Solana: Why THIS price level could be crucial for SOL’s upcoming rally

- The recent price action suggested that the bulls gained control, but strong resistance at $162 could prevent an immediate rally.

- Traders should closely monitor the $162 resistance, as a break above this level could signal a stronger recovery.

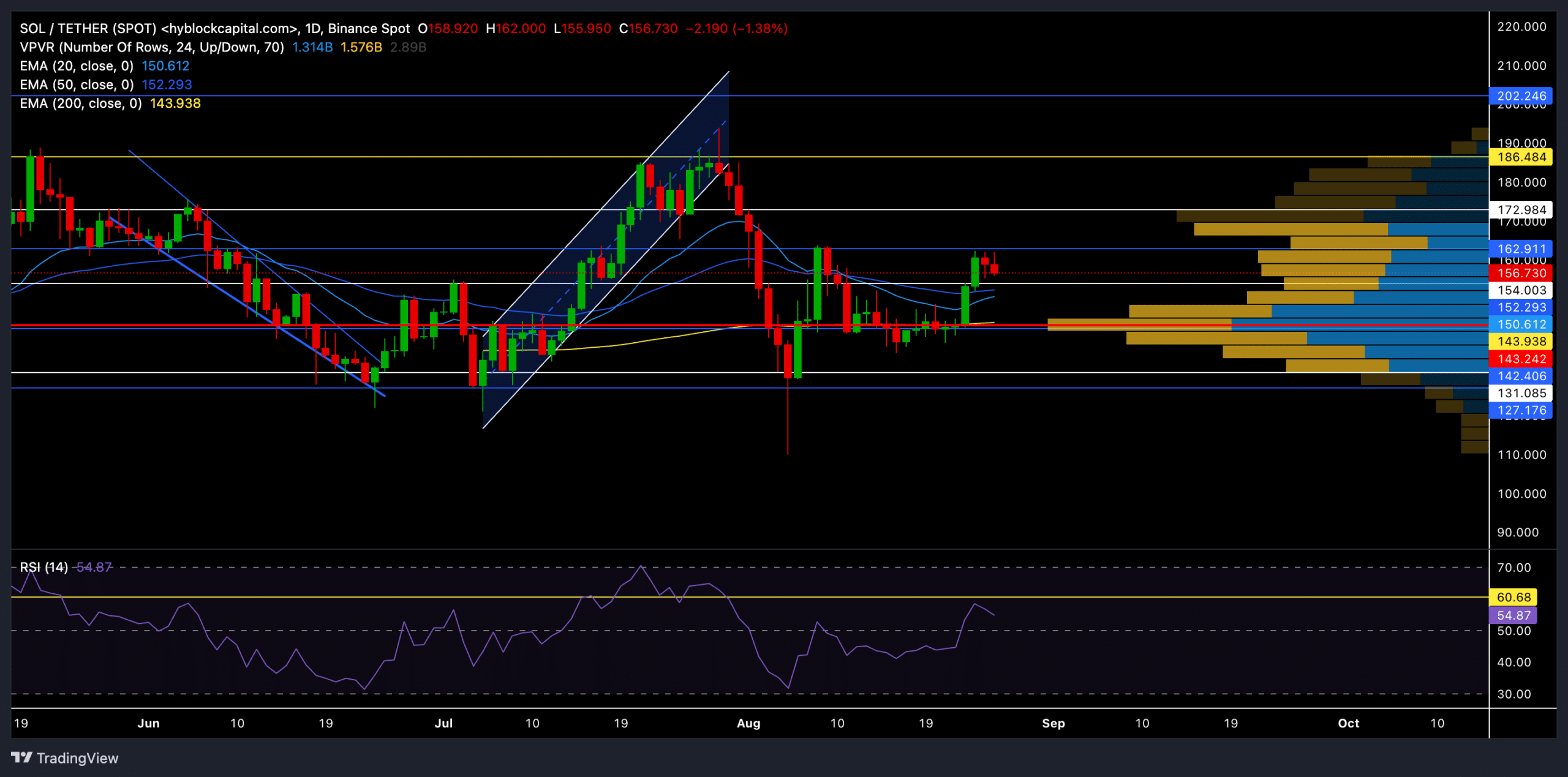

Solana [SOL] had recently experienced a decline after witnessing a classic ascending channel breakdown and falling below critical support levels as bearish momentum took hold. The question is whether the bulls can regain control or if further downside is imminent.

Solana bulls re-entered the market

SOL had been under bearish pressure in early August after failing to hold above the crucial $172 level. Currently trading at around $156.7, SOL was down by nearly 1.26% in the last 24 hours.

After bouncing from the $142.15 support level on 6 August, SOL managed to clock in a 20% gain in just over three weeks. However, this bullish momentum was short-lived as the price met resistance at $162, a level that has been difficult for the bulls to overcome this month.

Nonetheless, the price reclaimed some crucial support levels and hovered above the 20, 50, and 200-day EMA at the time of writing.

It’s worth noting that there was slight bearish pressure as the altcoin reversed from the $162 resistance, and the price hovered in a zone that could see more volatility.

The RSI stood above the 50 mark at press time, depicting a slight bullish edge. However, buyers should look for a potential close above the RSI resistance point at 60 to gauge the chances of a rally in the coming days.

Key levels to watch

The immediate support level to watch is near the $150 mark (20-day EMA). If SOL can hold above this level, it might attempt to retest the $172 resistance zone in the coming days.

However, if the bears continue to exert pressure and SOL falls below $150, it could retest the point of control (red) level of the VPVR indicator near the $143 level.

While the overall volume increased by 13% to $6.73 billion over the past day, open interest rose 3.15% to $2.43 billion. This suggested that traders were still actively participating, but the sentiment leaned toward the bearish side.

The long/short ratio for the last 24 hours was 0.9249, indicating a slight bearish sentiment among traders.

Is your portfolio green? Check the Solana Profit Calculator

However, on Binance, the SOL/USDT long/short ratio was bullish at 1.7917—showing that a significant portion of traders were still bullish.

Buyers should also keep an eye on Bitcoin’s sentiment and other macroeconomic factors that could impact SOL’s price action in the coming weeks.