Solana: Will THIS derail SOL’s bullish outlook?

- Solana’s transaction count has increased recently, but market activity suggested that sellers dominated.

- On the chart, SOL remained within a bullish pattern that could propel it back to its previous all-time high.

After achieving a new all-time high in December, Solana [SOL] has retraced, losing 18.18% over the past month.

However, the narrative appears to be shifting as the asset has gained 7.09% in the past week and 5.42% in the last 24 hours.

Despite the apparent bullish momentum, uncertainty persists. The overall structure leans bullish, but recent selling pressure raises questions about the sustainability of the trend.

Transaction counts surge, but sellers dominate

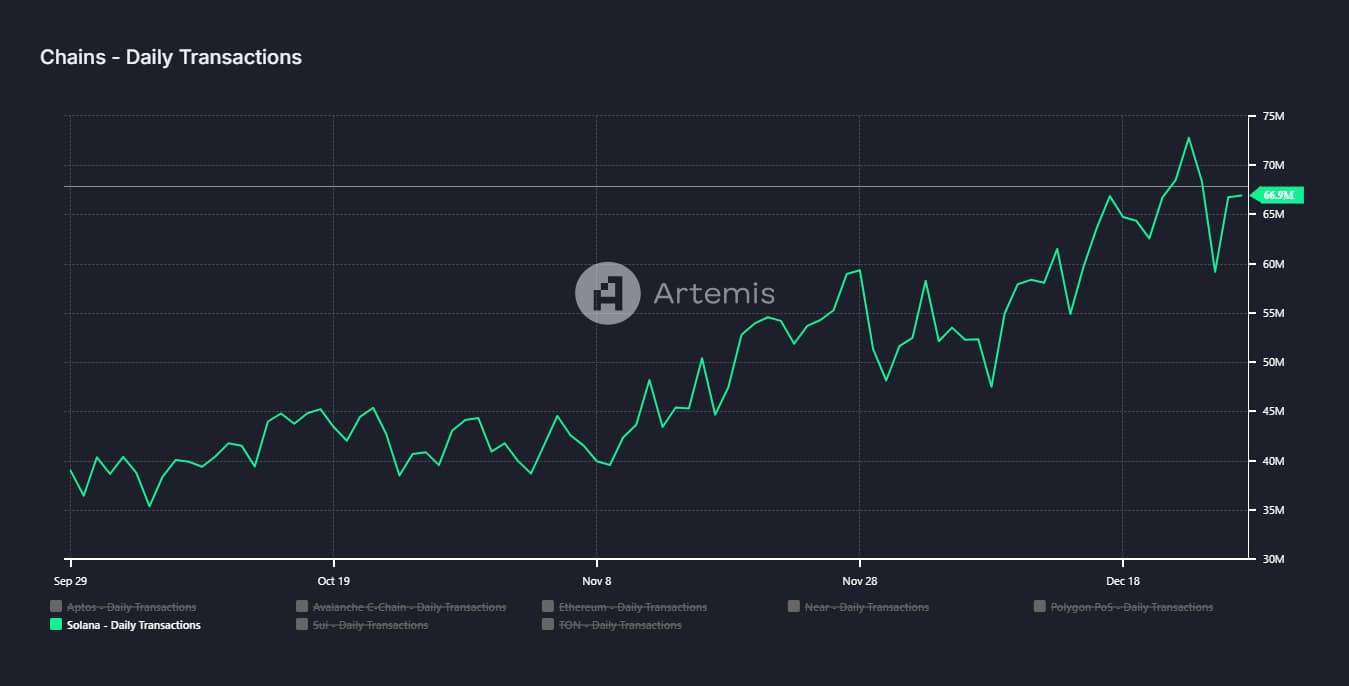

Solana’s network has recorded a surge in transaction activity, with 66.9 million transactions executed in the past 24 hours. This comes as the asset gradually recovers from its recent downturn.

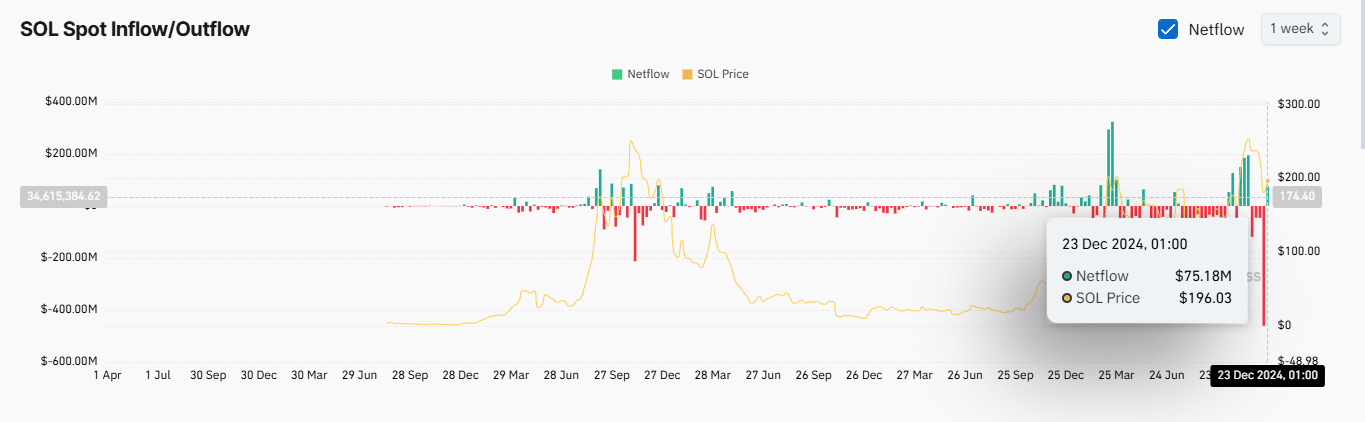

A spike in transaction counts can signal either bullish or bearish sentiment, depending on whether market participants are buying or selling. To discern the trend, AMBCrypto analyzed Solana’s Exchange Netflow.

Exchange Netflow measures the difference between the inflows and outflows of an asset on exchanges. A positive netflow indicates more selling activity, while a negative netflow suggests buying pressure dominates.

As of now, Solana’s Exchange Netflow is negative on both daily and weekly timeframes, suggesting that buying activity has outpaced selling.

In the past 24 hours, $6.15 million worth of SOL has been sold, and $75.18 million in the past seven days.

Despite the observed buying pressure, SOL’s price surge of 5.42% over the last 24 hours appeared fragile.

A closer analysis of trading volume revealed a 25% decline, indicating that the recent rally may lack sufficient market momentum to sustain itself.

Typically, when a price surge is accompanied by a drop in volume, it signals a temporary rally without substantial market support.

Unless Solana sees a corresponding increase in trading volume to back its price movement, the asset remains at risk of a deeper pullback.

SOL maintains bullish potential despite pressure

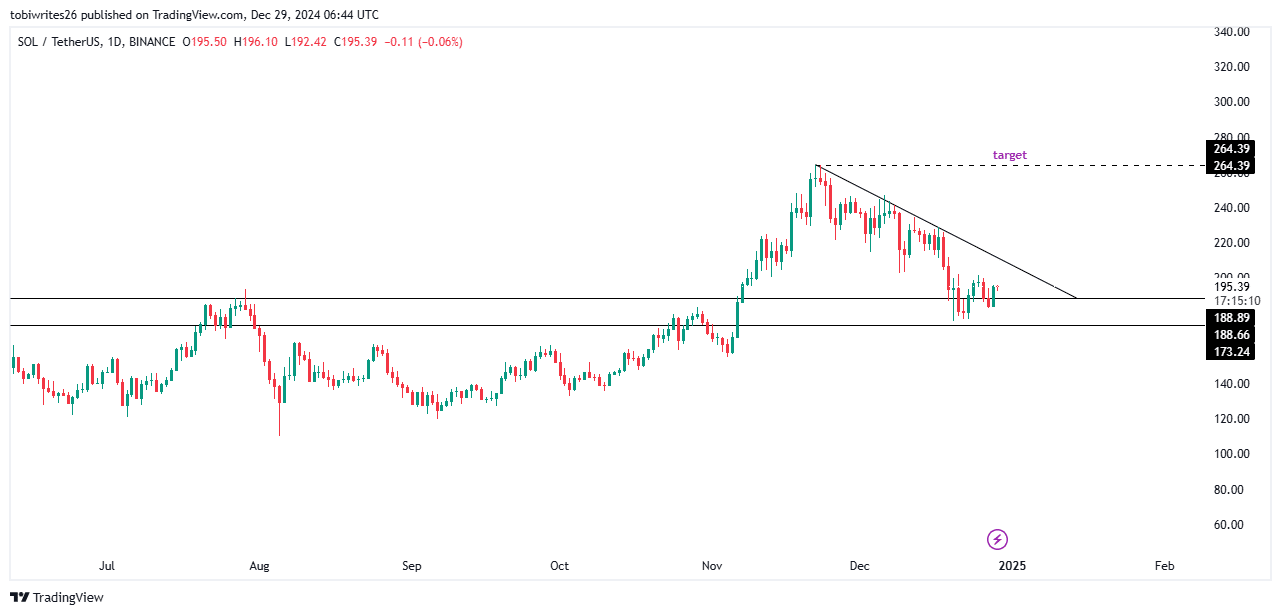

SOL has entered a key support zone on the chart, trading within a bullish triangle structure.

This support level ranges between $188.89 and $173.24, an area historically associated with significant buying pressure, though such activity has yet to materialize currently.

Read Solana’s [SOL] Price Prediction 2025–2026

If SOL breaches this support zone, it is likely to re-enter the consolidation phase it recently exited.

Conversely, if the support level serves as a catalyst for a rally, the asset could experience a significant upside. This could propel SOL toward its previous all-time high and potentially beyond.

![Bittensor [TAO] could fall to $216 - But a relief rally may come next](https://ambcrypto.com/wp-content/uploads/2025/03/TAO-Featured-400x240.webp)