Solana takes on Ethereum as ‘DEX war’ takes new turn

- Activity on Jupiter, Solana’s biggest DEX, trumped Ethereum-based Uniswap’s numbers

- ETH’s volume remained higher than SOL’s, while JUP and UNI sentiment differed

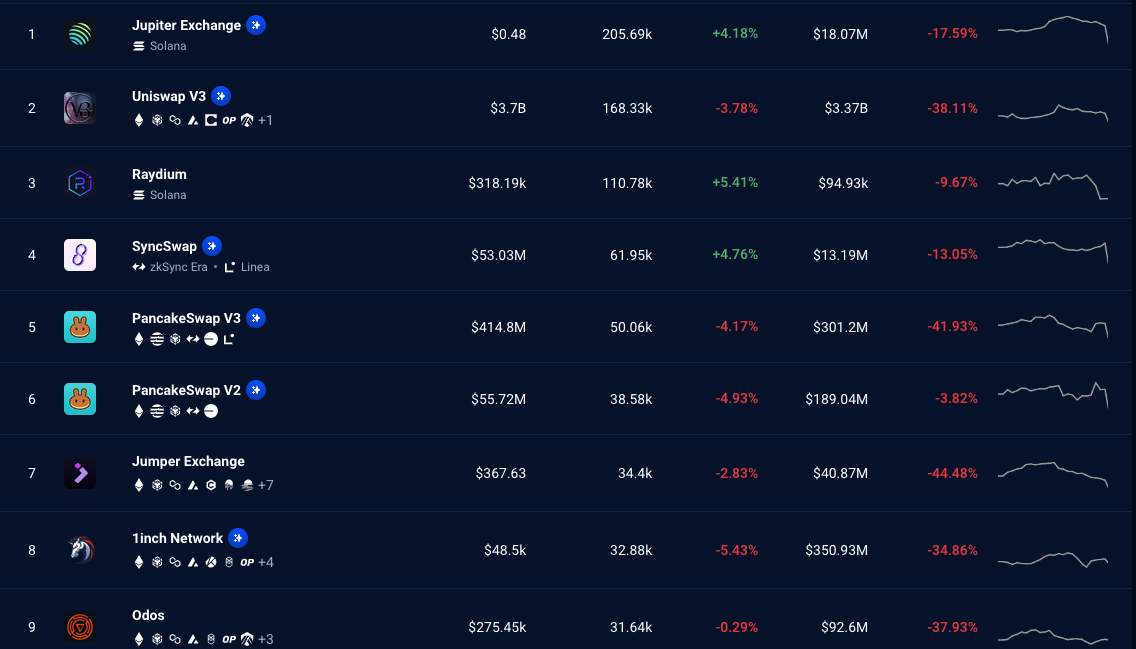

Jupiter, a decentralized exchange built on the Solana blockchain, has overtaken Uniswap as the DEX with the highest number of Unique Active Wallets (UAWs). AMBCrypto noticed this after looking at data from DappRadar.

At press time, UAWs on Jupiter exchanges were over 205,000. Uniswap, built on Ethereum [ETH], had less than 170,000.

How did this happen?

UAW measures the crypto-wallet addresses that interact with a network or applications. If the metric increases, it implies a rise in user activity. On the other hand, a decrease suggests dwindling attention.

As can be seen below, Jupiter’s active wallets rose over the last 24 hours while Uniswap’s declined. However, this is not just about the DEXs mentioned. Instead, it speaks more of the competition between Solana and Ethereum.

For years, Ethereum dominated Solana on this front. However, this cycle has been different, and there are reasons attached to it too. For starters, Solana has been the chain producing most of the top memecoins.

While a few have appeared on the Vitalik Buterin-developed blockchain, it has not been able to match Solana. For instance, you could mention dogwifhat [WIF], Bonk [BONK], and Popcat [POPCAT] as some of the memecoins that have grown incredibly on Solana. On the other hand, PEPE seems like the only major one that has come out of the other.

Beyond the emergence of tokens, another factor that has played a part is the transaction fees. Investigations revealed that the cheap fees Solana offers has helped with retaining traders. Though fees on Ethereum are now lower than before, it’s still nowhere close to what Solana’s fees are.

Simply put, the DEX takeover happened as a result of a combination of these factors.

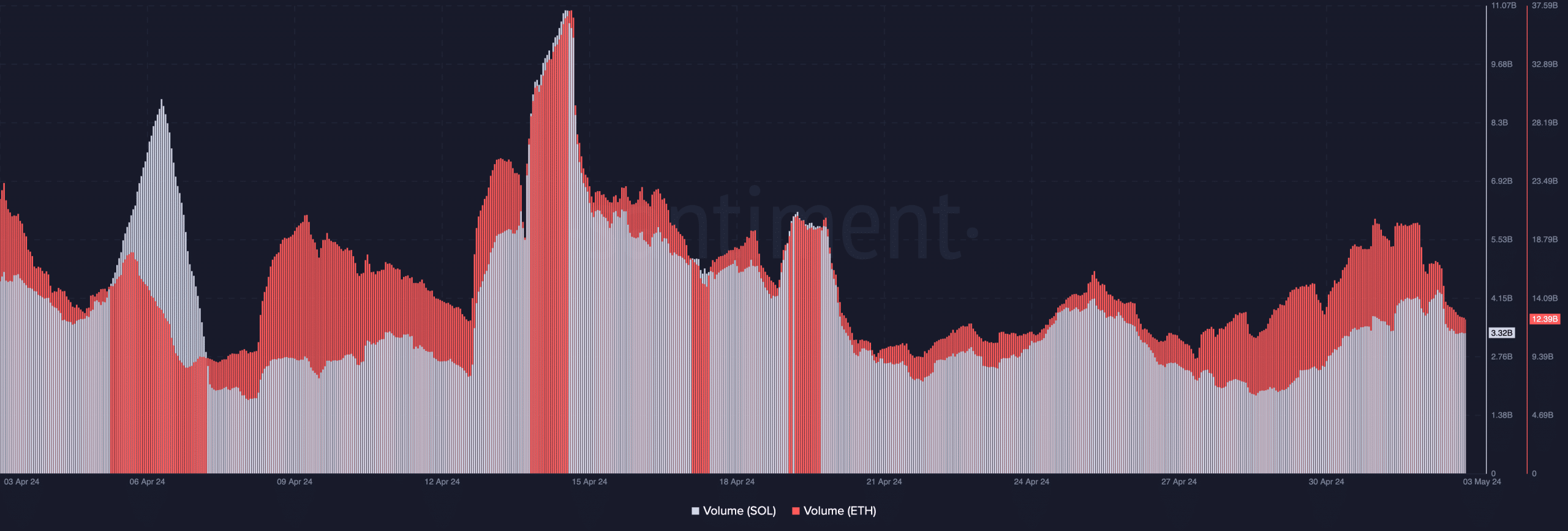

That being said, on-chain data also revealed that Ethereum’s volume is still much higher than Solana’s.

ETH, UNI, overtake SOL, JUP on some fronts

At press time, Solana’s volume was $3.32 billion. Ethereum, on the other hand, registered a figure of $12.39 billion. On the price front though, SOL led ETH in terms of growth.

At the time of writing, SOL was changing hands at $139.03 — A 537.65% hike in the last 365 days. Within the same period, ETH’s price appreciated by ‘just’ 61.10%.

Should this performance remain the same in months to come, then SOL could topple ETH all through this cycle. However, it is important to note that the DEXs mentioned have their native tokens too.

For Jupiter, the ticker is JUP. Uniswap’s UNI is more popular as it is a lot “older’ than the former. At the time of writing, JUP’s price was $1.02, representing a 75.53% hike in the last 90 days.

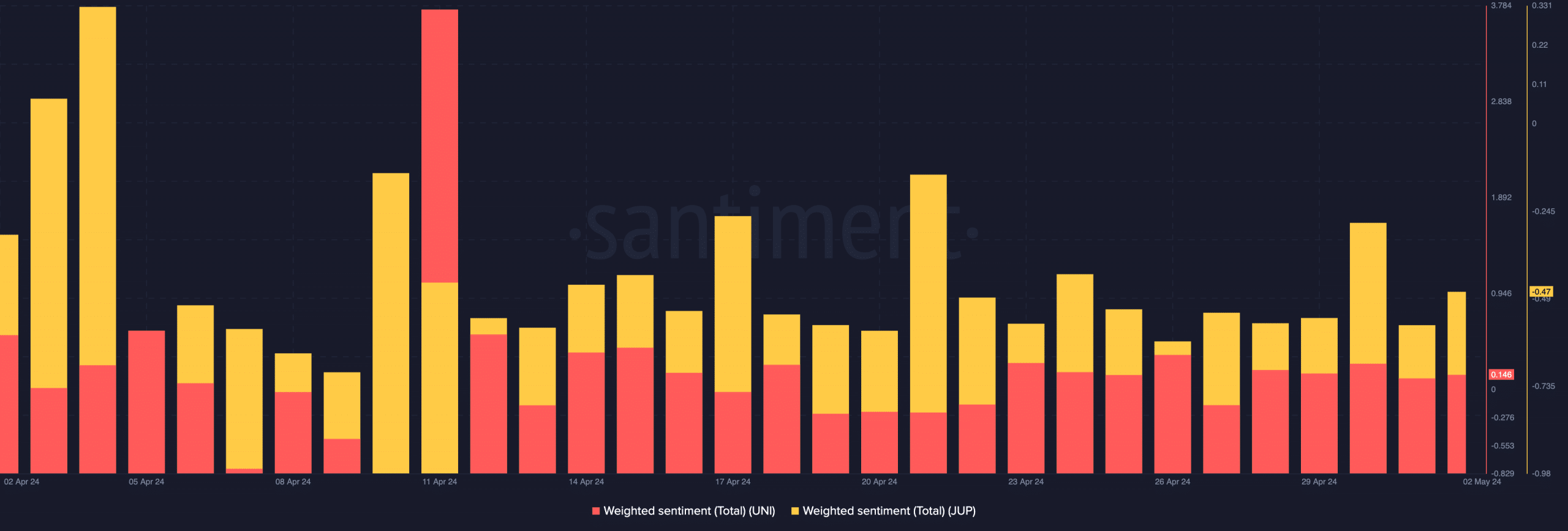

Meanwhile, UNI changed hands at $7.08 following a 14.54% hike within the same period. Regardless of the price action though, the Weighted Sentiment of Solana-based JUP was negative.

Ethereum-based UNI was in the green, indicating that market participants are more bullish on it than JUP. However, sentiment without action might not affect prices as JUP might continue to outperform UNI.

Realistic or not, here’s SOL’s market cap in ETH terms

For Ethereum and Solana, the battle might not stop anytime soon. Ergo, participants might need to keep an eye out for developments on their respective blockchains.