Analysis

Solana [SOL]: Will confluence at key support level be enough for bullish rally

Solana faced another price rejection at the $23 level. However, confluence at key support level could offer bulls a chance for a pullback.

![Solana [SOL]: Will a confluence at key support level be enough for bullish rally](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_SOL__1200x900-1000x600.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- SOL bears maintained control of price resistance zones.

- Fluctuating market demand could hamper a bullish rally.

Solana [SOL] suffered over 6% losses in the past seven days. Price got rejected at the $23 resistance level and traded at $20.7, as of press time.

Read Solana’s [SOL] Price Prediction 2023-24

With Bitcoin [BTC] struggling to hold on to $28k, bears might be tempted to push for more dips. However, bulls could rally as the price hovered over a critical support level.

Will the $20.5 support level hold again?

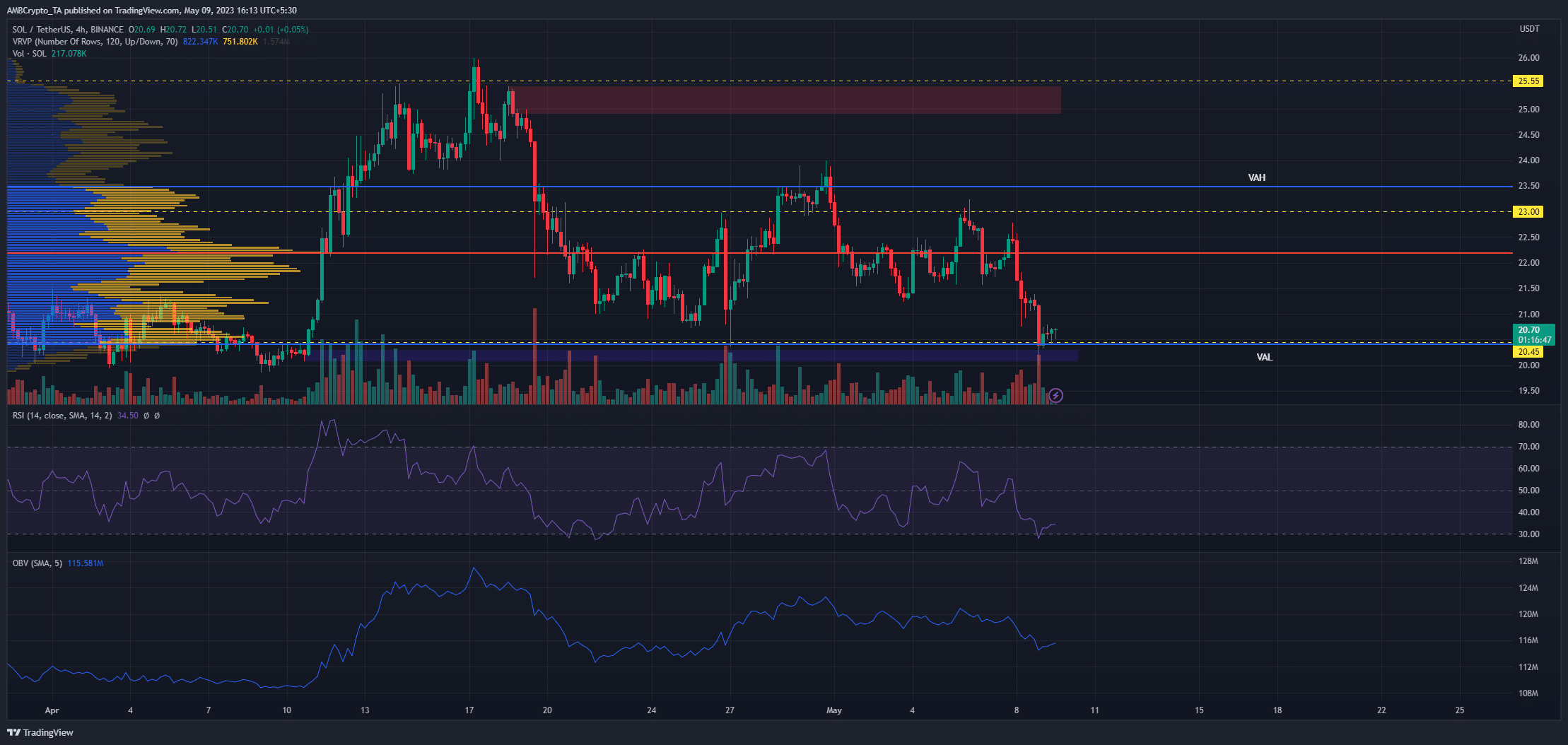

SOL has traded between the $20.5 – $25.5 region for over a month. The bearish order block just under the $25.5 resistance ushered in a price dip that pushed prices to the $20.5 support level. However, a quick bounce off the support level was rejected again at the $23 level.

The Visible Range Volume Profile provided insight into what SOL’s next move might look like. The Value Area High (VAH) stood at $23.5 while the Value Area Low (VAL) stood at $20.4. The VAL also had confluence with a critical resistance level and a bullish order block. This suggested that the price could rally from the $20.5 support level again, with buyers having historical precedence for this support level.

The Relative Strength Index (RSI) stood just above the oversold zone at 35.02. This suggested the selling pressure might be waning at press time. The OBV also recorded a slight uptick to boost buyers’ confidence.

Alternatively, sellers can look out for a four-hour close below the support level which will invalidate a bullish pullback. This could lead to SOL retesting March lows of $18.85.

Is your portfolio green? Check out SOL Profit Calculator

Market sentiment dampened buyers’ expectations

Short-term trading activity in the futures market leaned towards bearish sentiment. Data from Coinglass

showed that long positions worth $4.82M were liquidated over the past three days. This represented 86.6% of the total liquidations within that period.Funding rates also fluctuated between negative and positive. This pointed to a faltering demand for Solana. However, a strong bullish advance by BTC for $30k could accelerate SOL’s bullish rally.

Source: Coinalyze