Solana [SOL] suffers yet another technical challenge, details inside

![Solana [SOL] suffers yet another technical challenge, details inside](https://ambcrypto.com/wp-content/uploads/2023/02/hd-wallpaper-gae45acec9_1280.jpg)

- Solana adds yet another network downtime incident to its recent woes.

- SOL extends its decline for the fifth day in a row.

Solana users were unable to conduct transactions on the network on 25 February. Preliminary reports revealed that this was a network-wide problem reportedly caused by a long-forking event.

However, on 26 February, the Solana Status Twitter account informed that “the Solana community successfully resumed the cluster.”

Approximately 15 minutes ago the Solana community successfully resumed the cluster – engineers will continue to monitor network performance as network operators are restored.

— Solana Status (@SolanaStatus) February 26, 2023

Realistic or not, here’s Solana’s market cap in BTC’s terms

The Solana blockchain is certainly not new to the technical challenges that have been triggered. Some of those network glitches resulted in halted operations for some time before a network reboot was conducted.

The latest reports about Solana’s network disruption did not disclose the source of the problem. However, it was revealed that a reboot and reversion to a previous software version were among the solutions being contemplated.

The Solana network experienced a forking event early Sunday morning New York time that throttled users’ ability to execute transactions. It was not immediately clear what caused the “long forking event”. Validators and Solana engineers were discussing a range of options,… https://t.co/GFd8AT6kV9

— Wu Blockchain (@WuBlockchain) February 25, 2023

Did Solana’s latest downtime have an observable impact?

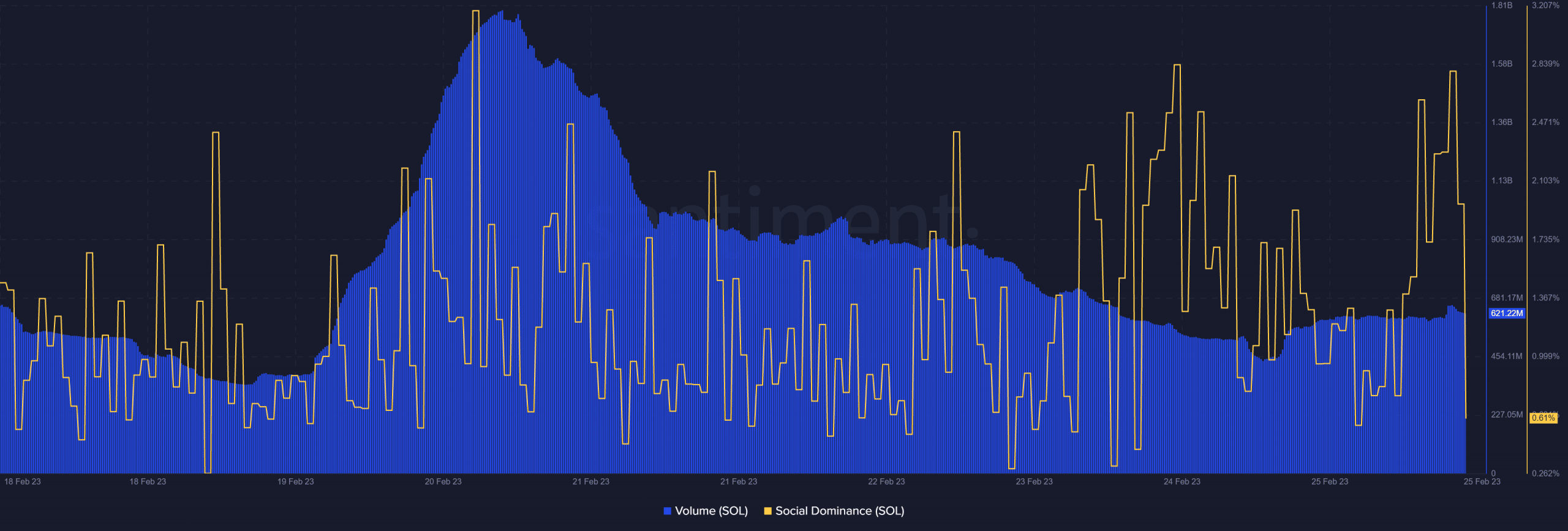

Solana’s latest network challenge triggered a spike in social dominance, as news about the network outage spread. Past instances of network outages have triggered more FUD among investors and this time not much of a change in volume was observed.

This is likely because Solana’s volume fell substantially in the last few days. However, there was a slight increase in volume in the last 24 hours which may suggest that the market reacted to the move.

As expected, SOL’s price action did face some downside by as much as 2.64% over the last day. This adds to the selling pressure that prevailed in the previous 4 days, hence contributing to a 16% pullback from its weekly high.

SOL sat on its 50-day MA at press time which might normally be considered a potential pivot point.

However, an extended downside is possible considering that the weekly pullback reflects the bearish sentiment in the overall crypto market.

In addition, the downside may spoof investors despite the attractive price discount.

The recent downtime incident may have also impacted SOL demand on the derivatives market. Both the Binance and DYDX funding rates dropped to their lowest levels in the last 24 hours. Thus, confirming that the network downtime triggered a demand shock.

The same derivatives metrics did bounce back slightly after the dip. This confirms a bit of recovery back to pre-downtime levels.

Is your portfolio green? Check out the Solana Profit Calculator

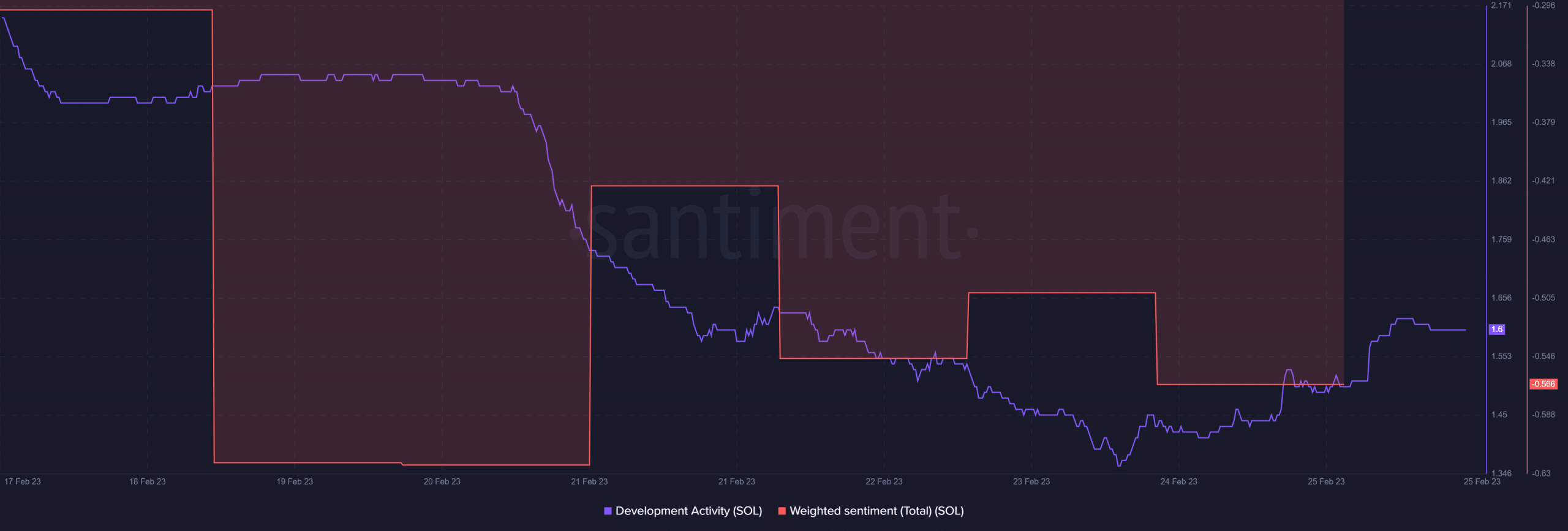

On the other hand, Solana’s development activity bounced slightly in the last 24 hours. This was a promising sign- developers were working towards restoring the network. The weighted sentiment remained within the lower range although slightly higher than its weekly low.

While this recent network downside may affect investor sentiment, we have seen SOL bounce back multiple times in the past.

These instances have become so common that investors may not be as shocked as they were in initial network downtime incidents.