Solana’s 27M SOL move at THIS level fuels sell pressure – Details

- Redistribution from $147 to $144 suggested profit-taking and preparation for consolidation.

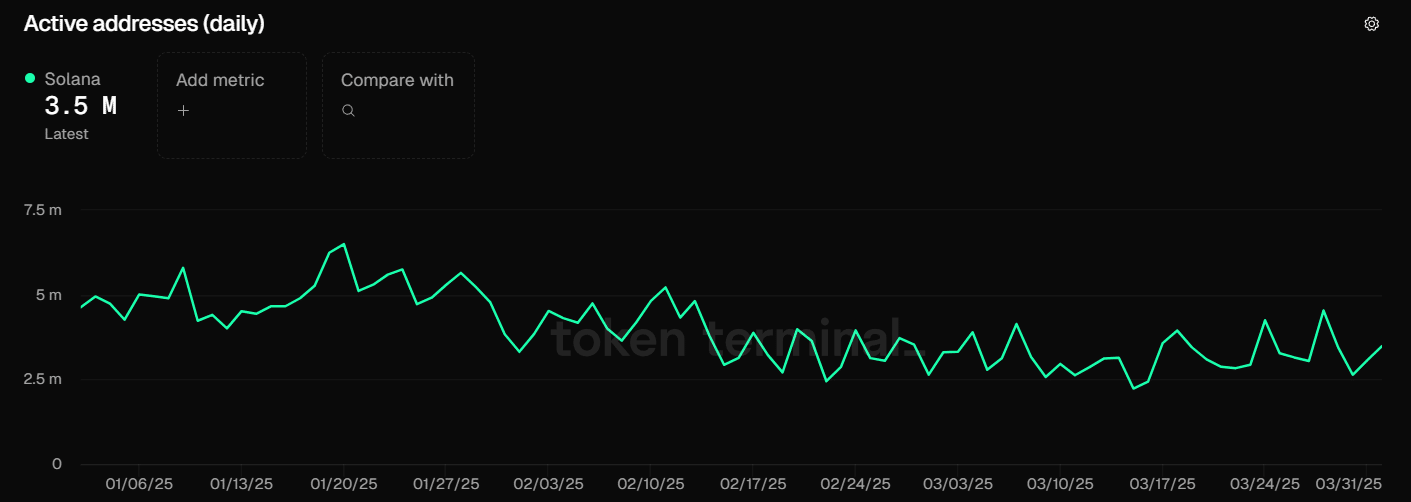

- Solana’s daily active addresses have declined by 46% since January

Solana’s path to $147 blocked by dense supply zone – Can support at $123 hold?

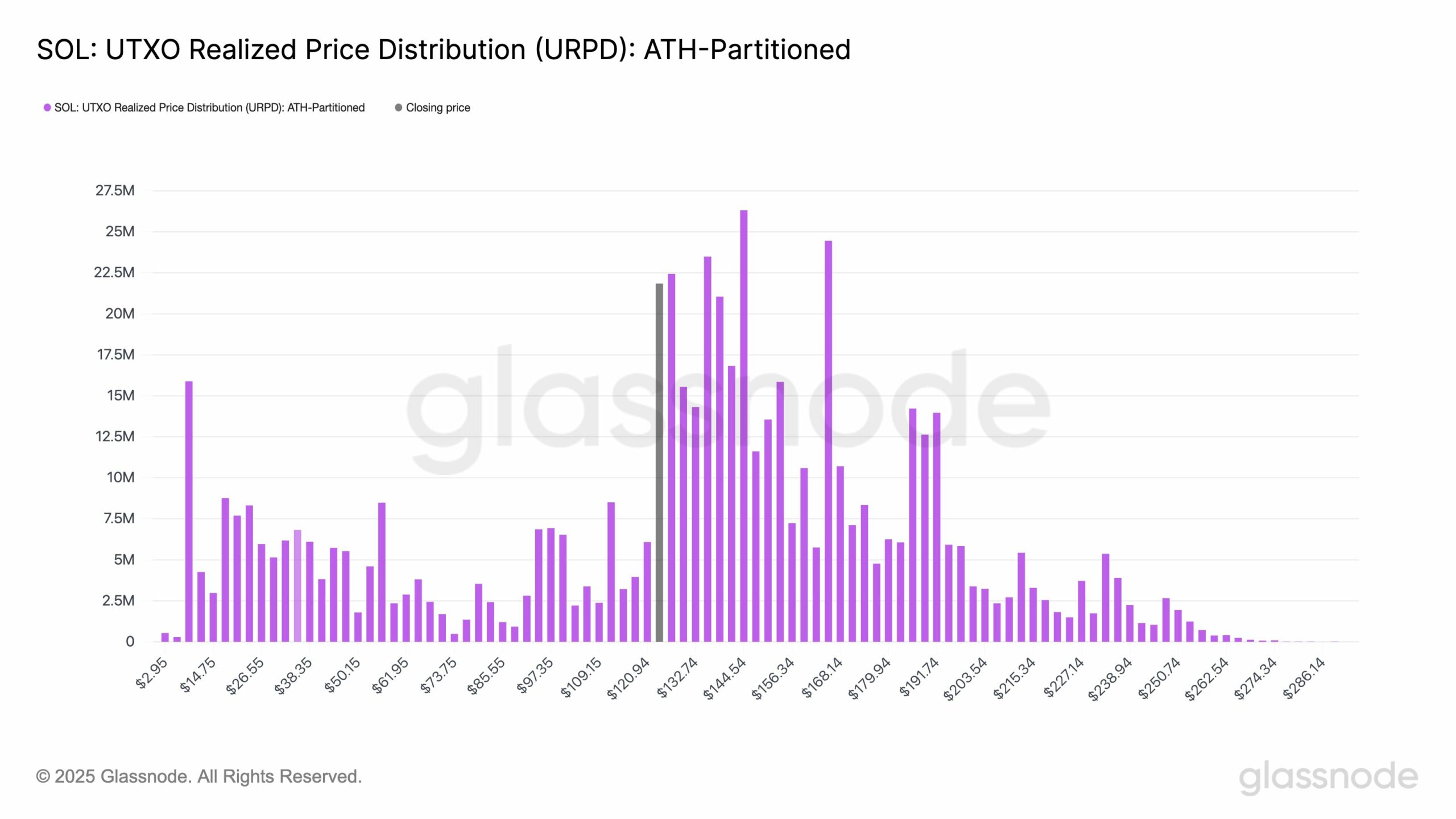

Solana [SOL] is facing renewed resistance near $144 as investor behavior shifts, according to on-chain data. In fact, Glassnode data revealed that nearly 27 million SOL last moved between $144 and $156, marking it a key resistance zone.

Another 26.6 million SOL changed hands between $132 and $144, forming a dense supply cluster.

Everyone’s got skin in this range

With many traders holding tokens at these prices, market reactions become predictable. To put it simply, selling pressure intensifies as the token revisits these levels.

In fact, between 19-31 March, Solana’s supply data highlighted clear signs of profit-taking and reaccumulation.

Glassnode reported a 0.3% hike in tokens moved at $144.54, while holdings at $147.49 dropped by 0.1% – Signaling reduced conviction at recent highs. Investors also appeared to be rotating into lower price zones, reinforcing support between $123 and $144.

Accumulation has also been rising near $112, where holdings more than doubled since January, from 4 million to 9.7 million SOL. This shift seemed to underlined a broader recalibration of key support and resistance levels.

In fact, the prevailing trading trend reflects a break-even mindset, with holders who entered between $144 and $147 seeking exits.

If the altcoin’s price revisits this range, selling may intensify unless buyers step in to absorb the pressure.

Will Solana’s floor hold or crack?

A strong support zone formed between $94 and $100, where over 21 million SOL—about 3.5% of supply—last changed hands. This range may cushion future declines.

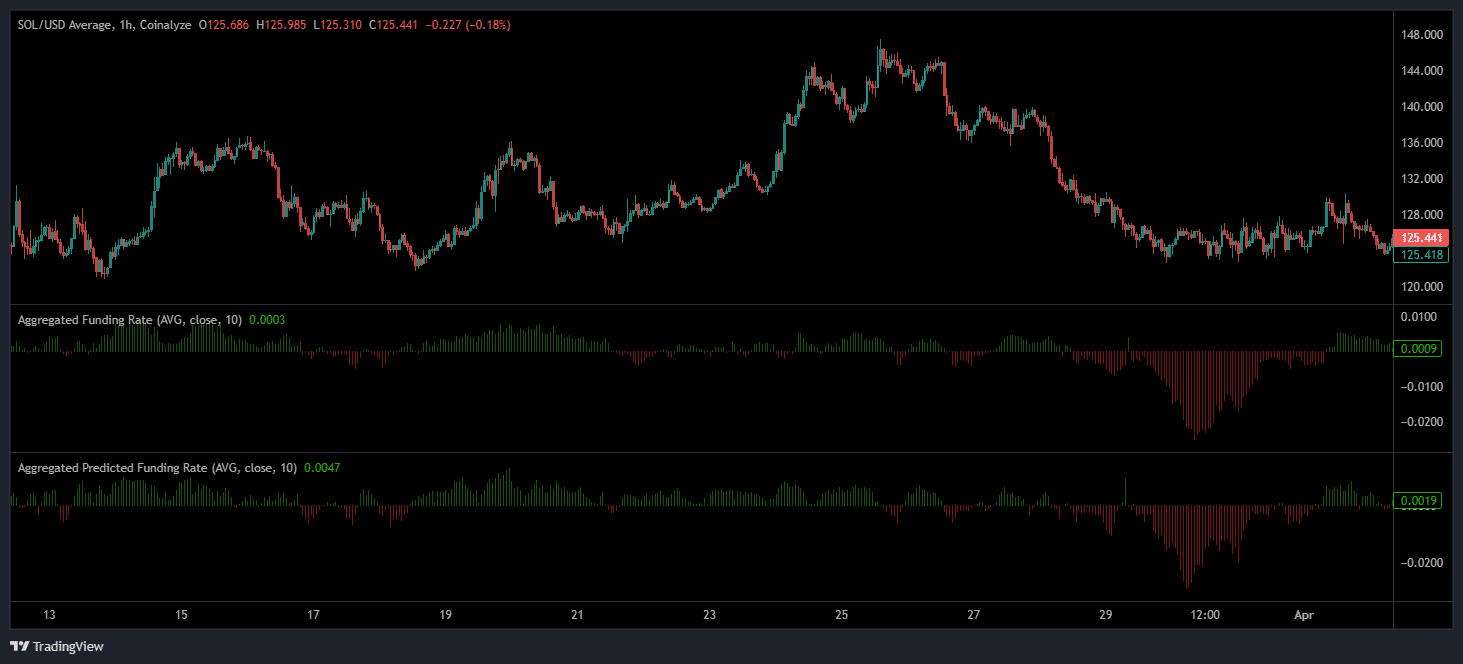

Additionally, funding rate trends confirmed shifting sentiments too.

From 18 to 24 March, SOL rose from $120 to over $140, with funding rates peaking at +0.0035 as long positions increased.

After 25 March, the altcoin’s price dropped to $125 and funding turned negative, hitting lows of -0.0047 – A sign of a bearish shift in trader expectations.

Clearly, traders reduced long exposure and grew cautious.

By late March, funding rates stabilized near neutral values – A sign of indecision and reduced volatility. This period of calm may reflect consolidation, as the market digests previous gains and prepares for the next move.

Flatline before the storm?

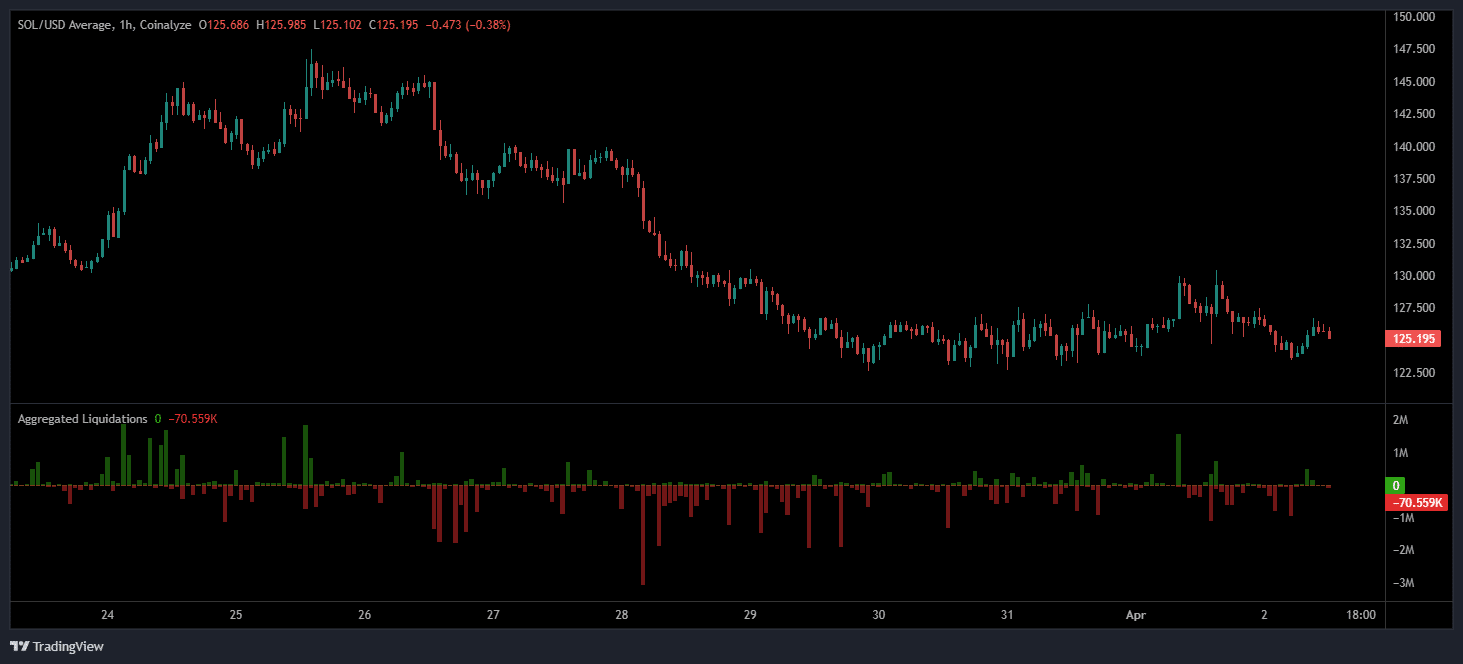

Liquidation data further reinforced this view.

Date from 24 March to 2 April showed $5.6 million of $7.6 million in liquidations being long positions.

On 28 March, the price fell from $137 to $125, triggering $3 million in liquidations.

Longs made up 73.68% of all liquidations, highlighting excessive bullish leverage.

The unwinding of these positions amplified short-term volatility and deepened the decline.

Additionally, exchange data revealed that liquidation volumes were fairly evenly spread. Binance and OKX saw slightly elevated activity, but no exchange led, indicating a broad market reaction.

Finally, Solana’s daily active addresses peaked at 6.5 million on 20 January. However, it had fallen by 46% to 3.5 million by 2 April.

In fact, activity has stabilized above 2.5 million since March – A sign of a steady, but less engaged user base.

Spikes in January and March were short-lived though, likely tied to campaigns or launches. The data suggested that Solana’s growth remains event-driven, with a strong core community but limited sustained engagement.

Sellers step down, buyers step in

Looking at the combined data, a few trends stand out.

For instance – Token flows revealed redistribution from the $147-zone into lower price bands, easing overhead resistance and reinforcing support below $144.

For now, however, Solana will remain range-bound below $130, consolidating as it waits for a decisive trigger.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)