Solana takes an unexpected turn – How will this affect SOL’s $200 goal?

- SOL sees massive spike in on-chain volume.

- Global long positions increased even as SOL’s price dipped.

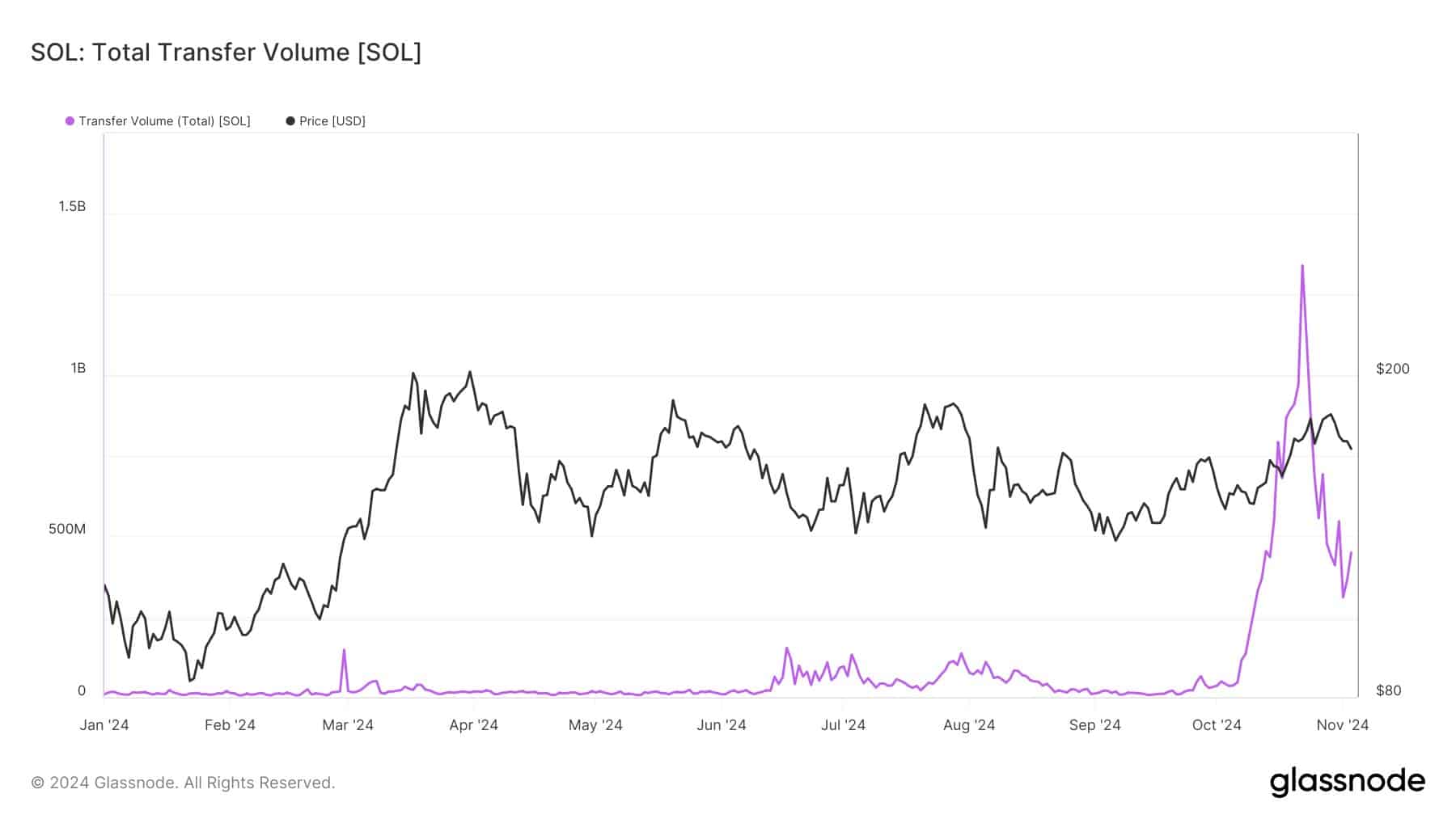

Solana [SOL] recently experienced a significant increase in on-chain transfer volume, reaching a peak of about $224 billion in just one day. This volume was nearly three times the entire market cap of SOL, which stood at $76 billion.

This remarkable surge came from a high-activity wallet using multiple accounts. Analysts speculated that this wallet was likely an arbitrage bot, ramping up its activity in early October.

This bot’s increased transactions could have contributed to the recent fee hikes observed across the network.

Despite this enormous activity on the blockchain, Solana’s price dipped rather than benefiting from the surge. Market participants watched closely as SOL’s price dropped, signaling an unexpected response to such a large-scale transfer.

The declining price contrasted with the spike in on-chain activity, puzzling some investors who expected a positive reaction to the high volume.

Can SOL bounce as longs increase?

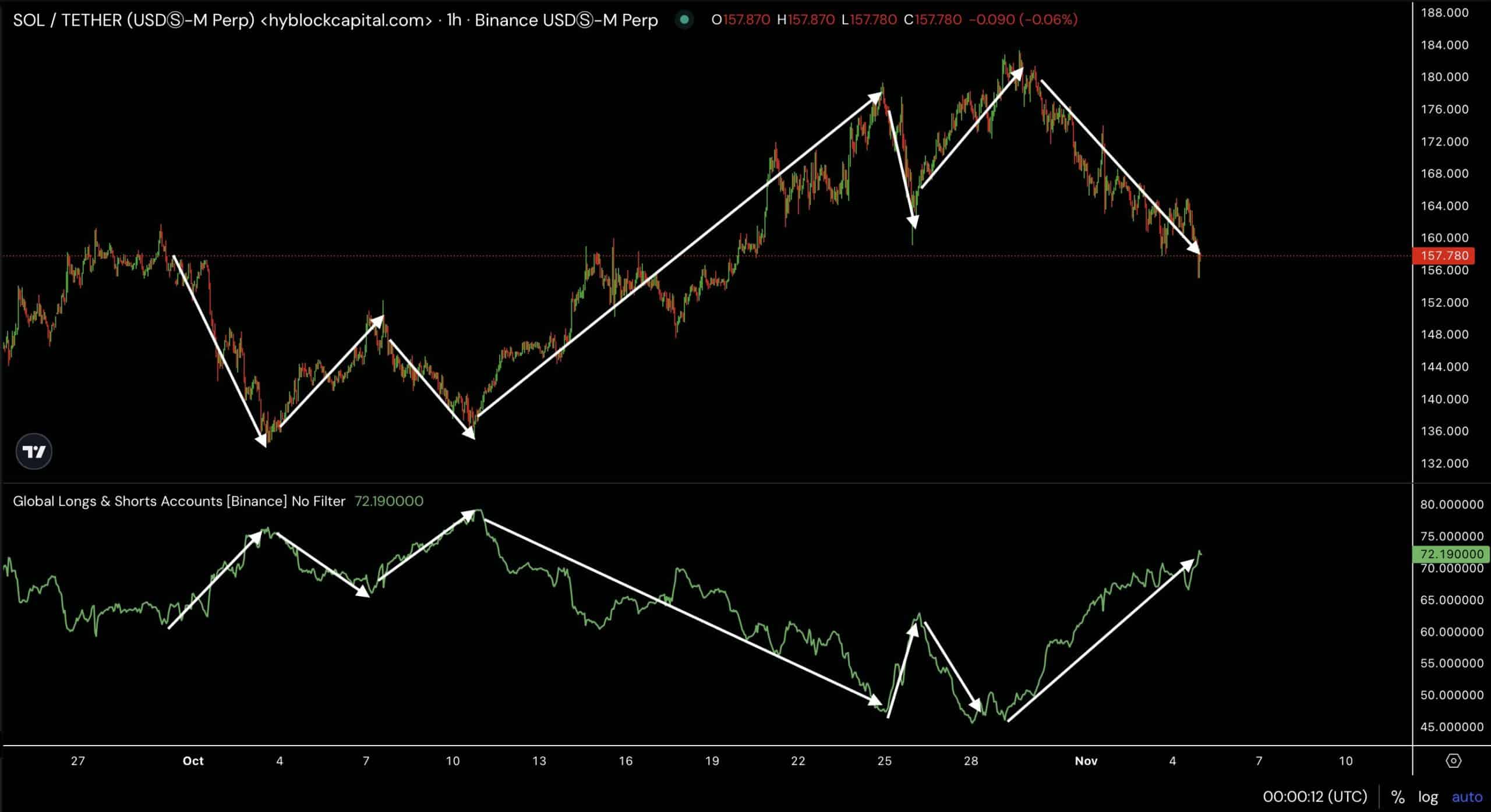

However, the global long positions increased even as Solana’s price dipped, which might indicate a shift in sentiment among traders. Traders are anticipating a potential turnaround for SOL, using the opportunity to go long during the price decline.

Solana’s recent movements revealed a strong inverse correlation between its Global Accounts Long percentage and its price.

The correlation matrix showed a value of -0.89, meaning the price and the number of long accounts usually moved in opposite directions.

Traders were clearly taking advantage of the dip by betting on Solana’s future price recovery. This inverse relationship suggested that many traders believed the current dip was temporary and that Solana would soon gain momentum again.

While no immediate bounce back occurred, the rise in long positions hinted at future confidence.

As the market considers the future of Solana, one key question remains: can SOL get back above $200? The answer to this question depends on several factors, including market sentiment, on-chain developments, and broader cryptocurrency trends.

If Solana manages to sustain the interest generated by the high on-chain volume and effectively leverage that activity, a price recovery could very well be on the cards.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Solana’s strong community and increasing interest from traders suggest that SOL’s price could make a comeback. However, the $200 mark represents a significant psychological barrier.

Whether or not Solana manages to overcome it would depend on overall market conditions, institutional interest, and the network’s ability to handle and capitalize on increased activity efficiently.