Analysis

Solana: Will a retest of $20 yield better results for bulls

Solana’s quick recovery from a price dip on 30 June signaled buyers’ intent to flip its structure from bearish to bullish.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bulls recovered from the latest dip to maintain SOL’s uptrend.

- A stable funding rate could fuel more gains.

Solana [SOL] posted four bullish candles in a row on the 12-hour timeframe, as bulls recovered from the 14.8% drop on 30 June that halted their bullish momentum. This saw SOL trade at $19.26, as of press time, as buyers prepared for another test of the $20 psychological level.

Is your portfolio green? Check the Solana Profit Calculator

Due to a surge in its NFT metrics in recent weeks, Solana recorded increased activity on its blockchain which could lead to more growth and translate to a price increase for the altcoin.

Bulls won’t be deterred

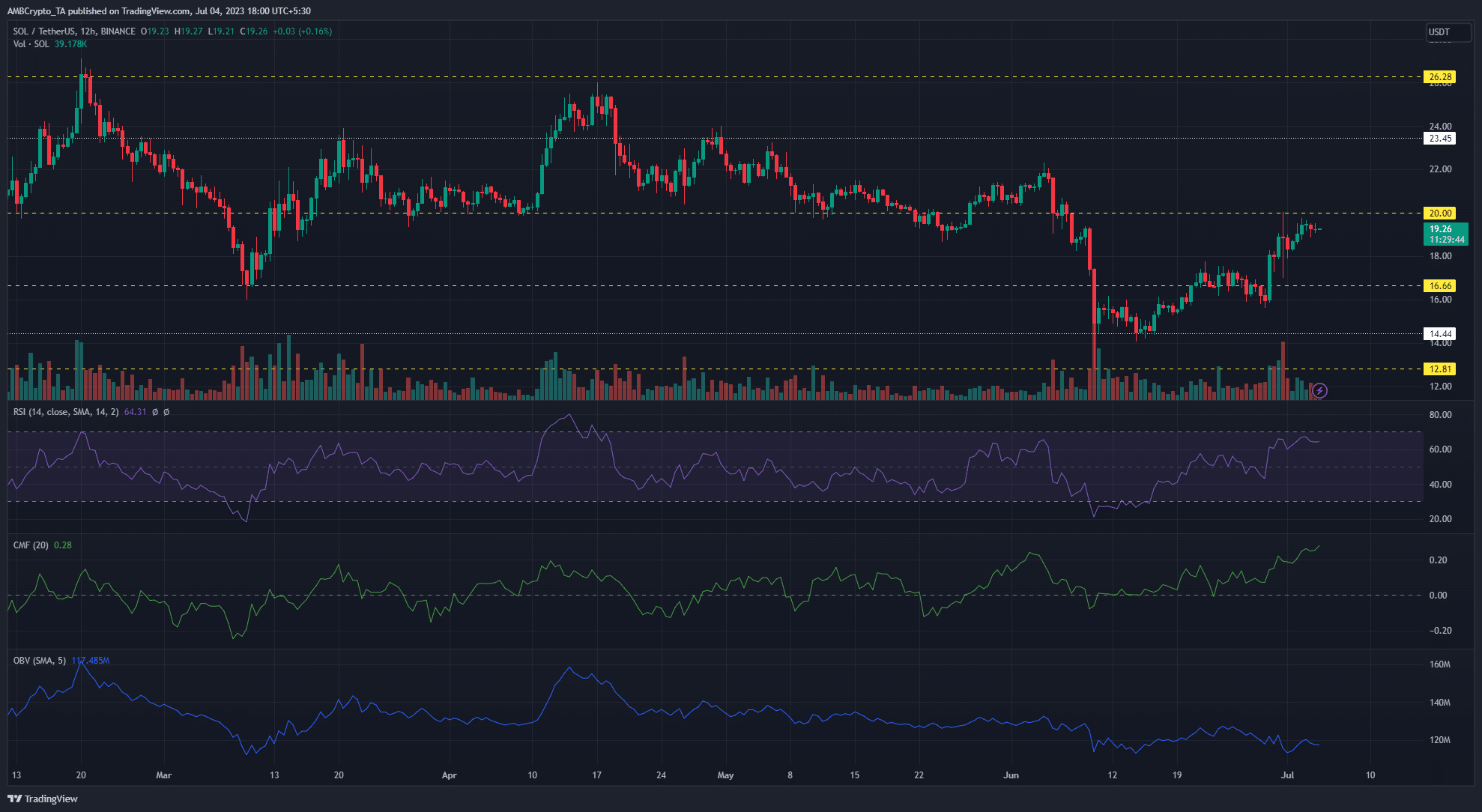

June saw Solana reverse some of its recent losses. After dropping to the $12.81 support level, price rallied to flip the $16.66 resistance back to support. However, the selling pressure at the $20 resistance level saw price rejected on 30 June, as bulls moved to claim another resistance level. This price rejection was accelerated by the market correction, due to the rejected Bitcoin ETF applications

by traditional asset firms.Despite the setback, bulls remained firm in their resolve. A 12.9% price jump between 30 June and 2 July maintained SOL’s uptrend, bringing it to the brink of a critical resistance level.

Looking at the on-chart indicators over the 12-hour timeframe, the Relative Strength Indicator highlighted the rising demand for SOL, posting a reading of 65. The Chaikin Money Flow continued to rise and stood at +0.28, as of press time. This showed significant capital inflows for Solana.

If buyers successfully break the $20 level, bulls will look to flip SOL’s structure to bullish. A break of the lower high around the $22 price zone could lead to a significant push on for the $23.45 resistance. Alternatively, sellers could leverage the bearish structure to push prices down again toward the $16.66 support.

Steady funding rate could support bulls

Data from Coinglass

showed that the OI-weighted Funding Rate was constantly positive since 26 June. This hinted at increased demand in the derivatives market which could boost SOL’s bullish charge.How much are 1,10,100 SOLs worth today?

Similarly, the exchange long/short ratio on the four-hour timeframe revealed strong bullish sentiment with longs holding a 51.5% advantage, as of the time of writing. Together, Solana buyers can be confident of taking the $20 resistance level.

Source: Coinglass