity registered a further increase at press time. The rise followed a sharp drop the previous day, which coincided with a price decline. Therefore, the rising development activity could boost SOL’s value in the short term.

In addition, the overall rise in of development activity on the network saw investors’ confidence improve, as evidenced by a retreating weighted sentiment from the negative territory. The improved investor sentiment could further bolster SOL’s value.

However, the trading volumes had dropped significantly and showed no sign of recovery at press time. As such, it could undermine trend reversal and strong uptrend momentum, delaying bulls from bypassing the $24.33 hurdle. But a bullish BTC could improve the trading volumes, thus worth tracking the king coin’s performance.