Solana’s DeFi activity could be good news for SOL’s price – Here’s why

- Activity across the Solana blockchain increased, but SOL’s price fell

- Correlation between SOL and BTC declined as indicators revealed that SOL might drop below $160

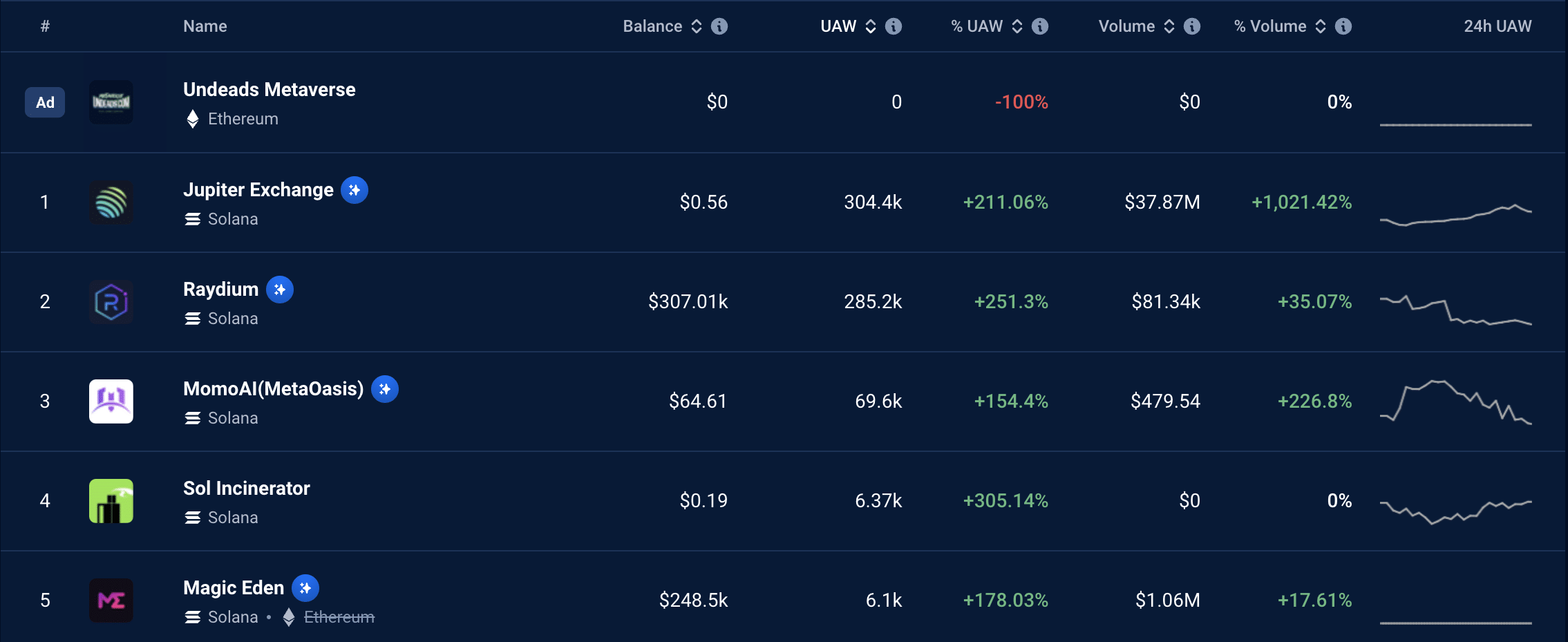

Unique Active Wallets (UAWs) on Solana [SOL] recorded an incredible surge in the last 24 hours, according to DappRadar. Decentralized applications including Jupiter, Raydium, and Magic Eden contributed to the aforementioned surge.

AMBCrypto found that UAWs on aggregator Jupiter Exchange were 307,100 in number, representing a 251% hike. For Raydium, it was an uptick to 285,200 while NFT activity picked up. Finally, the same hiked by up to 178% on Magic Eden.

Memecoins are driving SOL up and down

The rise in activity on Raydium and Jupiter could be linked to increasing memecoin activity in the market. An assessment of the platforms revealed that the buzzing memecoin narrative can be attributed to GameStop (GME) and legendary trader Keith Gill, popularly known as “Roaring Kitty.”

On 7 June, derivative tokens linked to the trader appeared in high numbers. Also, these Solana-based tokens jumped to mind-blowing market caps within just short periods.

This hike also indicated an increase in demand for SOL. However, at press time, Solana’s price was valued at $162.44, representing a 5.44% fall in the last 24 hours.

Here, it’s also worth noting that AMBCrypto found the reason why SOL could not sustain a hike, despite an increase in demand.

For many degenerates, the idea of buying a memecoin is not to hold for a long time. In crypto, a degenerate refers to an individual who engages in trading highly-volatile and speculative tokens with no fundamentals. As such, when the tokens reach a certain level of gain, they exchange it for the Solana native token, and sell it for a stablecoin or fiat.

Recently, there has been a plethora of such pumps and dumps, and it might not stop anytime soon. Should this be the case, SOL might continue to move sideways.

Can the token bank on BTC?

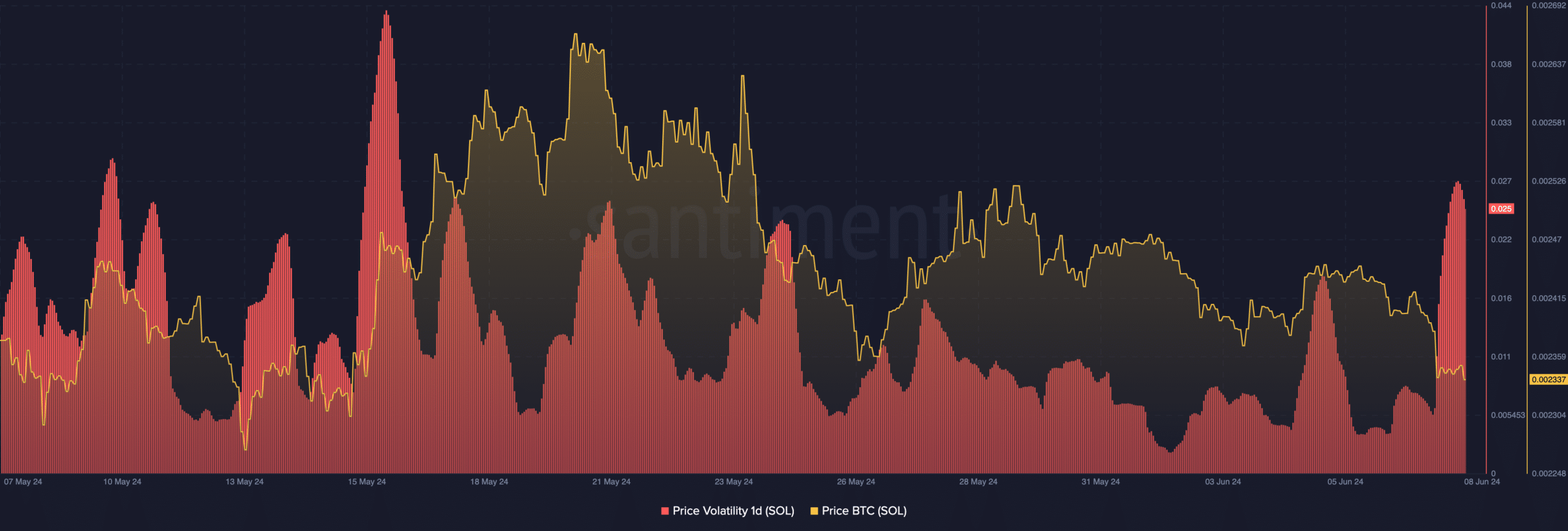

AMBCrypto also found that the one-day volatility for SOL jumped. Volatility tracks how rapidly the price can fluctuate. Thus, if selling pressure climbs amid high volatility, the token might fall on the charts.

On the other hand, a hike in buying pressure accompanied by high volatility could trigger a breakout in price. However, by the look of things, SOL could drop below $160 in the short term.

Another factor that could affect the price is Bitcoin [BTC]. According to data from Santiment, Solana’s correlation has been falling since 6 June, indicating that the respective price might not always move in the same direction.

Therefore, if BTC rises above $71,000 again, it is no guarantee that SOL would revisit $187. However, if the market’s recovery is more widespread, the prices might follow a similar path.

Is your portfolio green? Check the Solana Profit Calculator

Whichever way SOL goes, the cryptocurrency is unlikely to hit $200 in the coming week. In the long run, there are predictions that SOL might hit $1,000. For that to happen, the market condition needs to improve.