Solana

Solana: Top reasons why SOL could be on the path to recovery

SOL is showing signs of a major recovery as the market skews bullish, though its next move remains uncertain.

- Transaction activity on the SOL network surged over the past 24 hours, suggesting increased interest.

- Market sentiment in both the spot and derivatives markets is gradually shifting in favor of a bullish outlook.

Solana [SOL] has struggled after hitting its all-time high of $264.39. Over the past month, it has dropped by 13.20%, erasing its previous gains. On the daily chart, the asset is down 2.93%, trading at $209.44 at press time.

AMBCrypto observed that increased trader activity could indicate selling pressure, but the overall sentiment suggests a possible bullish reversal.

Increased trading activity: What does it mean for SOL?

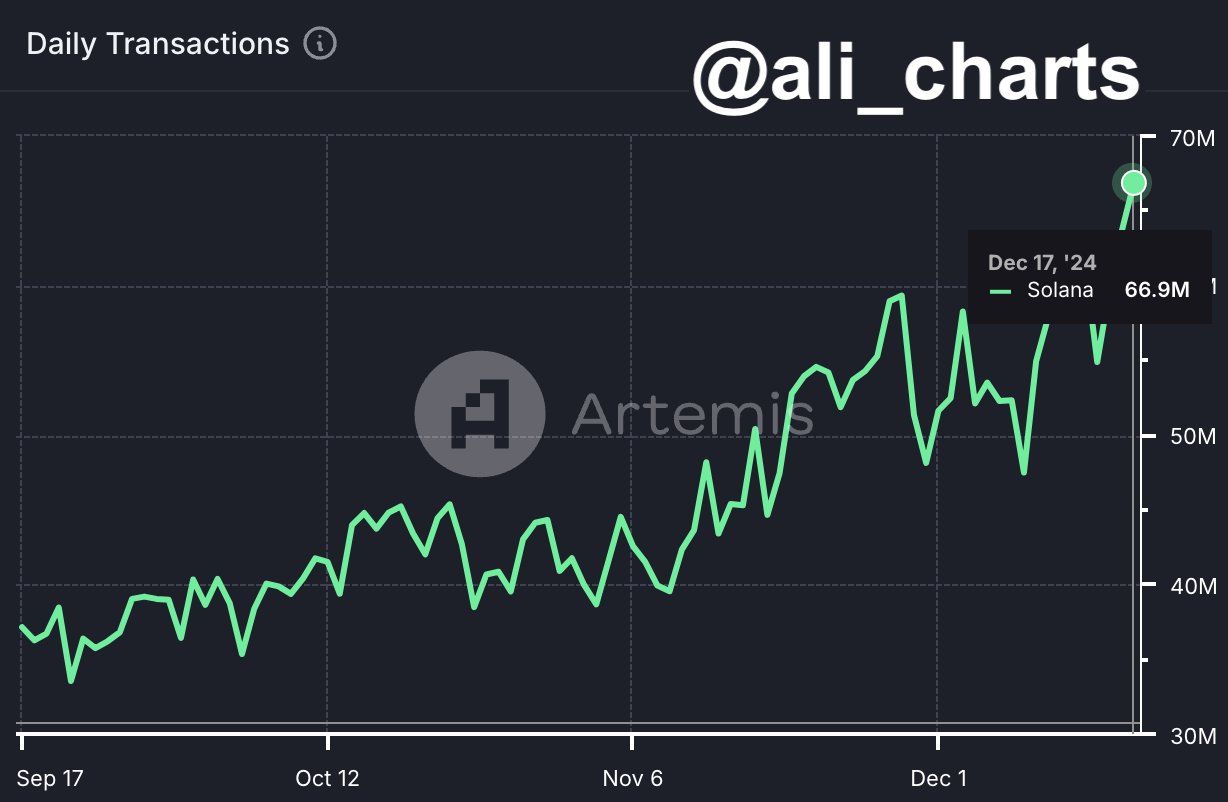

According to Artemis data, daily transactions on the SOL network have surged, with the number nearing 67 million—levels not seen in recent months.

A spike in transaction activity can signal either positive or negative momentum for an asset, often depending on price movement.

In SOL’s case, the price has declined by 2.93%, suggesting that the increased transactions may indicate selling pressure. The asset recently hit a new weekly low, trading at $199.39.

However, this decline has pushed SOL into a support zone on the weekly chart—a level historically associated with strong buying interest. This support could drive a potential price rebound in the near term.

SOL outflows surge as spot conviction changes

A high outflow of SOL from exchanges suggests that spot traders are moving their assets to wallets which means there’s a potential long-term commitment despite the recent market downturn.

Typically, spot traders deposit more assets into exchanges during such conditions. However, the current trend of withdrawals points to heightened bullish sentiment.

As of now, the Exchange Netflow is heavily negative, with over $264 million worth of SOL moved out of exchanges in the last 96 hours. Within the past 24 hours alone, $46.26 million worth of SOL has been withdrawn, contributing to market strength from a further drop.

In addition, the market’s funding rate remains positive at 0.0057%, indicating that bullish long traders are paying a periodic fee to maintain balance between spot and futures market prices.

If this trend of rising withdrawals and positive funding rates continues, SOL could be on track to reach new price highs.

Long liquidations set the stage for a bullish shift

The past 24 hours have seen massive long liquidations in the market, with $21.35 million lost. This occurs when the price of an asset moves downward, contrary to the upward bets placed by long traders, resulting in massive losses.

While this is bearish, a gradual shift is emerging on lower time frames, reflecting a change in trader sentiment.

Is your portfolio green? Check out the SOL Profit Calculator

Over the past 4 hours, short liquidations have exceeded $936,150 as opposed to long liquidation below $150,000. This indicates that traders are turning bullish, suggesting the asset could trend higher.

Additionally, Open Interest has grown by 0.62% in the same period, now totaling $3.52 billion. This increase points to bullish momentum, as the majority of unsettled derivative contracts are now positioned in favor of upward price movement.