Solana vs. Ethereum: Here’s how SOL is challenging ETH’s dominance

Solana [SOL], now the fourth-largest cryptocurrency by market capitalization, is rewriting the narrative in the blockchain space.

Surging ahead in key metrics such as daily network fees and DEX volumes, Solana’s rapid ascent reflects a maturing ecosystem and growing real-world adoption. Once a contender, it now stands as a formidable challenger to Ethereum [ETH], reshaping the competitive landscape of blockchain technology.

Solana vs. Ethereum

In recent months, Solana has achieved significant milestones, surpassing Ethereum in daily network fees and DEX volumes.

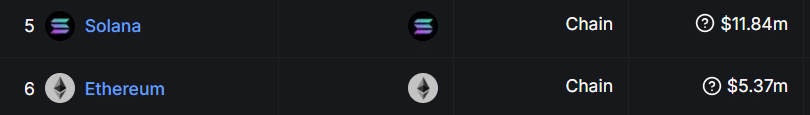

According to data from DeFiLlama, Solana generated $11.8 million in daily network fees within 24 hours—nearly double Ethereum’s $5.3 million.

On the DEX front, Solana has been equally impressive. Over the past week, its 24-hour trading volume reached $6.24 billion, dwarfing Ethereum’s $850 million and surpassing the combined volumes of all Ethereum Layer-2 solutions.

This performance was supported by robust year-to-date growth of 300.56% in SOL’s price, which recently climbed above $240. This was a testament to the network’s increasing adoption and bullish momentum in the broader crypto market.

Expanding ecosystem and real-world adoption

SOL’s explosive growth is not limited to market metrics. According to Ryan Watkins of Syncracy Capital, the blockchain’s evolution is grounded in hard data rather than potential.

Over the past year, Solana’s protocol fees have surged to $343 million — nearly double Ethereum’s $178 million. This rise is a dramatic shift from November last year when Solana’s chain fees were just 1.36% of Ethereum’s. Today, they stand at a striking 80%.

Watkins highlighted that Solana was no longer viewed as a speculative network driven by technical advantages like speed and scalability. Instead, it is now a blockchain ecosystem with undeniable data to back its success.

Will Solana surpass Ethereum?

As Solana’s ecosystem continues to expand and real-world adoption accelerates, the question arises: Can it surpass Ethereum entirely?

While Solana’s cost-efficiency and scalability provide significant advantages, Ethereum retains its edge in areas like developer adoption, institutional support, and decentralized finance (DeFi) infrastructure.

Realistic or not, here’s SOL market cap in BTC’s terms

However, if Solana maintains its current growth trajectory, it could solidify its position as a legitimate contender to Ethereum’s dominance. The coming months will reveal whether the altcoin can sustain its momentum, or if Ethereum will leverage its entrenched network effects to maintain its lead.

For now, SOL’s surge marks a pivotal shift in the market, highlighting the dynamic and competitive nature of blockchain technology.