Solana’s FUD story – Where do you stand after txn. failure rates of 61%?

- Users were concerned over Solana’s transaction failures.

- A big chunk was still optimistic of Solana’s prospects in the near term.

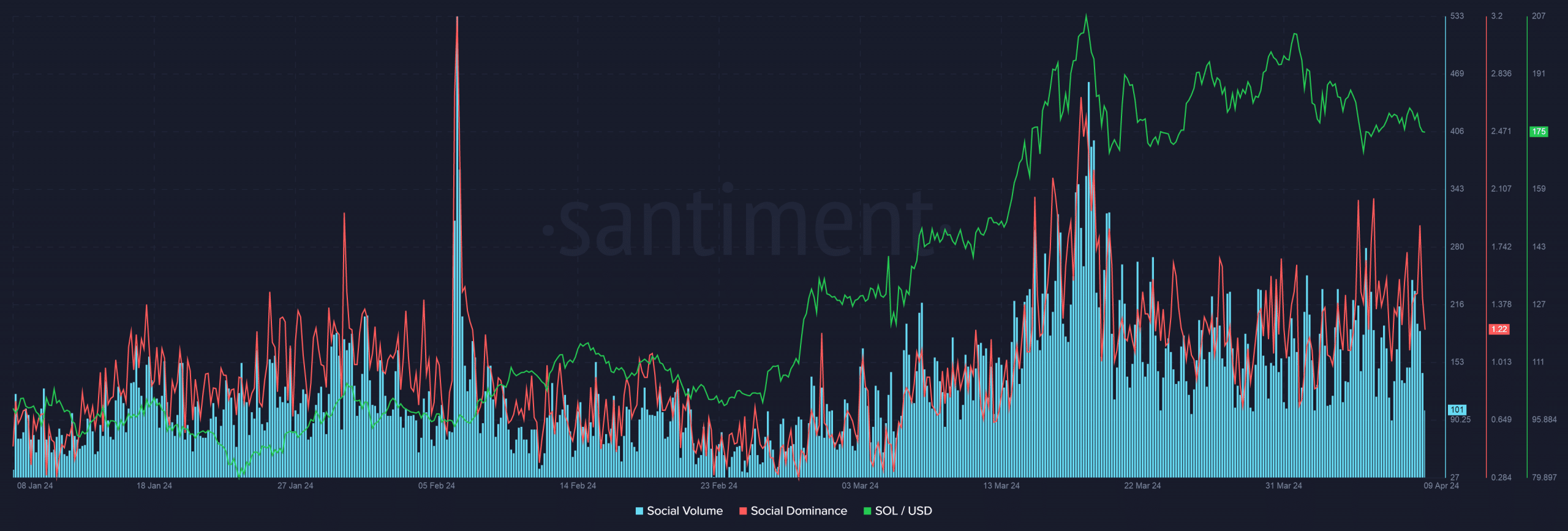

Solana [SOL] dipped below $180 after a 4% drop in market value in the last 24 hours, data from CoinMarketCap showed, as bulls struggled to challenge mounting FUD amid network congestion.

According to on-chain analytics firm Santiment, the fifth-largest cryptocurrency was trending heavily in the last 24 hours. About 42% of all commentary around the coin was negative in the last 24 hours, with words like “transactions”, “network”, and “time” dominating social media discussions.

Network issues spook Solana users

For the uninitiated, the Solana blockchain, known for its fast speeds and low fees, was witnessing high transaction failures last week, reaching as high as 75% on the 4th of April.

Though, the failure rate has dropped to 61% as of this writing, the developments have raised questions on the network’s ability to perform during peak demand.

To make matters worse, developers have failed to provide a quick fix for the issue. The fixes were getting tested and might be rolled out later this week, Solana devshop Anza informed earlier.

A lot more to be hopeful about

Interestingly, the FUD wasn’t strong enough to influence the optimists, with nearly 44% of the commentary in the last 24 hours being bullish on SOL. Supporters felt that advantages over Ethereum [ETH] in fees and speed would stand Solana in good stead.

In what could be a validation of their high hopes, Circle, the issuer of the world’s second-largest stablecoin USDC, announced support for Web3 services platform on Solana.

Realistic or not, here’s SOL’s market cap in BTC’s terms

The move was expected to provide developers with effective tools to build decentralized applications (dApps) on Solana efficiently.

Meanwhile, bearish bets for Solana continued to increase as the Long/Shorts Ratio dipped further in the last 24 hours, as per AMBCrypto’s analysis of Coinglass’ data.