Solana’s [SOL] DeFi activity inches towards pre-FTX levels thanks to…

![Solana's [SOL] DeFi activity inches towards pre-FTX levels, thanks to...](https://ambcrypto.com/wp-content/uploads/2023/05/Solana-1-1.jpg)

- After tumbling in December, the trajectory of SOL’s trading volume in the last four months resembled the pre-FTX levels.

- At the time of writing, Solana held assets worth more than $572 million, representing a change of 18% over the last 24 hours.

The dramatic collapse of the world’s second-largest crypto exchange FTX sent ripples across the broader market in November last year.

However, one of the biggest victims was Solana [SOL] which earned a lot of bad press due to its limited exposure to the fallen trading platform.

Sam Bankman-Fried, the disgraced former CEO of FTX, was a big supporter of Solana and a significant amount of coins were held on the balance sheets of FTX. As a result, SOL crashed 63% in the week following the collapse.

The SOL community did, however, have a reason to celebrate as recovery was being shown.

Is your portfolio green? Check out the Solana Profit Calculator

DeFi activity recovers

As per a tweet, cumulative decentralized exchange (DEX) volume on Solana over the last four months eclipsed pre-FTX levels, reflecting renewed demand for DeFi activities on the chain.

Consider this- Trades worth $5.57 billion were settled on the chain since the beginning of 2023, as compared to $5.54 billion in the four months before the collapse.

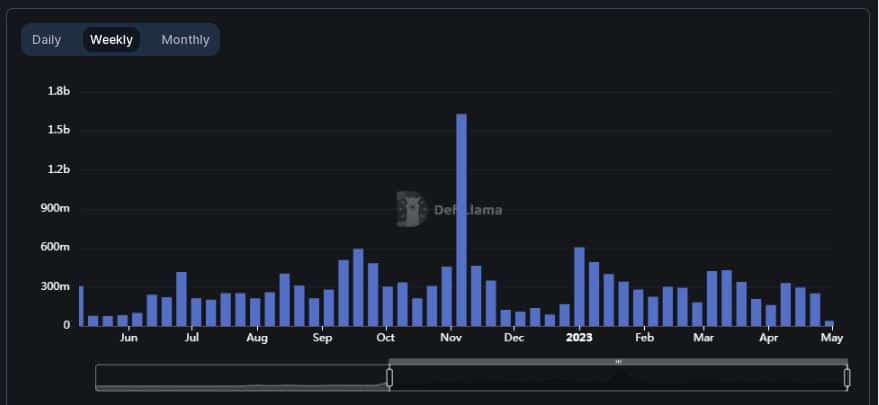

Data from DeFiLlama pointed towards a similar trend. After tumbling in December, the trajectory of the trading volume in the last four months resembled the pre-FTX levels.

To add to this, important milestones in the last month such as Helium’s [HNT] migration to the Solana chain provided a fillip to liquidity on the network.

At the time of writing, Solana held assets worth more than $572 million, representing a change of 18% over the last 24 hours. This was also the highest total value locked (TVL) recorded on the chain in over five months.

Solana gets busy

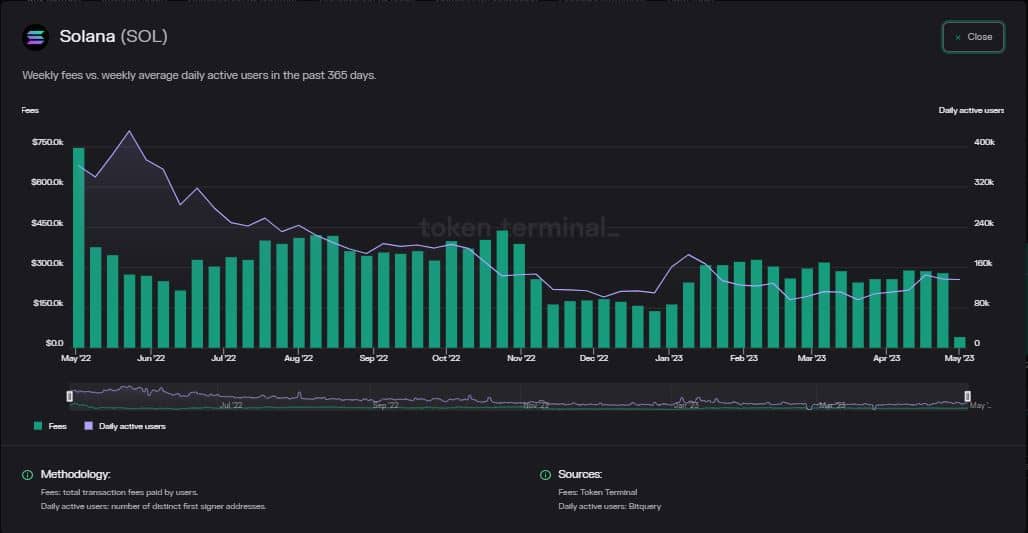

Some of the other key performance indicators of Solana have also exhibited promising recoveries. As shown by Token Terminal, the weekly transaction fees generated on the network inched toward the pre-FTX levels.

However, the same was not seen for users participating on the network as the weekly average of daily active users still hovered around 100k, a far cry from the average of 200k users before the collapse.

Realistic or not, here’s SOL’s market cap in BTC terms

At press time, SOL exchanged hands at $21.85, still 41% lower than the price just before the FTX collapse, data from CoinMarketCap revealed.

The nominal value of SOL’s Open Interest (OI) was $263 million as per Coinglass, representing a fall of nearly 17% over the last two weeks.