Solana: THIS indicator shows a sell sign! – What traders need to know

- If SOL fails to hold the $136 level, it could drop by 12% to reach $120.

- Solana’s bearish outlook could potentially shift if it surges and closes a daily candle above the $146 level.

Solana [SOL] appears to be preparing for a price decline as it has formed a bearish price action pattern.

While the broader market recovers, Solana has formed a bearish falling wedge pattern on the four-hour timeframe, similar to Bitcoin [BTC].

Solana’s technical analysis and price action

At press time, SOL was trading near $137.5, reflecting a 4.76% price drop in the past 24 hours.

Its trading volume fell by 10% during this period, indicating reduced trader and investor participation compared to the previous day.

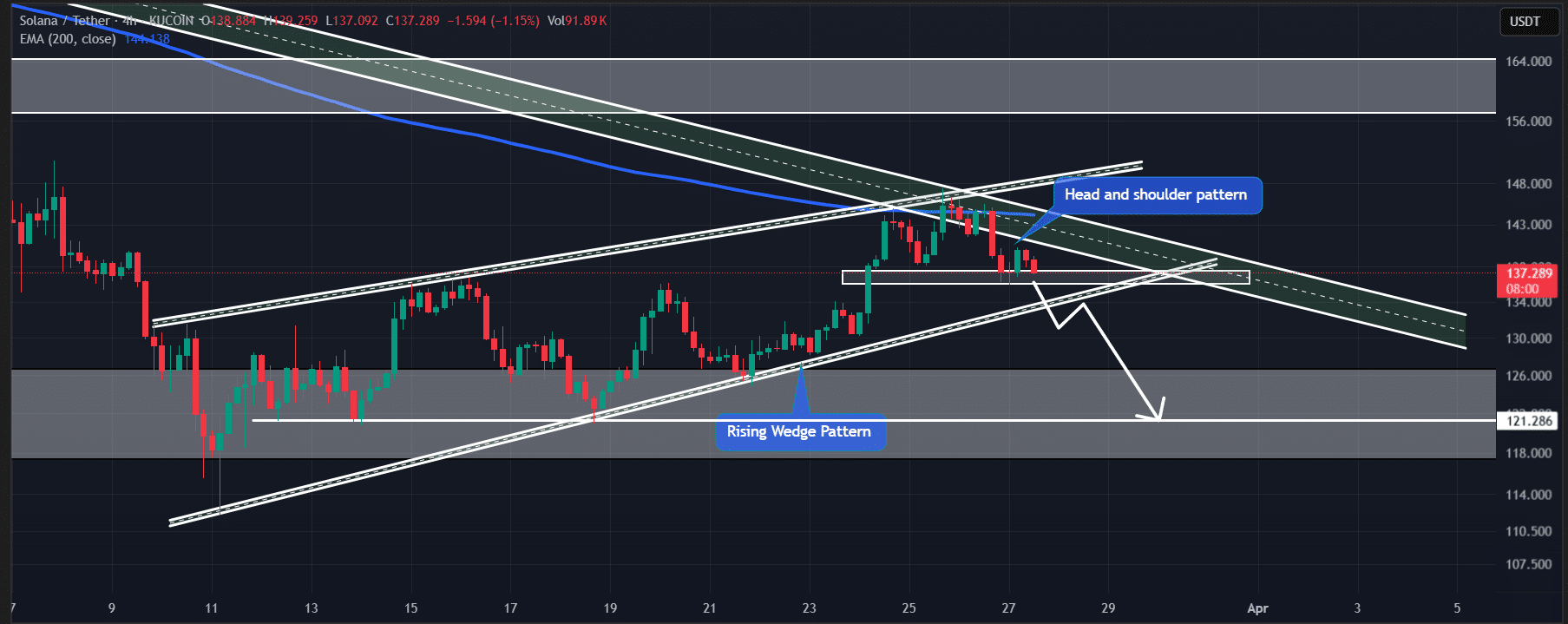

The price drop has brought SOL to the neckline of a bearish head and shoulders pattern on the four-hour timeframe, located within a rising wedge, with $136 as the neckline.

AMBCrypto’s technical analysis suggests that if SOL closes a four-hour candle below $136, it could drop by 12%, reaching $120 in the coming days.

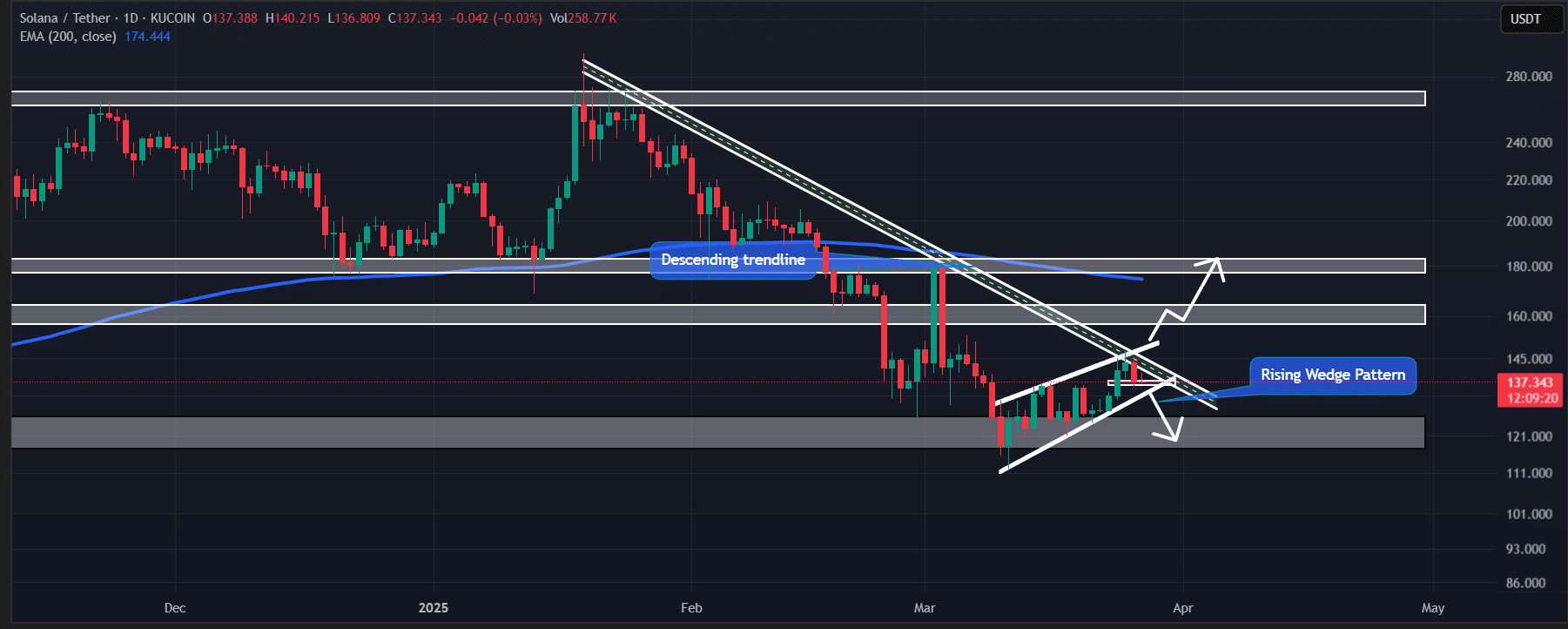

In addition to these bearish patterns, SOL has faced rejection from a descending trendline that has acted as a resistance level since January 2025.

This rejection, combined with the formation of a bearish engulfing candlestick pattern, strengthens the bearish outlook.

However, the bearish sentiment could change if Solana breaks the descending trendline and closes a daily candle above $147.50. If this occurs, SOL could potentially rise by 22% to reach $180 in the future.

Indicator flashing sell-signal, says analyst

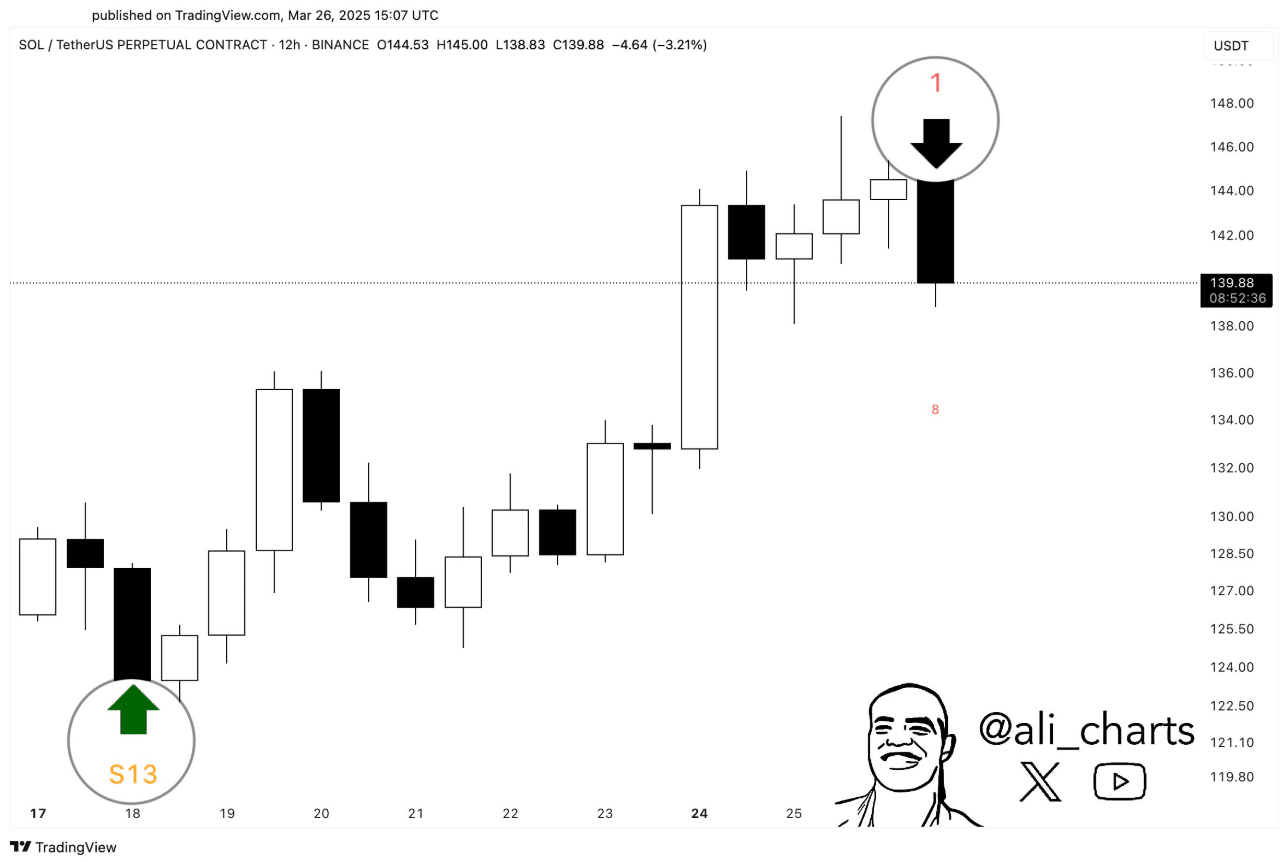

A notable crypto expert on X (formerly Twitter) has reinforced the bearish outlook for Solana.

The expert highlighted that the TD Sequential indicator, which previously signaled a buy ahead of SOL’s 22% rally, now shows a sell signal.

This raises questions about whether the price will continue to decline, or if the indicator is merely a signal.

Traders bullish view for Solana

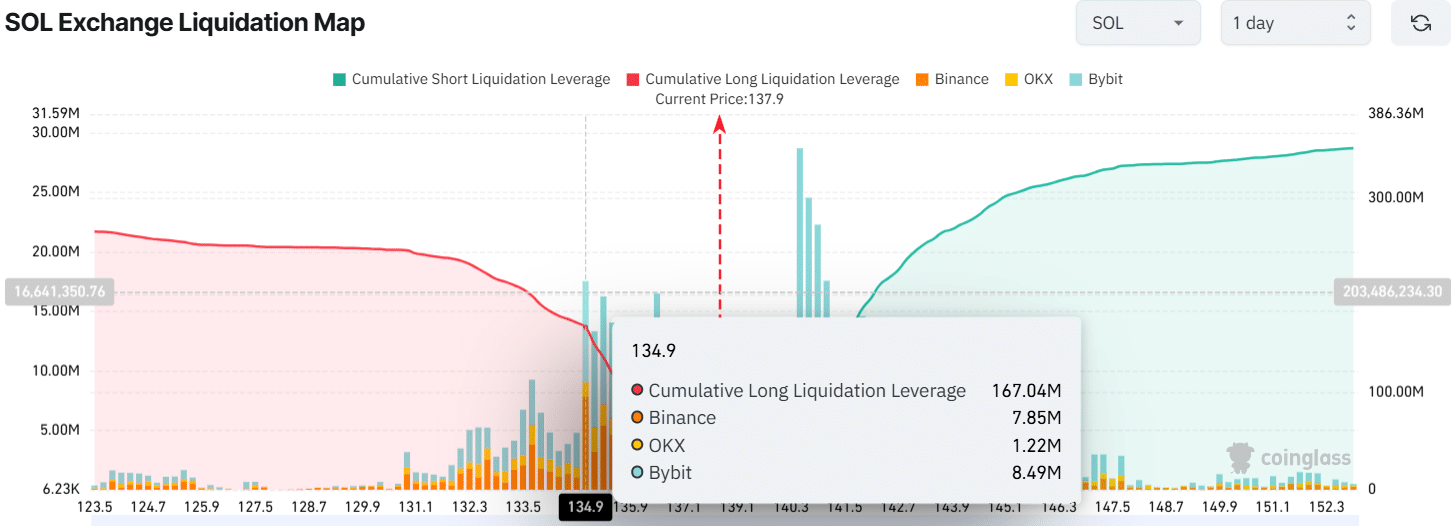

However, intraday traders appear to be acting contrary to the overall market sentiment, as they are strongly betting on the long side.

Data from the on-chain analytics firm Coinglass revealed that traders are currently over-leveraged at $135 on the lower side, holding $167 million worth of long positions.

Meanwhile, $140 is another overleveraged level where intraday traders have built $83 million worth of short positions.

This highlights that bulls are currently dominating despite the bearish outlook, which is preventing SOL from falling further.