Solana’s rally: Analyzing the impact of spot and perp CVD on prices

- SOL has surged by 7.01% over the past week as market sentiment shift.

- Spot CVD is the main driver as buyers dominant the market.

Over the past week, Solana [SOL] has experienced a sustained uptrend. In fact, as of this writing, Solana was trading at $146.88. This marked a 7.01% increase over the past week.

Prior to these gains, SOL saw a sustained downtrend, hitting a local low of $120. However, since then, the altcoin has reached a local high of $152.

Despite these gains, Solana remains 43% below its ATH of $259.96. Therefore, the current market conditions raise questions about whether Solana is on the verge of a more sustained recovery and what’s driving the recovery.

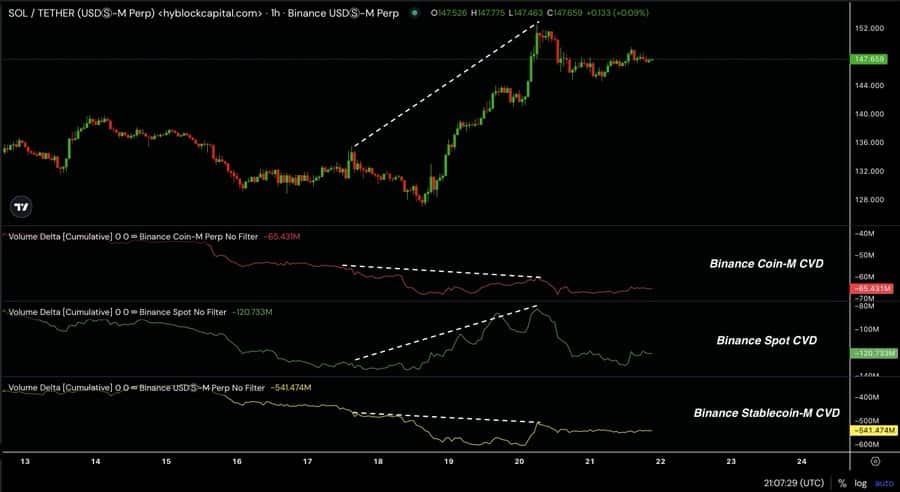

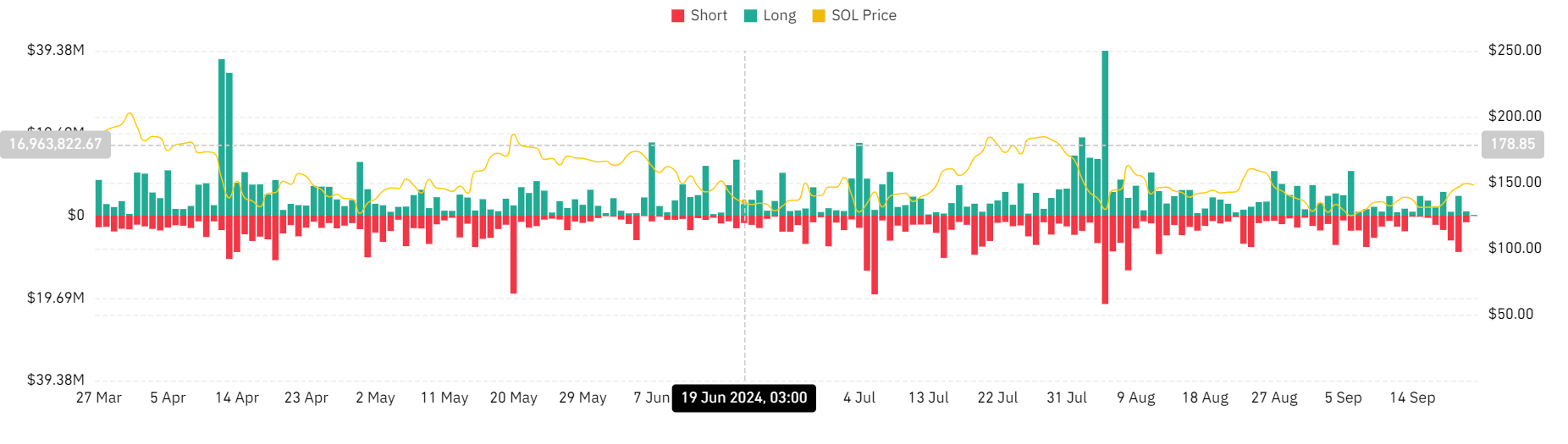

Inasmuch, HyblockCapital analysts have suggested increased buying pressure as the main driver of the recent rally citing spot CDV and Perp CVD.

Prevailing market sentiment

In their analysis, Hyblockcapital cited buying interest, especially among spot buyers as a catalyst leading the surge.

According to this analysis, the demand for actual SOL tokens is the primary factor pushing prices higher. This suggests that spot buyers are dominant and their demand for the altcoin is creating upward price pressure.

However, the analysts also pointed out that Perp CVD is showing divergence. This means that perpetual futures traders are showing signs of a different trend.

As such, when prices are rising because of spot buying while Perp CVD is declining or flat, it indicates futures are not bullish like spot traders.

Therefore, since Spot CVD is the main driver, the price is being pushed by real demand for SOL. This usually indicates the potential for a more sustainable rally.

What SOL charts suggest

Undoubtedly, the metrics highlighted by Hyblockcapital offer a promising outlook for Sol’s potential rally. Accompanied by prevailing market conditions, they could set Solana for more gains on price charts.

For example, Solana’s Dydx exchange funding rate has been positive for the last four days, indicating that over the past few days, long position holders have been paying funding to short position holders.

This suggests that the market sentiment is bullish as there is a higher demand for long positions.

Additionally, this demand for long positions is supported by a positive funding rate aggregated by exchange. This shows that long-position holders are willing to pay a premium to hold their positions.

Source: Coinglass

Finally, for the last four days, liquidation for short positions has skyrocketed while those for long positions have declined. Short position liquidation has reached a high of $8.65 million while those for long positions have hit a low of $185.7k over this period.

This shows investors betting against the markets are forced out of their positions.

Read Solana’s [SOL] Price Prediction 2024–2025

Simply put, Solana is increasingly seeing a shift in market sentiment. As noted by Hyblockcapital, there’s a higher demand for Solana especially for long positions.

The positive market sentiment positions the altcoins for further price growth. As such, if the prevailing conditions hold, SOL will attempt a $160 resistance level in the short term. A breakout from this level will strengthen the altcoin to challenge the $185 resistance.