Solana’s TVL increases, but key metrics decline with the price

- Solana receives a $15 million liquidity boost, and its TVL surges over 21%.

- Active wallets and new token accounts on Solana show a steady decline while SOL price remains largely unaffected.

Solana [SOL] received a much-needed injection of positivity during the week as one of its chains infused liquidity into the network. While this development is certainly encouraging, it remains to be seen whether the injections will have a positive impact on other key metrics of the network.

Read Solana [SOL] Price Prediction 2023-24

Solana’s TVL receives a boost

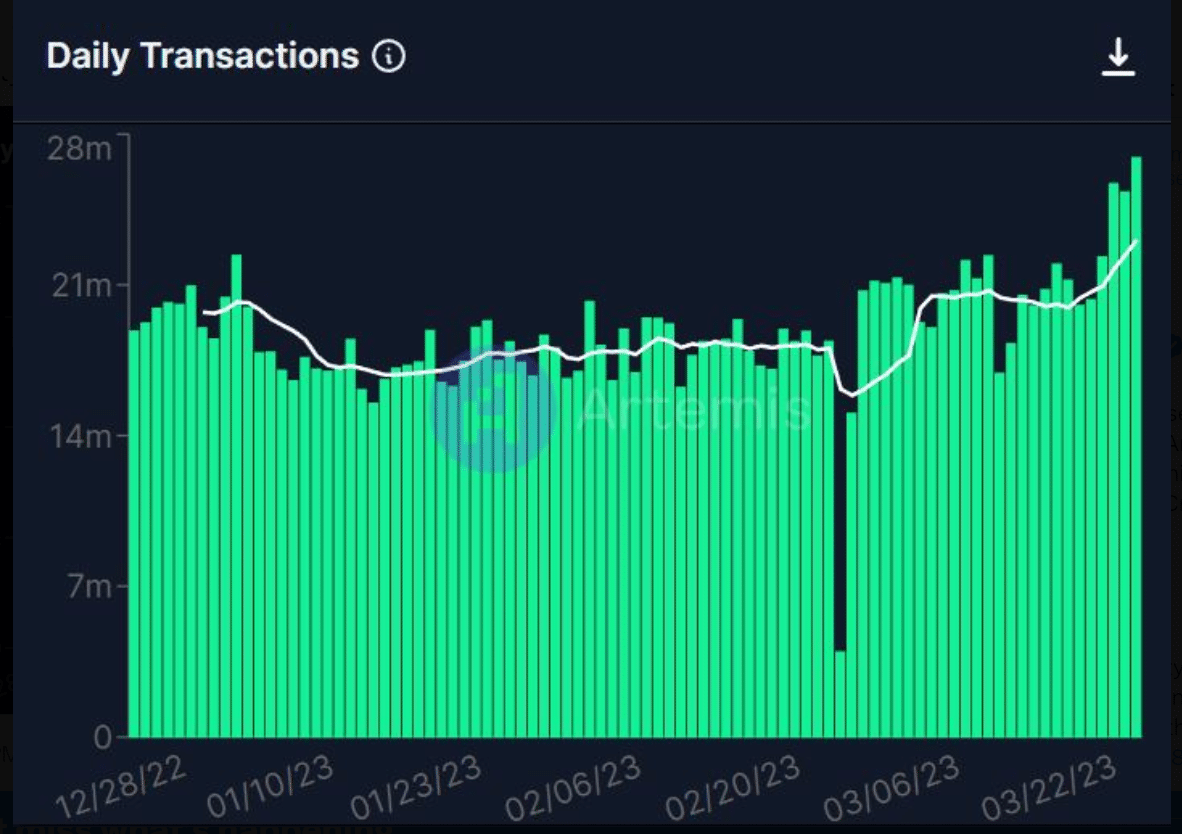

Artemis data revealed that Solana experienced a significant uptick in its Total Value Locked (TVL) for the first time in several months. Solana’s TVL has skyrocketed by over 21% in the past week alone, and transaction volumes have reached their highest point in three months.

A post suggested that this surge in TVL could be attributed to HxroNetwork, a decentralized protocol on the Solana network, injecting a whopping $15 million of liquidity. This liquidity infusion has undoubtedly breathed new life into Solana’s network.

Active wallets and new token accounts check

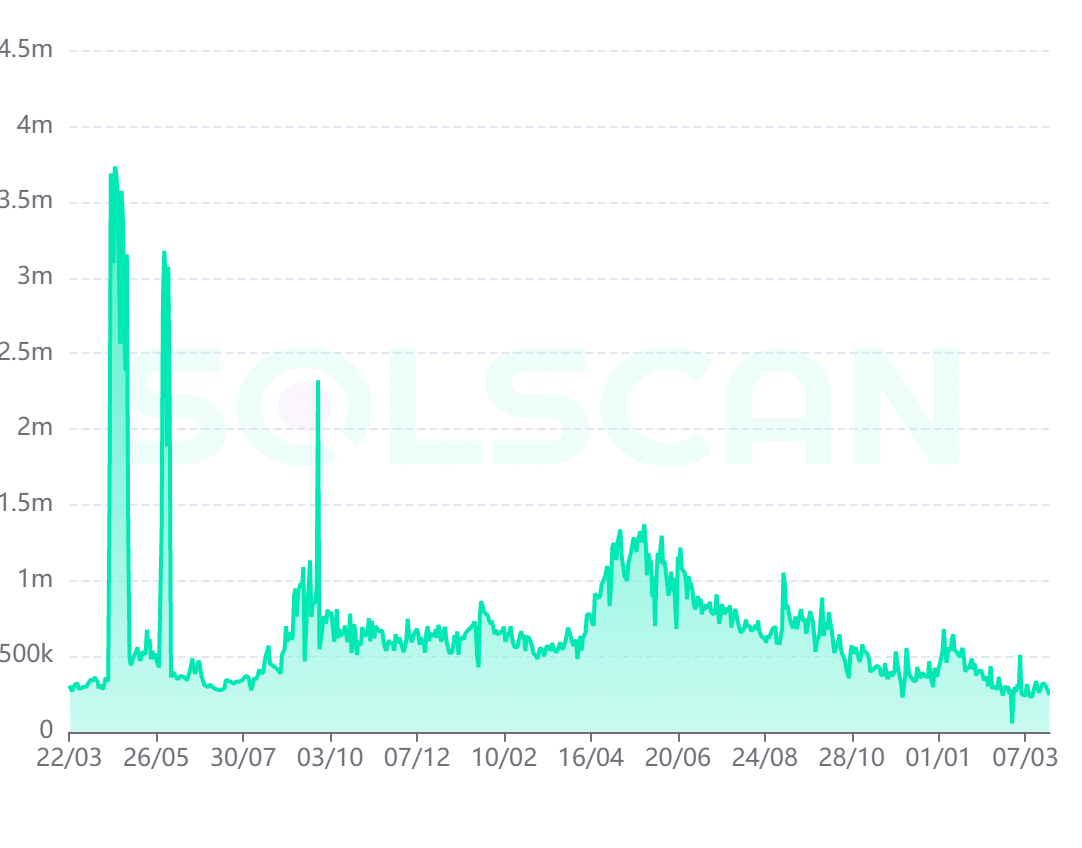

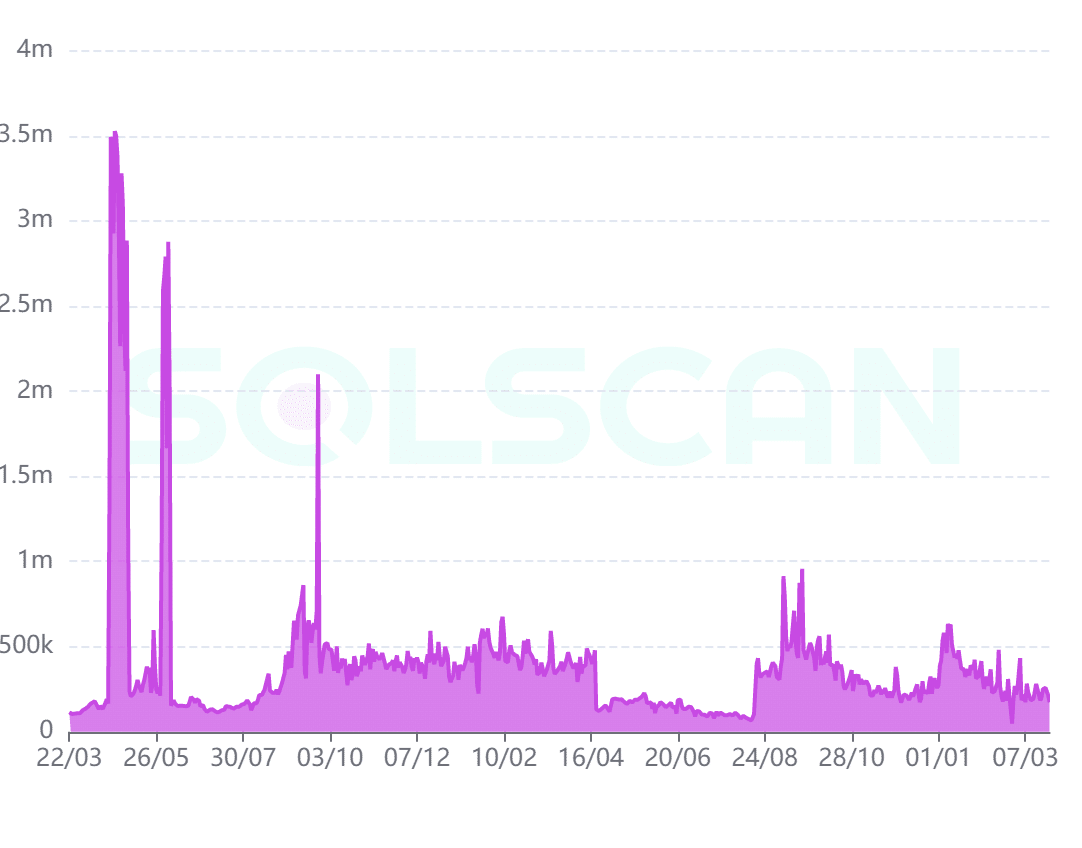

Following the remarkable increase in Solana’s Total Value Locked (TVL), it’s only natural to wonder if other key metrics on the network have also been impacted. Solscan was consulted to assess the status of active wallets and new token accounts on the platform.

A close inspection of Solana’s active wallet chart showed a steady decline in the number of active wallets on the network. The chart indicated that January was the only month in 2023 where active wallets surpassed 500,000. Since then, the figure has gradually decreased and hovers around 271,000, at the time of writing.

Similarly, Solana’s new token account metric has also seen a significant decline. Over 600,000 new token accounts were created in January, but the number has been decreasing steadily ever since.

As of this writing, the figure stood at around 212,770, indicating a substantial drop from the earlier peak.

Price impact?

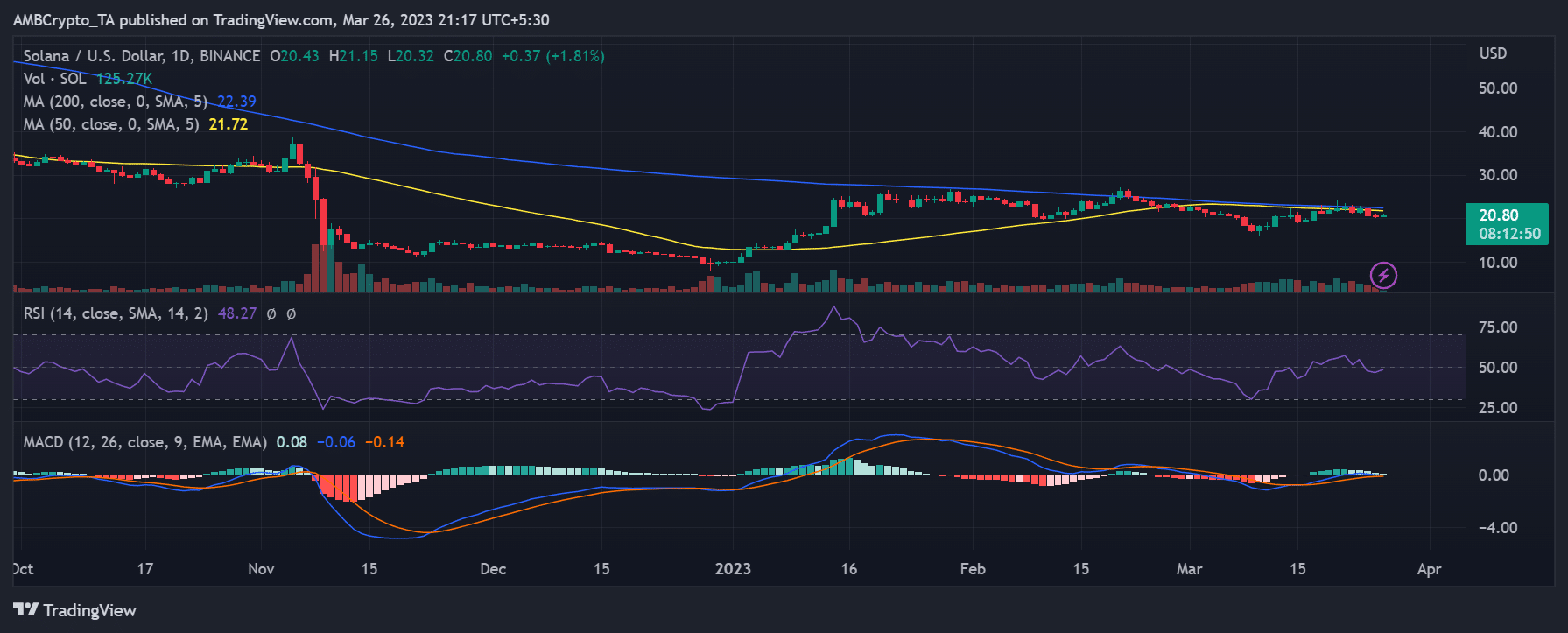

Solana’s price showed signs of recovery, bouncing back almost 2% after experiencing two consecutive days of decline. At press time, SOL was trading around $20.8.

It’s worth noting that the long and short Moving Averages (blue and yellow lines) acted as resistance around $21 and $22. However, there was potential for a golden cross formation if the price continued to move up.

Is your portfolio green? Check out the Solana Profit Calculator

Furthermore, the recent surge in TVL and liquidity injection by HxroNetwork did not seriously impact SOL’s price movement. The current price recovery may provide investors with renewed hope.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)