Solana

Solana’s ‘death cross’ dilemma: Can bulls overcome $127 barrier?

Solana faces a tough battle at the $125-$127 support, with a failure to hold potentially leading to deeper declines in the near term.

- SOL continued its downtrend and fell below key resistance levels.

- Derivates data reaffirmed this bearish edge, but many trader accounts on OKX and Binance are betting on a bullish reversal.

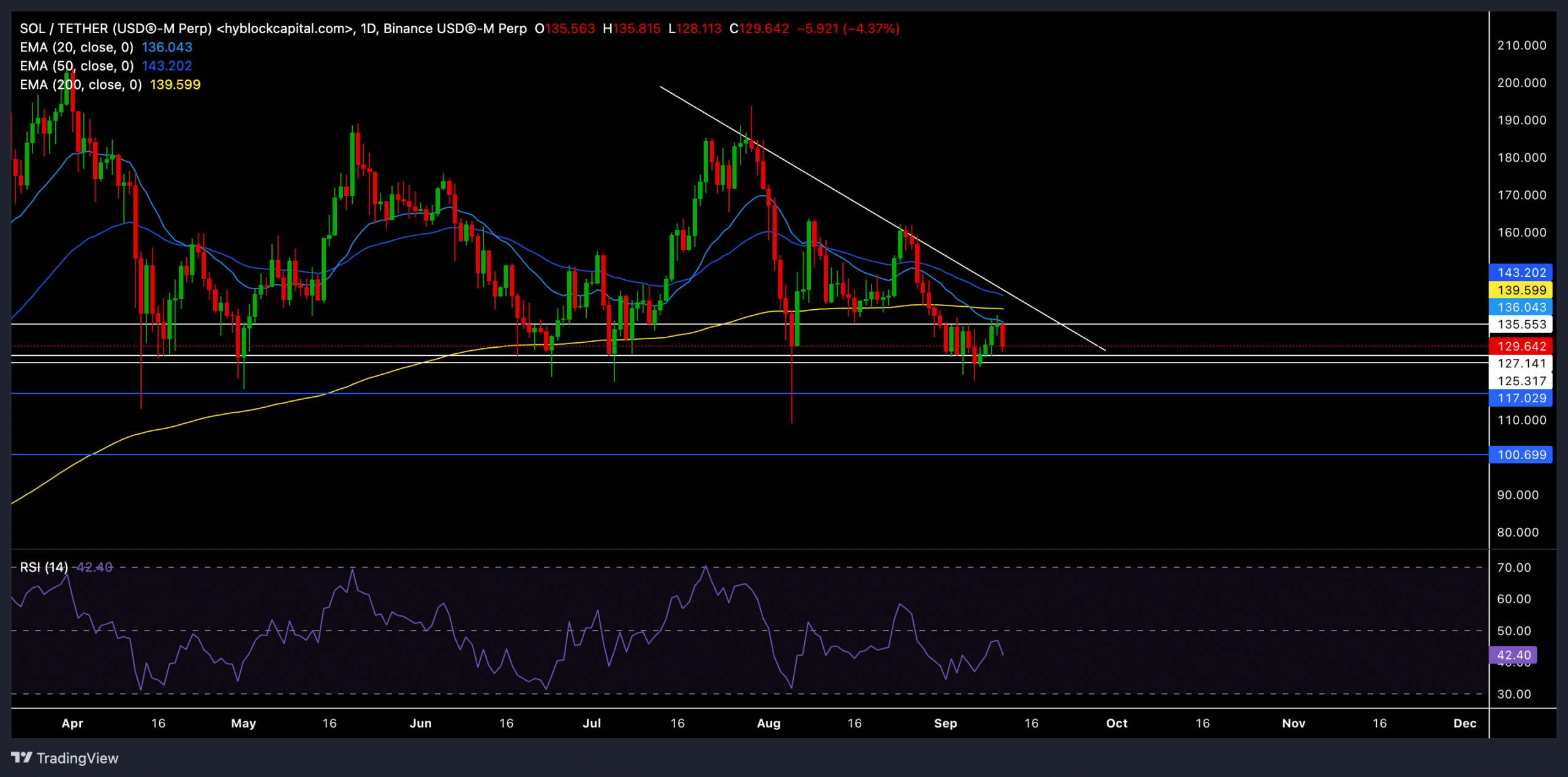

Solana [SOL] continued its long-term downtrend, with bearish momentum intensifying after the price recently fell below the crucial 200-day EMA.

The downtrend was further confirmed by a death cross, a bearish technical signal where the 20-day EMA crosses below the 200-day EMA. Historically, Solana has seen extended periods of bearish pressure following a death cross.

At press time, SOL traded at $129, declining by around 5% in the last 24 hours. The bears have been consistently testing the $125-$127 support range for over five months, and a failure to hold this level could expose SOL to further downside.

Bearish signals persist for Solna after a death cross

The $125-$127 support range remained critical for Solana. If the bears manage to push below this zone, the next significant support stood near $117 and could become the target in the event of further declines.

On the upside, bulls need to break past the 20-day EMA ($135.92), 50-day EMA ($143.15), and 200-day EMA ($139.58) to initiate any potential recovery.

However, this will be an uphill battle given the current bearish sentiment in the market. Additionally, the long-term trendline resistance continued to cap any upward movement. SOL would need a strong breakout above this level to reverse the prevailing trend.

The Relative Strength Index (RSI) was below equilibrium, depicting a bearish edge. An immediate reversal isn’t a given since it had yet to hit the oversold mark. For a potential bullish comeback, the RSI would need to climb above the neutral 50 level.

Solana derivates data revealed THIS

According to the latest derivatives data per Coinglass, SOL saw a 6.17% decline in trading volume, with total volume sitting at $5.97B. However, open interest slightly increased by 0.15% to $2.06B, indicating that traders remained active despite the bearish conditions.

The overall long/short ratio for SOL over the last 24 hours is 0.9342, reaffirming a bearish sentiment among investors.

However, the data also showed some interesting divergences. On Binance, the SOL/USDT long/short ratio for top trader accounts was heavily skewed towards long positions at 3.817.

Similarly, OKX showed a long bias with a ratio of 3.35. These readings indicated that some traders still expect a potential bullish reversal despite the overall market conditions.

Read Solana’s [SOL] Price Prediction 2024–2025

SOL’s price is currently hanging in the balance, with the $125-$127 support range acting as the key level to watch. A failure to hold this support could lead to a decline toward the next major support level at $117.

Given the prevailing market conditions and bearish sentiment, a short-term bullish reversal for SOL seems unlikely unless Bitcoin witnesses a sudden buying resurgence.