Solana vs Ethereum – Here are some key insights on the SOL/ETH ratio

- SOL underperformed ETH by 25% towards the end of January

- However, the SOL/ETH ratio may be heading towards key inflection points

Solana [SOL] lost ground against Ethereum [ETH] in the last week of January. The altcoin retraced most of its gains post-TRUMP memecoin’s launch, dropping from $295 to nearly $220 on the charts.

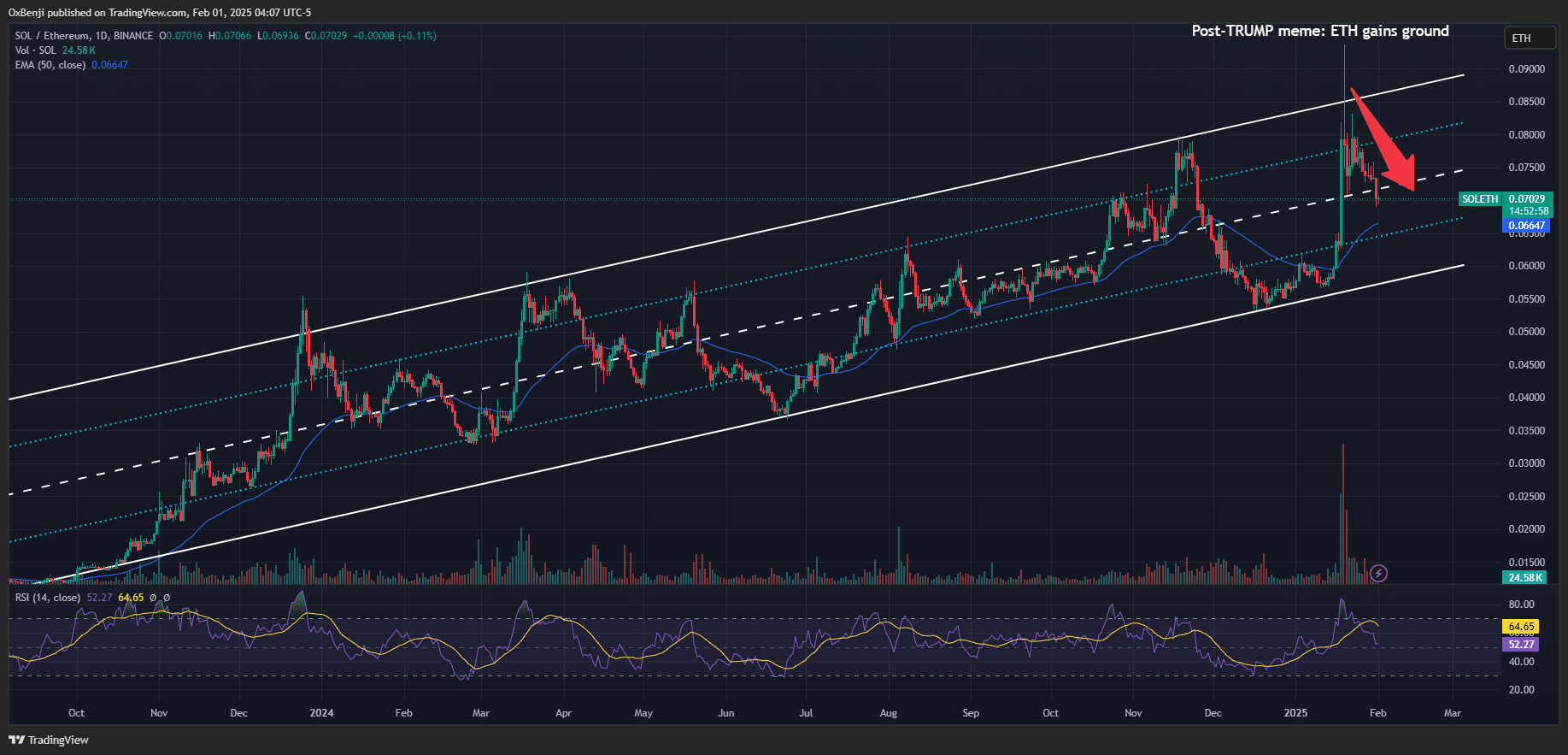

The SOL/ETH ratio revealed that over the same period, SOL’s decline was over 25% relative to ETH. For the unfamiliar, the SOL/ETH ratio tracks SOL’s relative performance to ETH and by extension, the likely capital rotation between the two smart contract platforms.

SOL/ETH ratio eyes key inflection area

During the TRUMP craze, SOL outperformed ETH by nearly 50% in 2 days. However, the Trump mania didn’t last long, dragging SOL into its slump. Additionally, Chinese Deepseek AI fears and overvaluation concerns among U.S tech firms induced a broader market rout that didn’t spare SOL and the rest of crypto.

Interestingly, ETH held the weak market sentiment better than SOL. SOL underperformed ETH by 25% during the most recent market dump.

Worth noting, however, that the drop also marked SOL/ETH rejection at the upper channel, which has historically led to reversal. Now, the pair has retreated towards key inflection points at the 50-day EMA (moving average) and the channel lows.

If the channel holds, the pair could rebound at the lower support levels – A sign that SOL could regain ground against ETH over the next few days.

Besides, Solana has maintained its position against Ethereum on some fronts, especially after flipping it for the first time in monthly revenue. In January, Solana raked in $119M in revenue against Ethereum’s $107.6M.

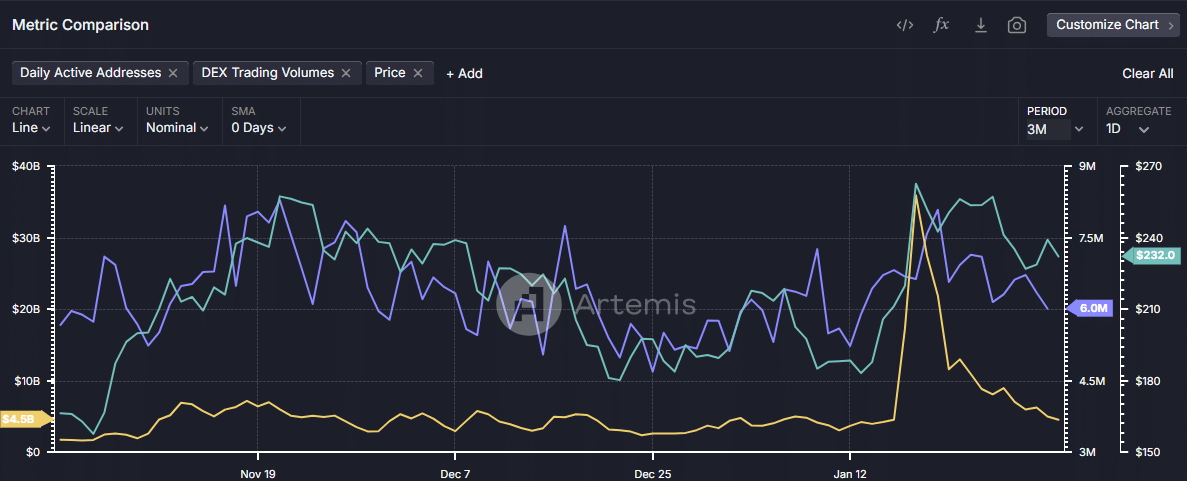

That being said, after Solana’s daily trading DEX volume peaked at $35.9 billion after TRUMP’s launch, the metric fell to $4.5 billion at press time – A whopping 87% drop.

Simply put, demand for SOL, since it’s the primary token for gas fees within its DeFi ecosystem, dropped by nearly 90%. This weighed on SOL’s price too. Hence, the altcoin might only rebound if traction trading DEX volumes rise across the board.

Source: Artemis

On the price charts the $220 price zone remains a key short-term level to track. In fact, it has been doubling as the 50-day EMA (moving average) too. A breach below the level could drag SOL to $200 or below.