Solana’s Breakpoint effect: Analysts predict 62% surge ahead of…

- Solana price has recovered to $132 with a predicted 62% surge ahead of its Breakpoint event.

- Analysts highlighted Solana’s historical Breakpoint price surges, with excitement building for 2024’s event in 16 days.

Solana [SOL], one of the top-performing cryptocurrencies by market cap, is starting to show signs of recovery after a bearish end to August.

Over the past week, SOL saw a significant decline, dropping nearly 10% from its previous highs. However, since the beginning of September, the asset has been gradually climbing back.

After touching a low of $124 in the last few days, Solana has rebounded to above $134 during early trading hours. Currently, the asset has seen a slight pullback and was trading at $132, up by 2.3% over the past 24 hours.

Solana Breakpoint event: Historical price surges

This recent price movement has caught the attention of crypto analysts. A well-known analyst, Marty Party, shared his outlook on Solana.

Responding to another analyst Sai, he discussed the asset’s price behavior before the Solana Breakpoint event, which is a conference that brings the SOL community together to discuss latest developments in web3.

Party noted, “Solana Breakpoint pump average is 62%. SOL is $133 right now. 62% is $215.46,” indicating the potential for a significant price increase ahead of this year’s Breakpoint event.

Sai provided an in-depth analysis of Solana’s price behavior leading up to the Breakpoint conference, pointing out the historical patterns of price surges before the event.

In previous years, Solana has experienced notable price increases in the days leading up to Breakpoint.

According to Sai, in 2021, the price surged by 68% in the 19 days before the conference, followed by a 42% surge in 2022 and a 58% rise in 2023.

This year’s Breakpoint event, set for September 20th in Singapore, could potentially see similar price behavior, as analysts predict another substantial rally in the lead-up to the conference.

Key metrics to watch: RSI and open interest

While analysts such as Party and Sai are optimistic about Solana’s price action, it’s essential to examine the asset’s fundamentals to determine whether this bullish outlook is plausible.

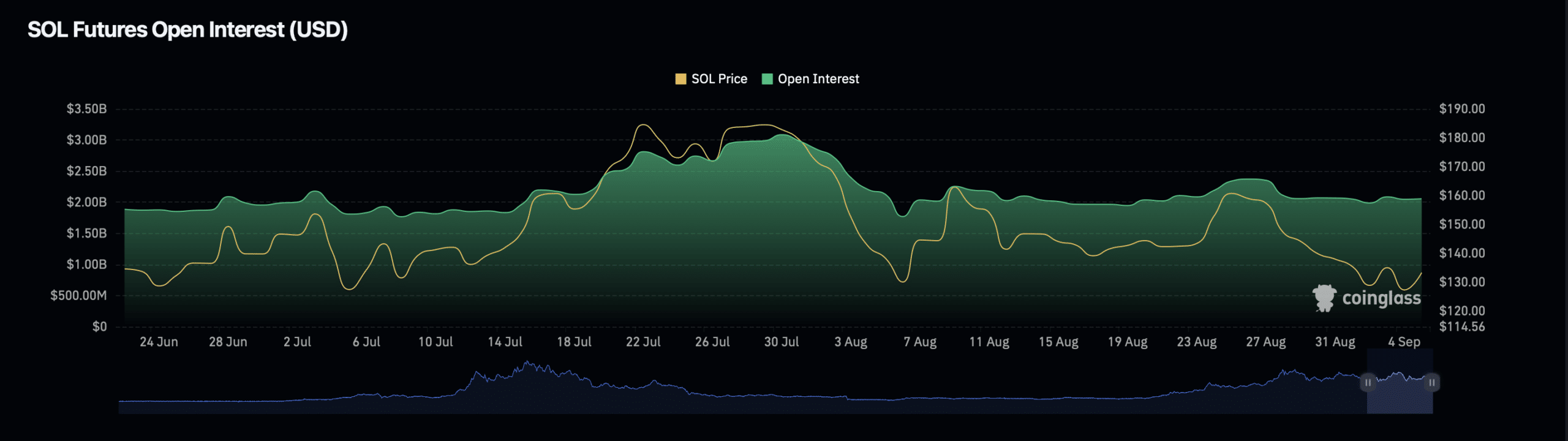

One critical factor to consider is Solana’s open interest, a metric that measures the total number of open contracts in futures markets.

Data from Coinglass shows that Solana’s open interest has declined by 0.96%, with a current valuation of $2.03 billion. Additionally, open interest volume has also seen a decline, plunging by 13.20% to $6.35 billion.

A decrease in open interest generally indicates a reduction in market activity and could suggest limited price movement in the near term.

Source: Coinglass

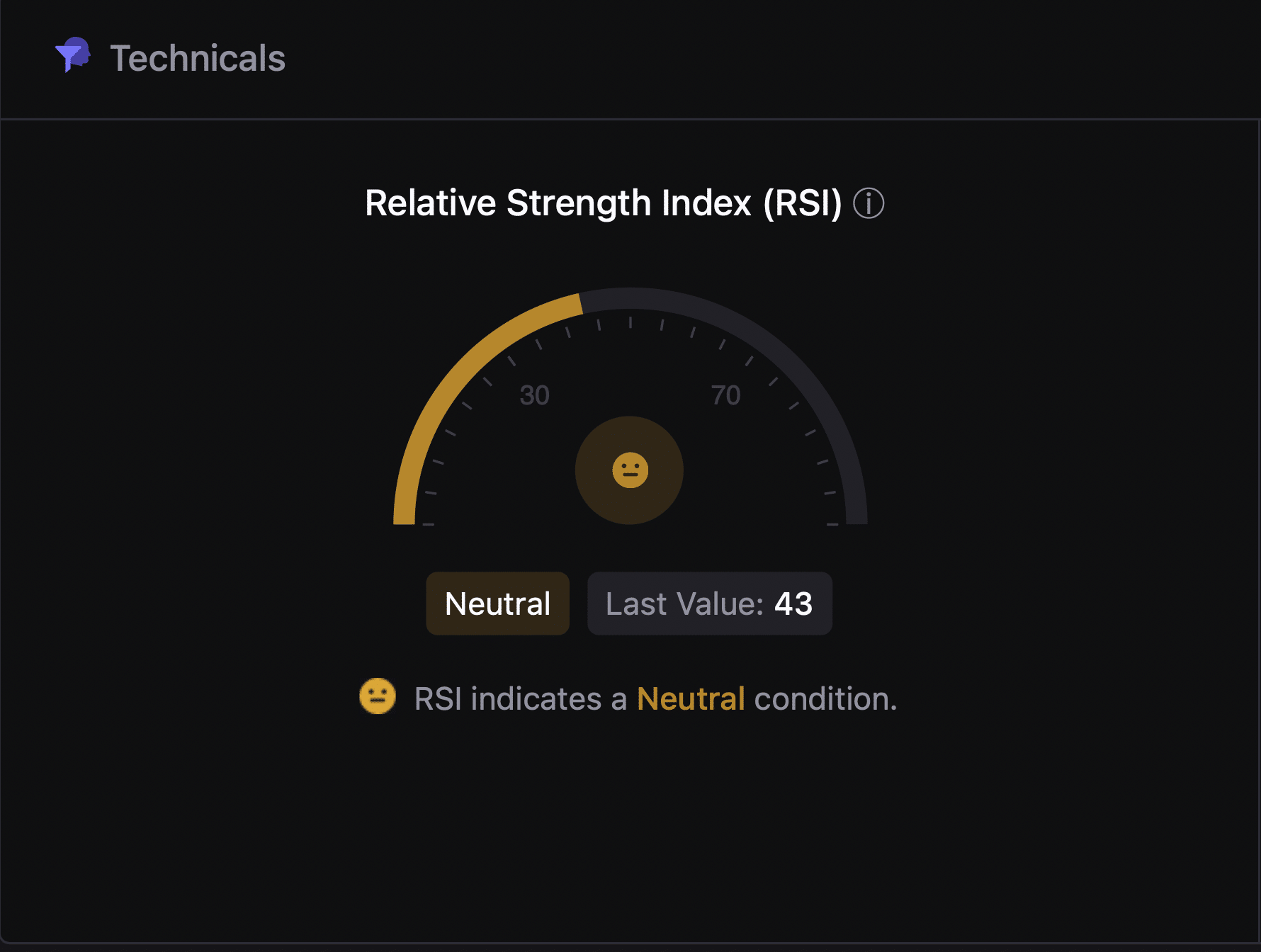

Alongside open interest, another key indicator to watch is Solana’s Relative Strength Index (RSI). According to data from CryptoQuant, Solana’s RSI is currently sitting at 43, which is considered neutral.

Source: CryptoQuant

Read Solana’s [SOL] Price Prediction 2024–2025

The RSI is a technical indicator that measures the momentum of price movements, helping traders identify overbought or oversold conditions in the market.

An RSI of 43 suggests that Solana is neither overbought nor oversold at the moment, indicating potential for either side of the market to gain momentum.