Solana’s latest surge can kickoff a bullish wave — will SOL get up to speed?

- Solana observes a spike in activity, stablecoin, and DEX volumes increase.

- The price of Solana continues to decline, however, stakers remain optimistic about the network.

Solana [SOL], despite facing criticisms for multiple downtimes on its network, has remained undeterred as it continued to make progress in terms of improving on its technology.

Is your portfolio green? Check out the Solana Profit Calculator

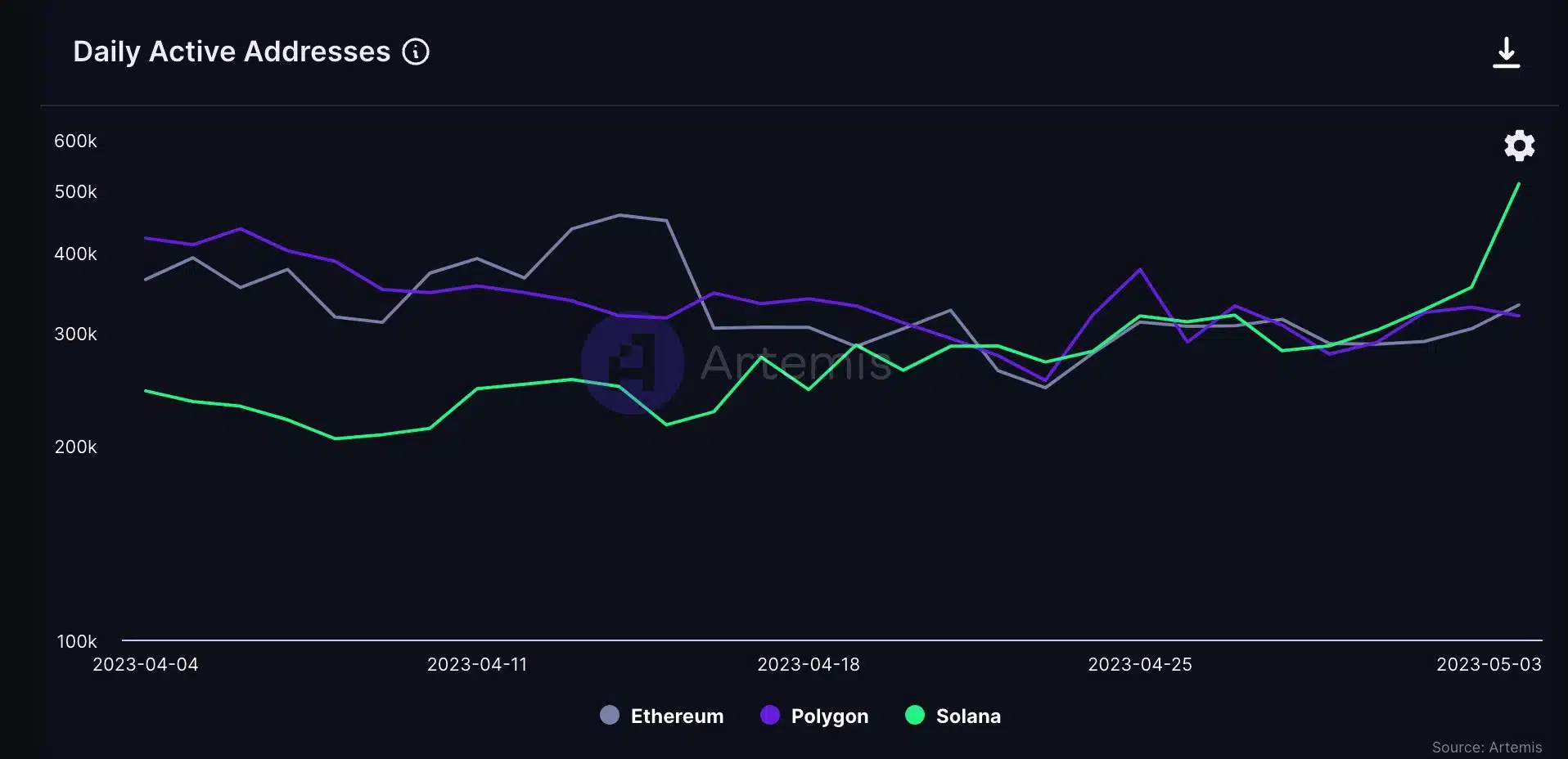

Due to this and various other factors, the overall activity on Solana started to surge. According to data provided by Step Data Insights, in the past 24 hours, there has been a significant increase of 150,000 in the daily active addresses on Solana.

This development was in contrast to the downtrend observed on Polygon and Ethereum during the same period and reinforces the 30-day uptrend in Solana’s activity.

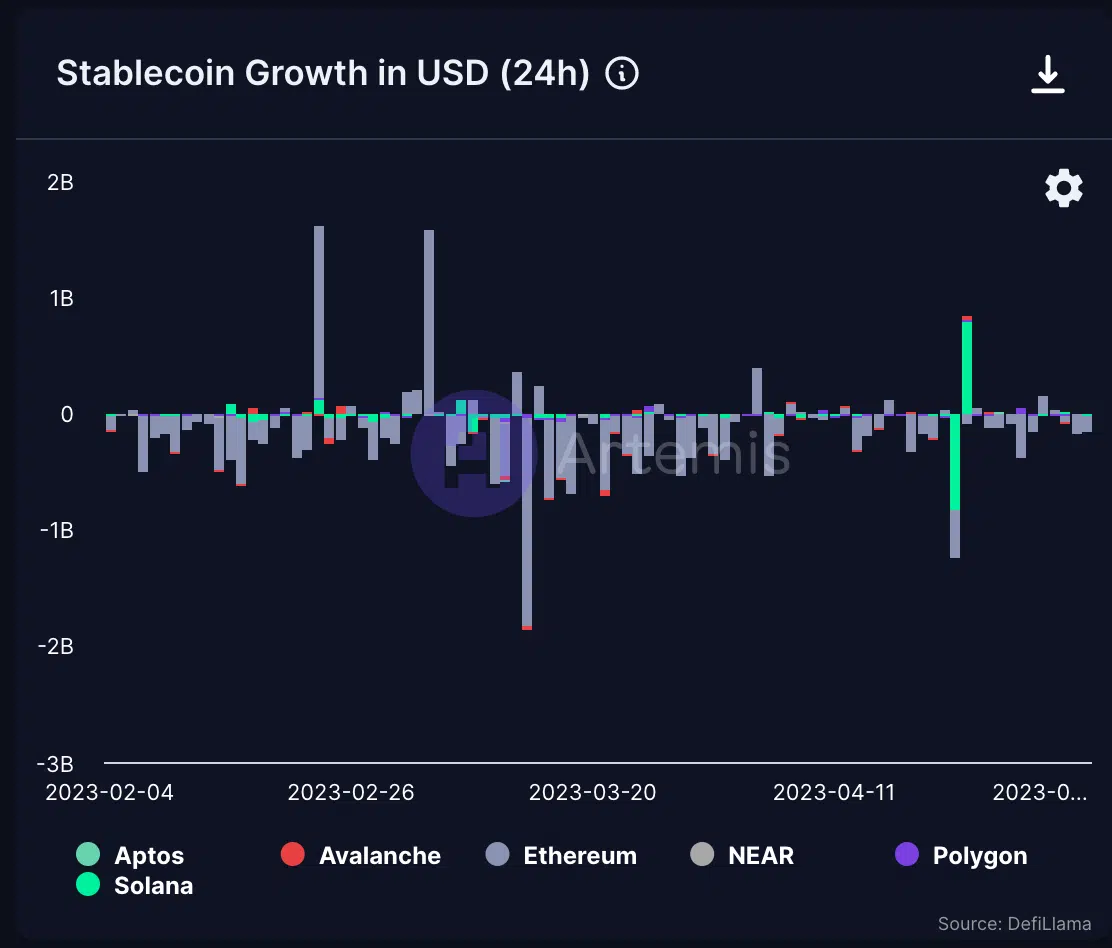

Solana was also observed to be doing well in the DeFi space as well. Artemis’ data indicated that there was a huge surge in terms of stablecoin growth on Solana. The Solana protocol managed to eclipse major competitors in the crypto space in this regard.

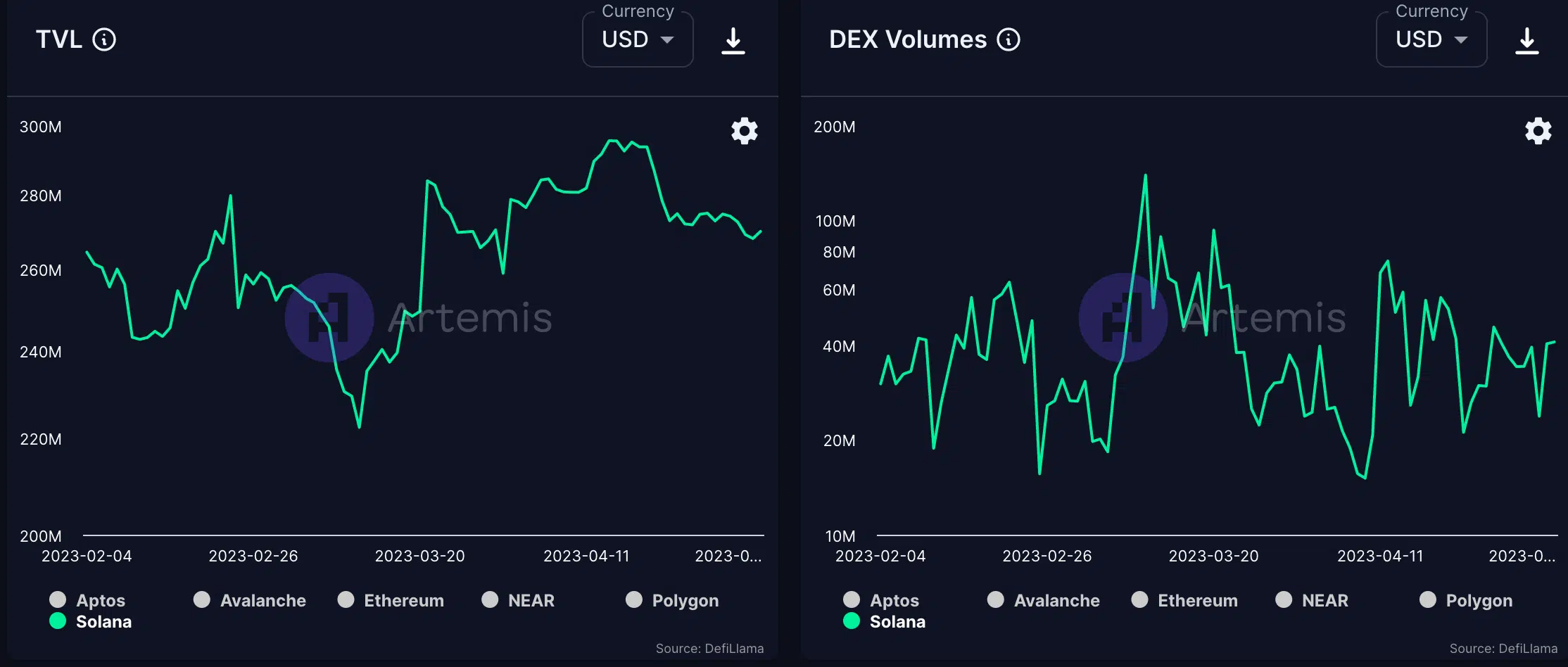

Additionally, the overall DEX volume on Solana also increased. This was due to the interest gained by popular DEX’s on the Solana protocol such as Saber. Dapp Radar’s data revealed that over the past week, Saber gained 61.14% unique active wallets on its platform.

Because of the positive performance of the DEX’s on the Solana network, its TVL also witnessed a massive uptick.

Stakers also showed their optimism in the Solana network during this period. According to recent data provided by Staking Rewards, the number of addresses staking Solana increased by 2.99% over the last week. At press time, the cumulative number of stakers on the Solana network was 608,394.

Realistic or not, here’s SOL market cap in BTC’s terms

Assesing the state of SOL

However, the same enthusiasm wasn’t shown by addresses in terms of buying SOL. Since 17 April, the price of Solana fell by 16.08% after testing the $26.03 resistance.

Solana’s price later traded between the $24.05 and $20.77 levels, with the majority of the volume occurring at the $22.24 price point as showcased by the point of control line (red). This line could act as a resistance to Solana’s price in the future.

Its Relative Stregnth Index (RSI) was at 48.40, and was slowly climbing up suggesting that Solana, may be slightly underbought at press time.