Solana to fall below $93? Here’s what’s fueling predictions

- SOL’s price might drop to $93 as over one million tokens flowed into Coinbase.

- If demand for SOL heightens, then the price might jump above $100.

According to Whale Alert, two large transactions involving Solana [SOL] happened on the 5th of February.

First, 1.78 million SOL tokens were transferred to the Coinbase exchange. Minutes later, another round of SOL, valued at $11.43 million, was sent to the same exchange.

? 119,597 #SOL (11,436,478 USD) transferred from #Coinbase to unknown new wallethttps://t.co/k4ScR62UYh

— Whale Alert (@whale_alert) February 5, 2024

Traders keep expectations very low

When tokens of this magnitude are sent into exchanges, it means the cryptocurrency involved might experience a notable sell-off.

For SOL, this could be the case considering how the price action has moved in the last 24 hours. At press time, the price of the 5th most valuable cryptocurrency was $97.92.

SOL’s price mirrored a contrary performance compared to how it performed during the first quarter of 2023. When last year began, the Solana token was $9.96.

By the 5th of February 2023, the price had increased to $23.50. However, the Year-To-Date (YTD) performance of SOL has seen its price slide by 10.70%.

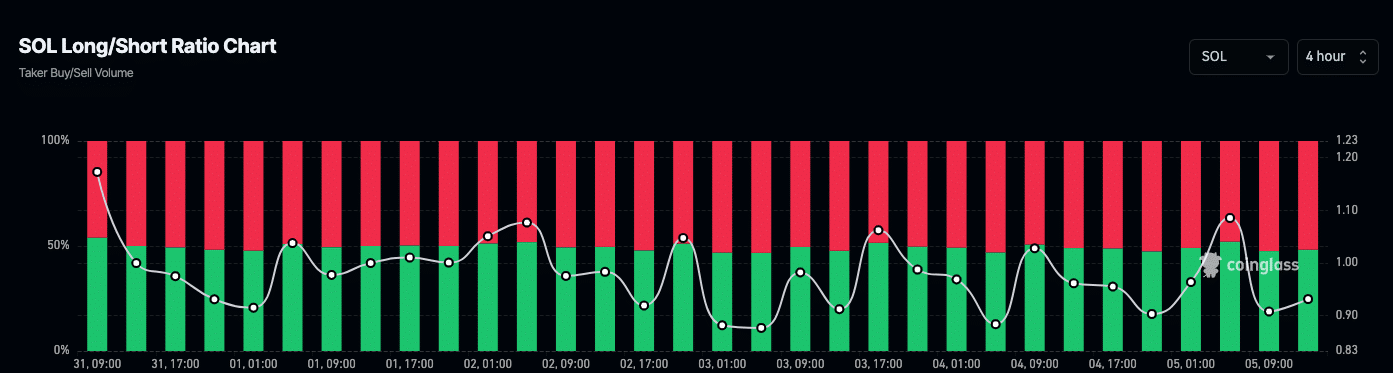

With the recent transfers, the price can drop below $90. Furthermore, AMBCrypto’s analysis of the Long/Short ratio showed that traders shared a similar sentiment.

This ratio measures the number of long positions compared to the number of short positions.

Values of the Long/Short ratio above 1 suggest that there are more long positions than shorts. In this case, traders expect the asset price to increase.

However, SOL’s Long/Short ratio was 0.93, indicating that the broader sentiment was bearish.

No big move yet for SOL

A further assessment of the derivatives market showed that there were visibly higher long liquidations than short on the 4th of February. However, the dynamics seem to have changed at press time.

As of this writing, long liquidations constituted $1.82 million, while shorts were worth $1.44 million.

The closeness of these forceful position closures could be linked to SOL’s recent move. Unlike the way it moved some days back, SOL has been consolidating.

Therefore, those who bet on higher prices and those who did the opposite seem to have taken the same level of risk.

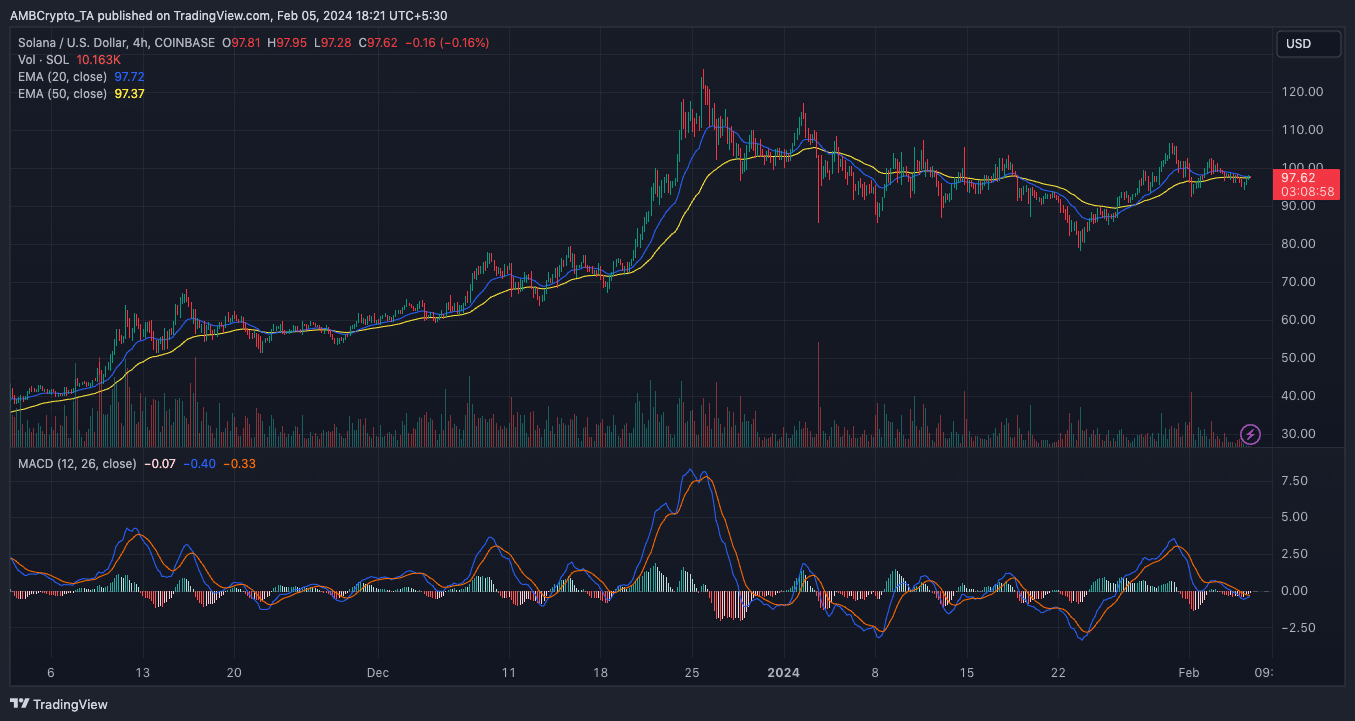

From a trading perspective, the 20 EMA (blue) and 50 EMA (yellow) were around the same spot. Also, these EMA points were close to Solana’s price at the time of writing.

A trend like this suggests that a big upward move was not the next thing for SOL. Instead, the token might keep $93 and $98.

Is your portfolio green? Check out the SOL Profit Calculator

In addition, the Moving Average Convergence Divergence (MACD) trended downwards. The reading at press time, indicates a likely bearish momentum for Solana.

In the short to mid-term, SOL might find it challenging to cross the $100 market. However, if the sentiment in the market changes, the price could flip the level within a short period.