Solana’s 23M token move raises eyebrows: Where to, SOL?

- Data showed that participants are HODLing, but SOL fell by 6.16%.

- An increase in volume with the current price trend could lead the token to $129.

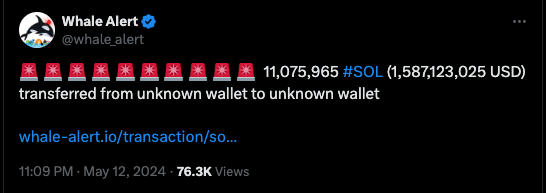

On the 13th of May, 23 million Solana [SOL] was sent to undisclosed wallets, according to data from Whale Alert. From the post shared, the first transaction was worth $1.58 billion.

The second one, suspected to be the same participants, sent another 11 million tokens, valued around the same price, to another wallet.

Three hours later, another large transaction occurred. This time, it was 1 million SOL that was transferred.

One thing AMBCrypto noticed was that none of the transactions went into exchanges. If the tokens had gone into exchanges, it would have prompted the notion that they were for sale.

$129 or $155? Where is the next target?

In this case, SOL’s price might have recorded a notable decline. Nonetheless, the performance of the token was not any better. At press time, the price of SOL was $140.

This value was a 6.16% decrease in the 24 hours, indicating the supposed HODLing strategy could not liberate the cryptocurrency from another downfall.

Where the Solana native token would head next could be a concern for both long-term investors and traders. As such, AMBCrypto analyzed the potential direction.

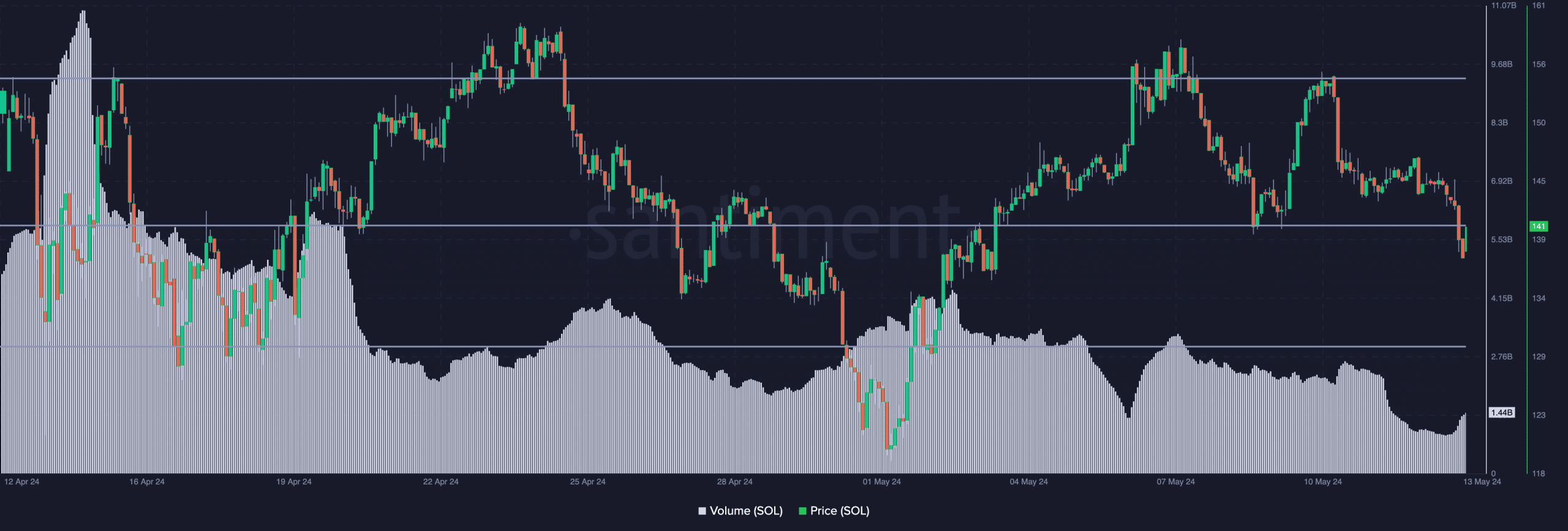

The first metric considered was Solana’s on-chain volume. Volume shows (in monetary terms) how much crypto has been traded over some time.

For SOL, Santiment’s data showed that the volume was $1.44 billion, which was an increase from the figure on the 12th of May. Rising volume while the price decreases might be good news for bears.

This is because the hike in the metric might offer strength to the downside. Therefore, if the value continues to increase, then SOL’s price could continue to fall.

As such, a decrease to $129 could be the next plausible target.

On the other hand, a reversal to the upside might change the direction. If this happens and the volume hits new peaks, the price of SOL could attempt to reach $155.

Bears are getting less confident

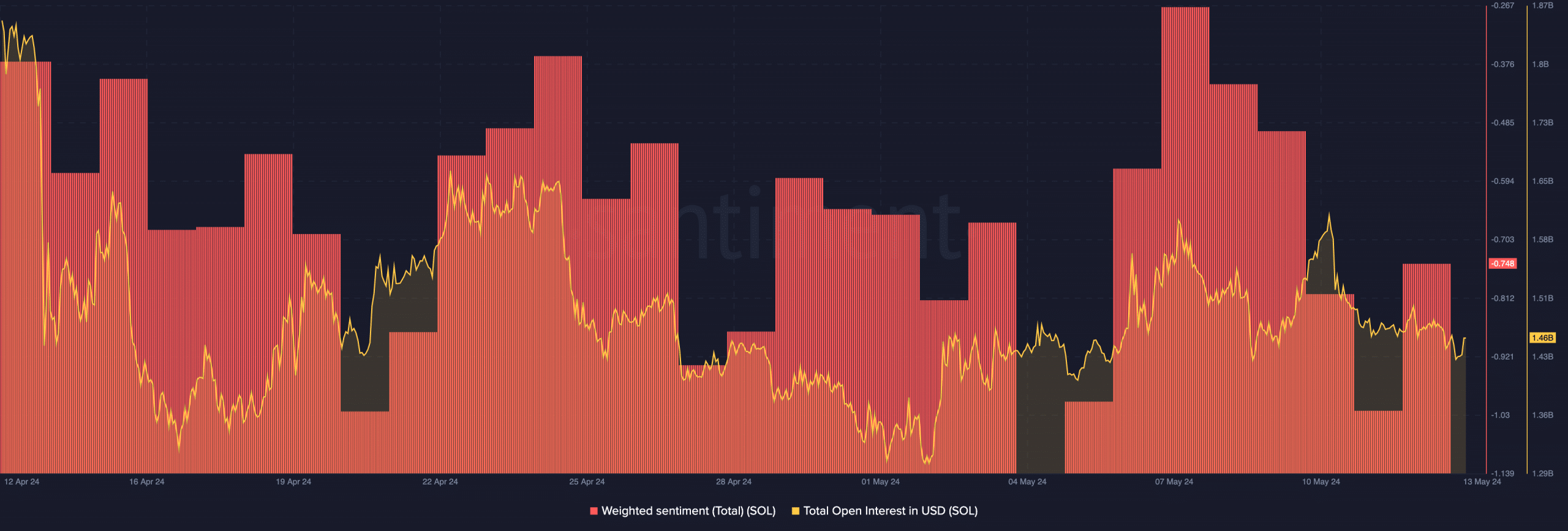

In terms of the perception the market has about SOL, AMBCrypto looked at the Weighted Sentiment. At press time, the Weighted Sentiment was negative, suggesting an increase in gloomy remarks.

However, one notable observation was that the sentiment was improving. Should this metric continue to rise, demand for SOL might increase.

An increase in demand could invalidate the bearish prediction to $129. Instead, a rise to $155 could be next for Solana. Furthermore, the total Open Interest (OI) was starting to increase.

As of this writing, the OI was $1.46 billion. OI increases or decreases depending on net positioning. In this case, buyers are getting more aggressive than sellers.

Read Solana’s [SOL] Price Prediction 2024-2025

If sustained, this increase could lead to a SOL breakout. However, the interest did not seem large enough to confirm the pump into the overhead resistance.

As such, SOL might not be able to surge higher than $155 in the short term.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)