Solana sparks hope of an upswing as bulls continue to struggle

- SOL has surged by 9.11% over the past month.

- Solana has flipped 200 EMA on daily and 4-hour timeframes, signaling potential upswing.

Since hitting a local high of $193, Solana [SOL] has failed to maintain an upward momentum and reclaim higher levels. As such, the altcoin remains stuck in a consolidation range between $140 and $160.

This shows that, since dropping below $160, bears have outweighed bulls to keep the prices stuck within this range.

In fact, at the time of writing, SOL was trading at $146. This marked a 9.11% on monthly charts, with the altcoin recording moderate gains on weekly and daily charts too.

Despite the recent gains, SOL remains 43.9% below its ATH of $259 recorded in 2021.

Although SOL has struggled to break above $160, the recent price action breeds optimism, leaving analysts talking. One of them is Coin Signals who have suggested a potential upsurge citing 200 EMA.

Solana flips 200 EMA

In their analysis, Coin Signals posited that SOL has flipped 200 EMA on daily and 4-hour timeframes. This price movement means that the altcoin has broken out of the symmetrical triangle.

Source: X

What this means is that a breakout above the upper trendline signals the start of an uptrend. Therefore, the altcoin is well-positioned to see further gains on price charts.

What SOL’s charts suggest

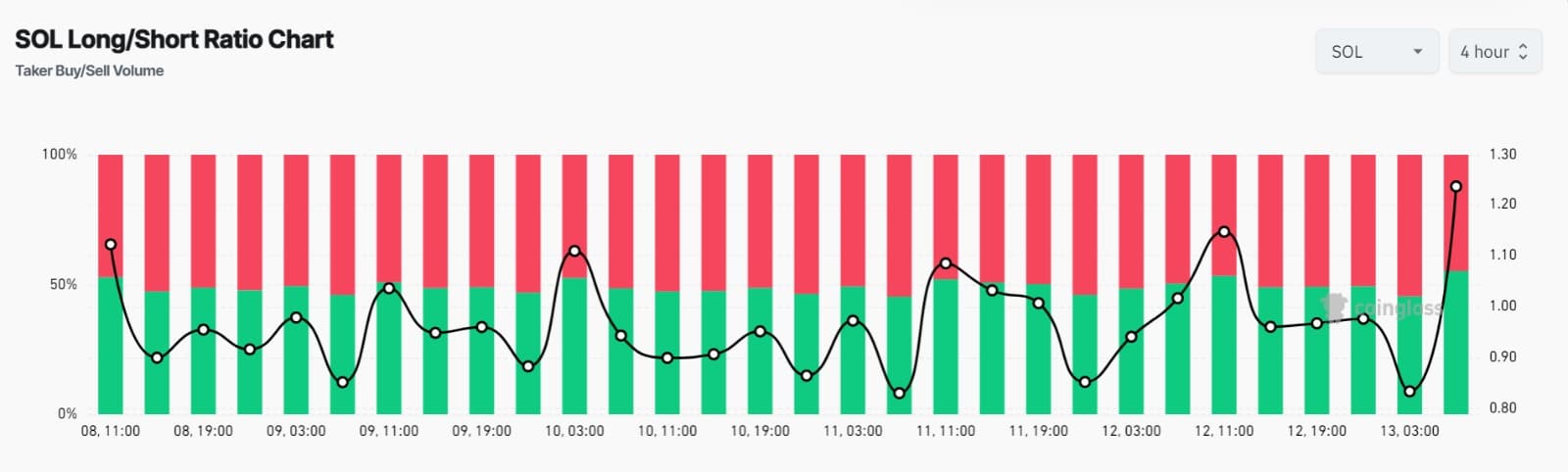

Solana’s Long/Short Ratio on a 4-hour timeframe sat at 1.2 at press time, signaling that long position holders were taking over the market. Thus, more traders are betting on prices to rise, instead of a decline.

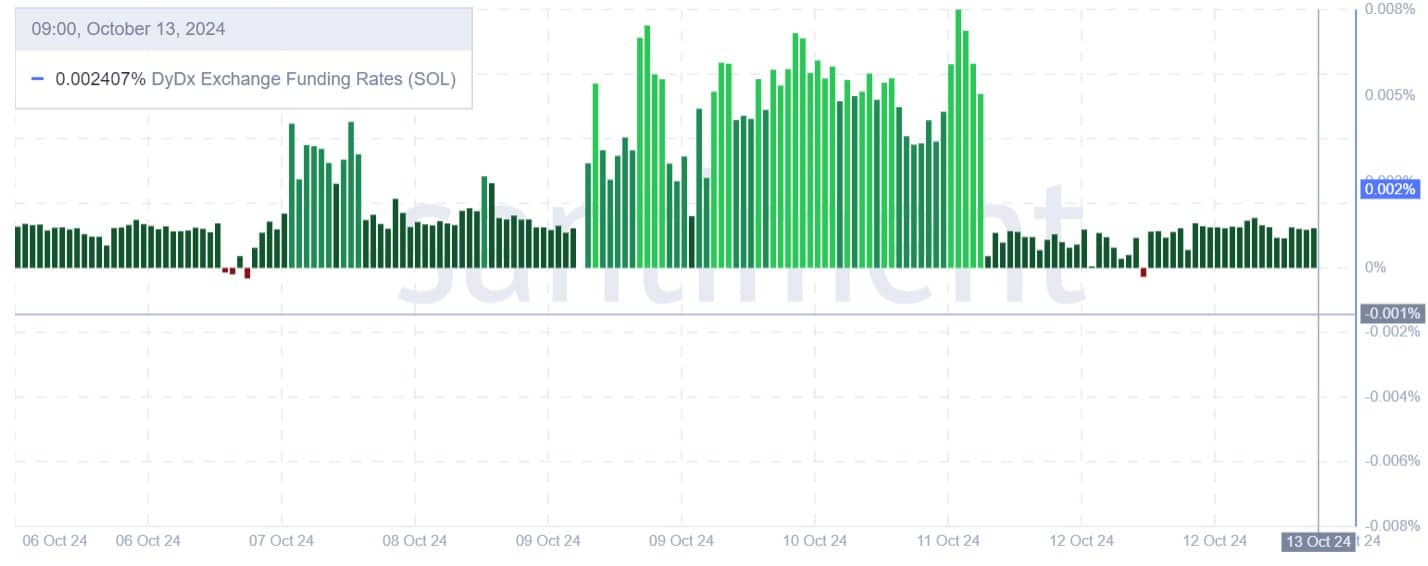

This demand for long positions was further supported by a positive DyDx Exchange Funding Rate over the past week. This suggests that longs are paying shorts a premium fee during market downturns to hold their positions.

Such market behavior also indicates that investors are confident with the altcoin’s future gains.

Finally, Solana’s Open interest in USD per Exchange has been rising over the past week. Open Interest has surged from a low of $649 million to $712 million.

This shows that investors were continually opening new positions in an anticipation of further gains.

Read Solana’s [SOL] Price Prediction 2024–2025

Simply put, while SOL has struggled to reclaim levels above $140 and $160 range, the altcoin is showing increased positive market sentiment.

As such, the current conditions could set Solana up for further gains. Therefore, a breakout above the $160 resistance will see the altcoin hit $170.