Solana’s longs take a hit – What does this mean for you now?

- SOL contracts surpassed $5 million with longs taking a larger share

- High areas of liquidity existed between $138 and $140, indicating that the price might fall to these levels

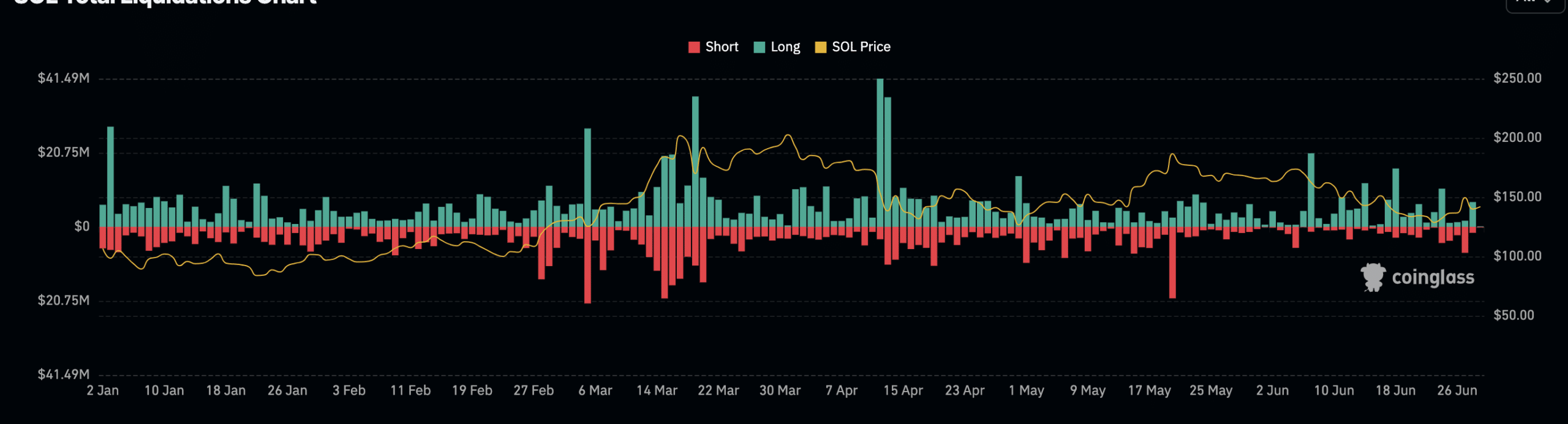

The last 24 hours have been a bad day at the office for traders who chose to bet on a Solana [SOL] price hike. This was evidenced by Coinglass’s liquidations data.

According to the derivatives information portal, the total SOL liquidations amounted to $5.47 million. Out of this, longs accounted for $4.3 million. Shorts, however, made do with just $1.11 million.

Positive expectations did not pay off

Liquidation occurs when a trader can no longer meet the margin requirements of keeping a contract open. As a result, an exchange closes the trader’s position. This is done to avoid further losses.

While longs are those hoping to profit from a price hike, shorts bet on a decline. Based on AMBCrypto’s findings, SOL’s price action was the reason behind the hike in long liquidations.

On 27 June, the price of the altcoin jumped to $150 after reports spread that an asset management firm had filed for a Solana spot ETF. The development caused a wave of positive comments on social media platform, with many calling for SOL to continue the rally.

However, the cryptocurrency had other plans. Shortly after the price hike, SOL began to move down the chart slowly.

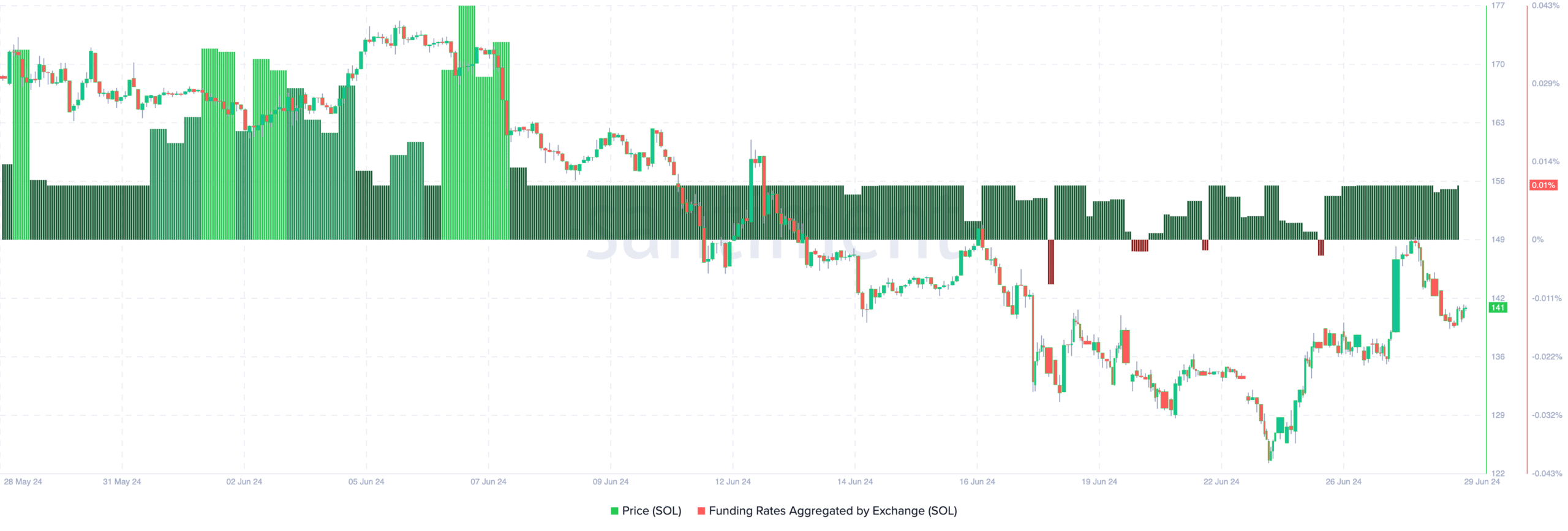

At press time, SOL was trading at $141.96, following a 2.39% decline in the last 24 hours. On the contrary, Solana’s funding rate revealed that traders seem unfazed, with some still sticking to their bullish predictions for the cryptocurrency.

This, because the funding rate was positive at press time. Here, funding rate refers to the cost of holding open positions in the market.

Traders stick to their guts amid bearish signs

When the rate is positive, it means that longs are paying shorts to keep their positions open. If this is the case, it implies that participants expect the price to climb.

Conversely, negative funding means shorts are paying longs. In this instance, traders expectations’ are bearish. However, the rising funding rates and declining price could affect SOL’s value.

Simply put, when this metric rises, it means longs are aggressive. However, the fall in price suggests that they are not getting rewards for their position. In summary, this is bearish for the token because spot buyers do not seem to support the uptrend.

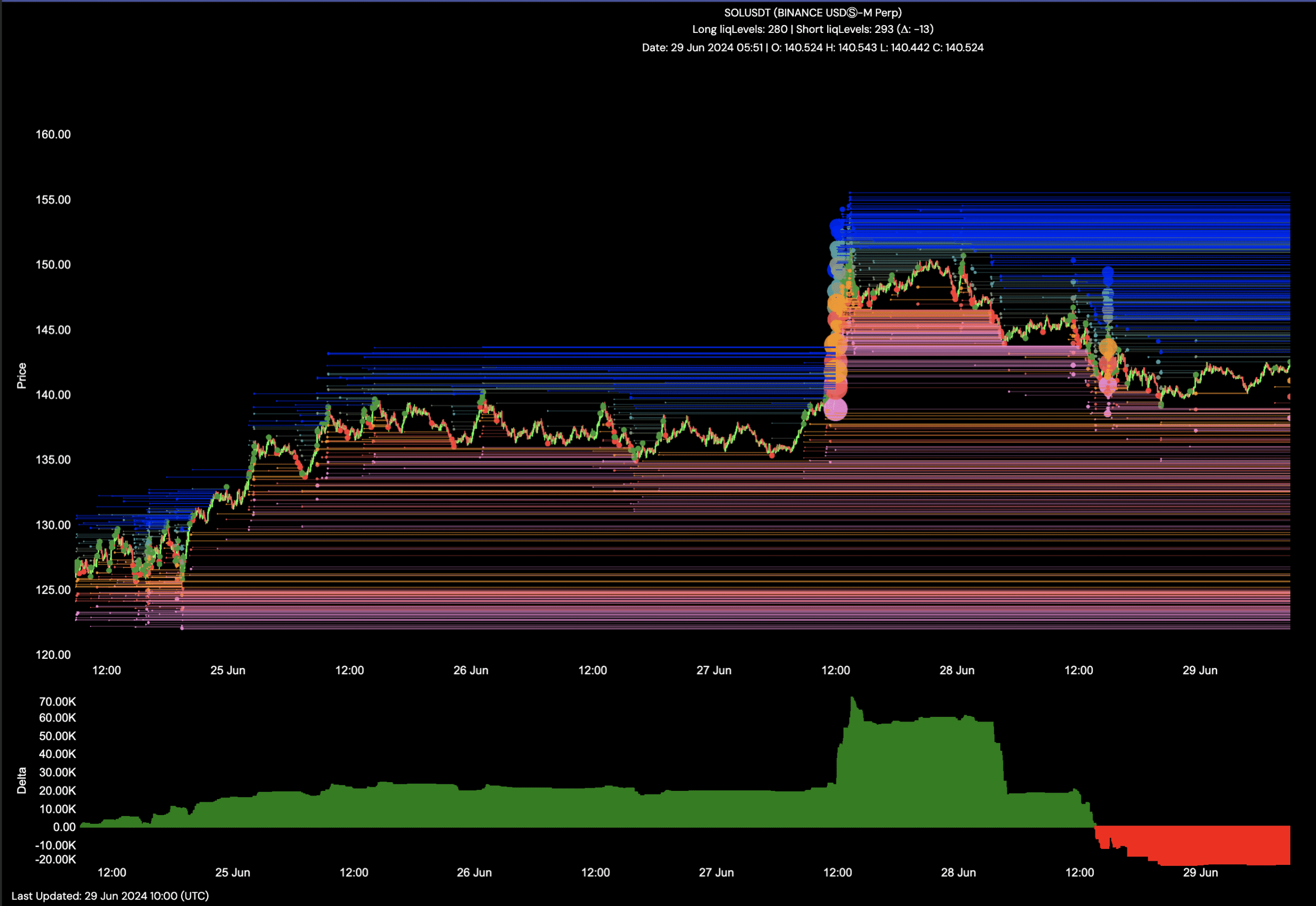

Should this remain the case in the coming days too, SOL could drop below $140. Additionally, AMBCrypto looked at the liquidation levels too.

Here, liquidation levels show estimate price points where liquidations might occur. If there is high cluster of liquidity at a price range, a cryptocurrency might move towards that zone.

Is your portfolio green? Check the Solana Profit Calculator

To the upside, there was no liquidity cluster. What this means is that SOL’s price might not hike anytime soon.

However, AMBCrypto also noticed high areas of liquidity between $141 down to $138. Hence, the altcoin’s price might drop to these levels in the short term.