Solana to $50? Here’s why it could be possible

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Solana has a bullish structure on the higher timeframe price charts.

- The $40-$50 zone could be pivotal in the coming weeks.

Solana [SOL] was in the midst of a bullish run of a magnitude not witnessed since April 2022. However, the run back then was followed by a continuation of the previous downtrend. Was the same scenario set to repeat itself?

Is your portfolio green? Check out the SOL Profit Calculator

News of FTX unstaking an additional 1.6 million SOL meant bullish sentiment could take a hit and lead to a large price correction. It was unclear if traders and investors could expect such a drop, as Bitcoin [BTC] managed to stay above the $33k level and could go further up.

Where would an ideal retracement take SOL prices?

The one-day chart showed that bullish intent remained overwhelming. The RSI continued to move in the overbought territory above 70 and the On-Balance Volume was climbing higher. Together they showed buying volume was on the rise and the upward momentum was firm.

The higher timeframe charts showed that the move above $27-$30 was a definitive signal that further gains could follow. They did, and SOL reached $46.9 on 1 November. A revisit to the former range highs at $27 would be an ideal long-term buying opportunity.

The Fibonacci extension levels showed $44.08 and $51.46 were levels where bulls could book profits and wait for a retracement.

The conviction of buyers in the market meant such a deep retracement might not arrive anytime soon

Source: Santiment

The Weighted Sentiment shot higher in recent days as prices surged northward. The Social Dominance also rose enormously to stand at 6.32%. These metrics underlined the idea that the bullish narrative for SOL had strength in the eyes of the majority.

Yet, by itself, the social metrics do not exclude the possibility of a retracement.

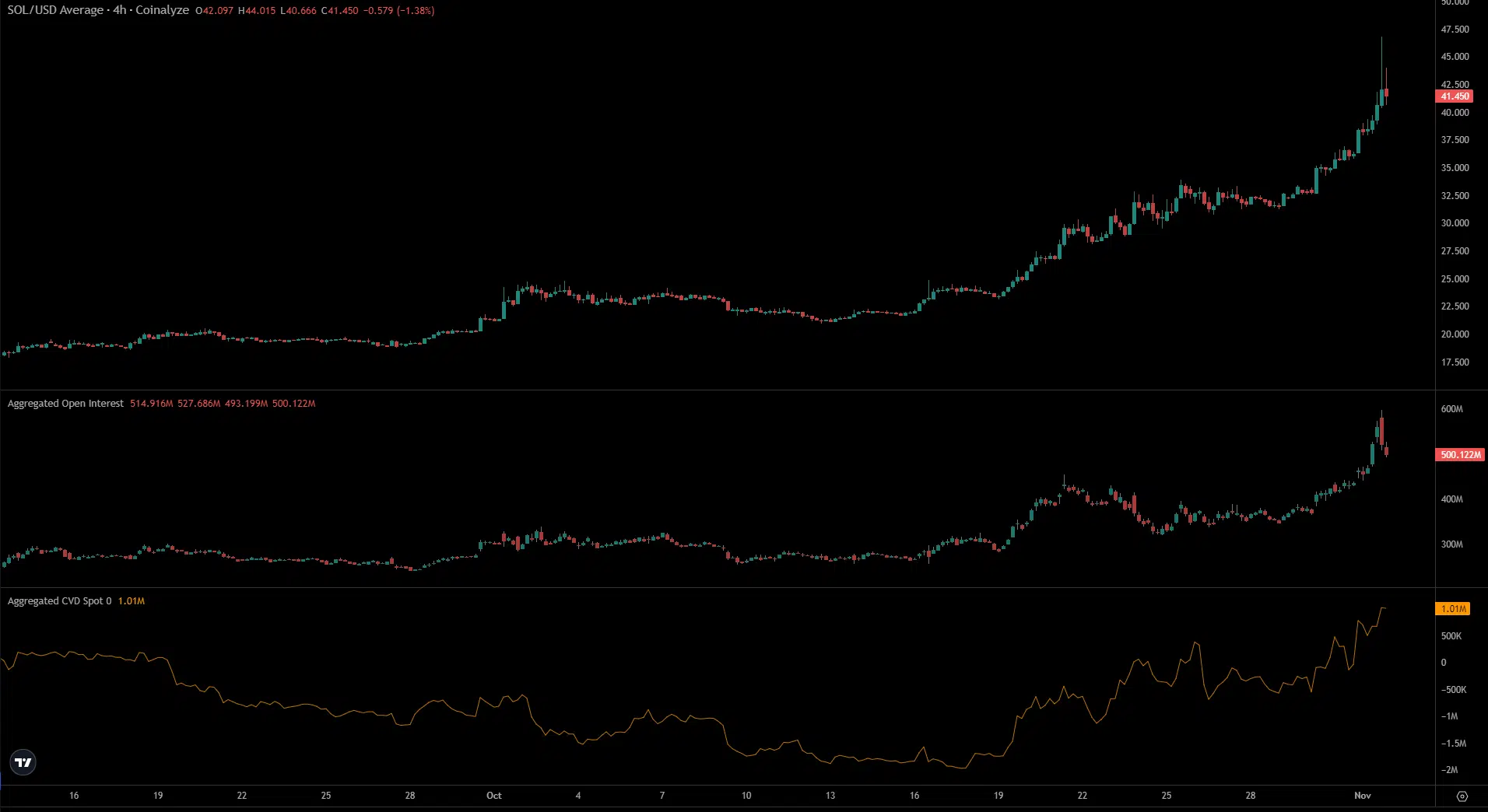

Source: Coinalyze

Realistic or not, here’s SOL’s market cap in BTC’s terms

The spot CVD on the Coinalyze data has been on a steady uptrend since 19 October, when the SOL price was at $23. This showed the demand for the token. The rally was followed by a rising Open Interest (OI) as well, which specified strong bullish sentiment.

The weekly chart revealed that the $38-$50 region, which had served as resistance in August 2022, could pose problems for the buyers once more. If $50 was flipped to support, it was likely that SOL could rally to $80 and $105 next.