Solana: Will SOL enter Q4 in the green light? These reasons may convince you…

Solana [SOL] wasn’t at its best last week as it registered a more than 8% decline in its value. Though the current bearish market condition was a factor that led to this result, there were several metrics that also played a role in this recent decline.

At the time of writing, SOL was trading at $31.36 with a market capitalization of $11,066,237,560. However, there have been a few positive developments in the community that have brought SOL back into the limelight again. Can these new developments help SOL to push its price upward?

New on the table

Recently, KuCoin, a popular crypto exchange, announced that it opened mainnet Solana (SOL) token deposit and withdrawal services. It is a positive development for the blockchain as it would help increase its reach and allow investors to buy the token.

#KuCoin Opens Mainnet #Solana $SOL Tokens Deposit and Withdrawal Services

— KUCOIN (@kucoincom) September 22, 2022

SOL also made it to the list of the top 10 cryptos by weekly search popularity on KuCoin, which reflects the interest of investors in the token.

Top 10 Coins by Weekly Search Popularity on #KuCoin (Sep 21, 2022)

? $ETH

? $LUNC

? $ETC

? $RVN

? $BTC

? $SHIB

? $XRP

? $CAKE

? $ERG

? $SOL#KuCoinTrendingCoins pic.twitter.com/95fa0ftY7Y— KUCOIN (@kucoincom) September 21, 2022

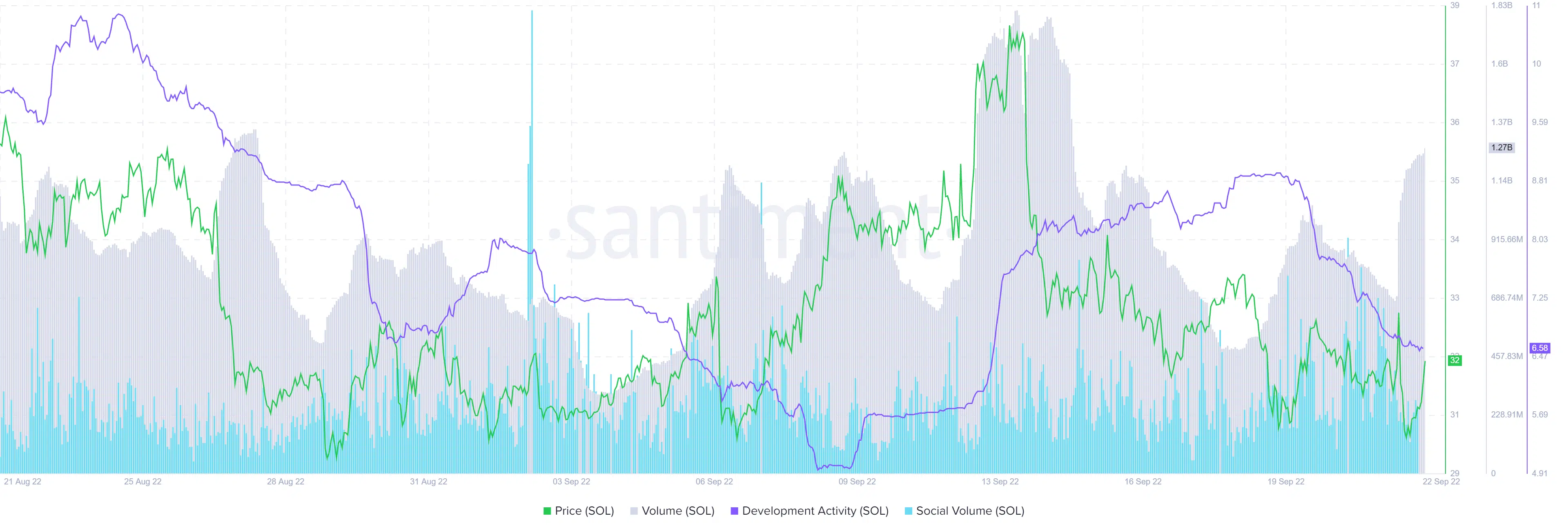

While several metrics were not in favor of the token, a few also gave hope for better days. One of the setbacks for SOL was that there was a sharp decline in the token’s development activity. This, on usual terms, acts as a negative indicator. However, SOL recently registered higher volume as its price rose slightly, which is a positive signal.

Moreover, the token’s social volume also increased as compared to last week, indicating that a higher number of investors were talking about SOL. This may thus, increase the chances of a northbound breakout soon.

Moving on to better pursuits…

SOL’s daily chart also painted a positive picture, suggesting a breakout soon. For instance, the RSI and Chaikin Money Flow (CMF) registered upticks, indicating that SOL’s price can go up in the coming days. Bollinger Bands (BB) showed that SOL’s price was in a crunched zone, further increasing the chances of a northbound breakout.

However, the 50-day Exponential Moving Average (EMA) line was above the 20-day EMA, which might restrict SOL’s price from going up in the short-term.