Some respite for XRP, but here’s how long the good times might last

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bulls were unable to mount a significant fight at the range lows, highlighting seller strength

- XRP seems likely to follow BTC south on the price charts

Bitcoin [BTC] was unable to defend yet another support level at $27.7k, reinforcing the bearish pressure. This was reflected across the crypto-market, with altcoin prices continuing to tank. XRP bears had control of the momentum, and a bounce towards the $0.465-level would present a selling opportunity.

Read XRP’s Price Prediction 2023-24

XRP bulls hoped that the range formation around the $0.5-area could result in another rally to breach the $0.6-resistance. However, the fall under the mid-range mark flipped the structure to bearish.

Slump beneath the range lows meant a revisit to $0.4 is possible

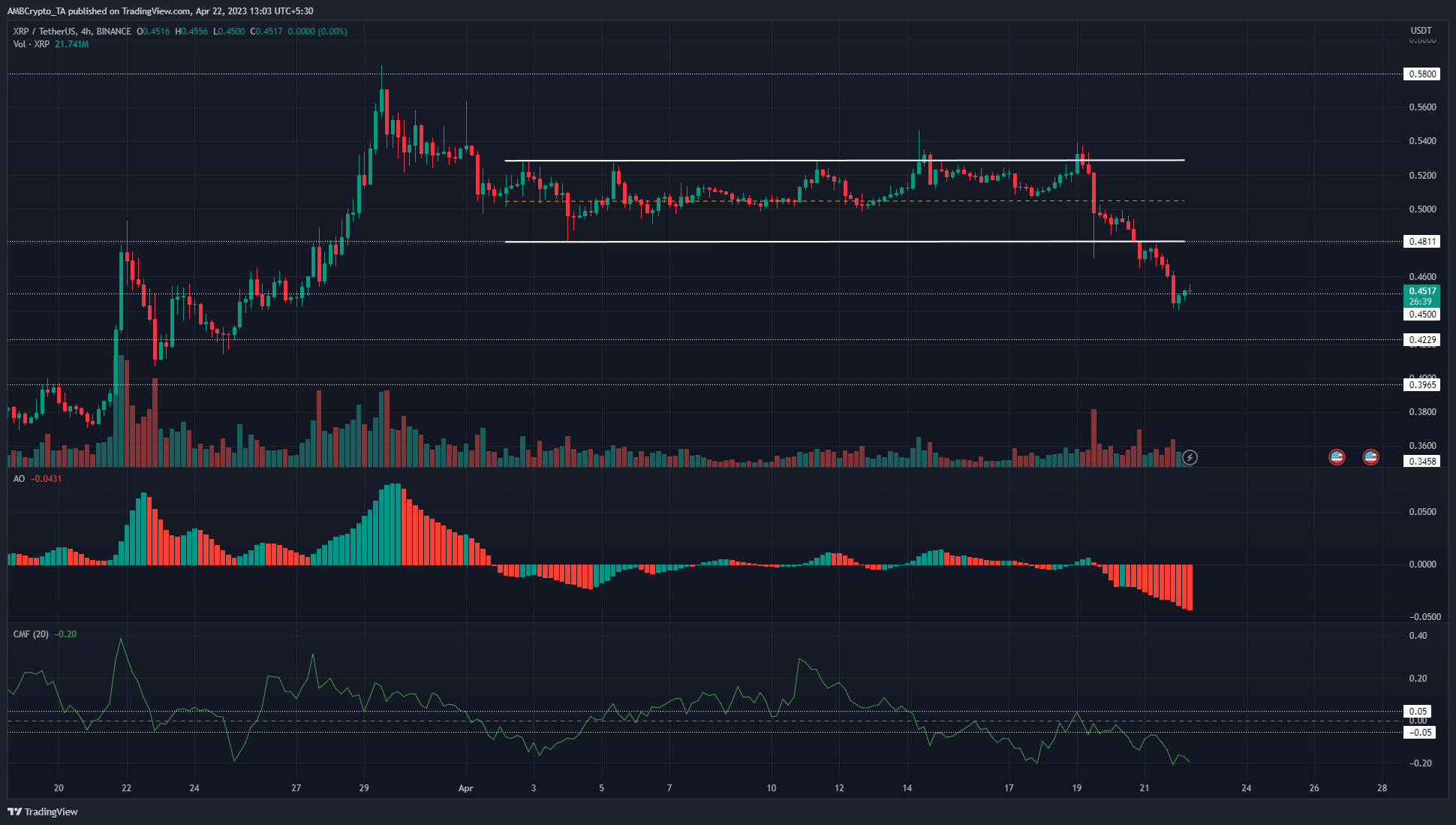

In April, XRP ranged within the $0.48-$0.528 levels (white). This, after a strong rally in March that took XRP from $0.36 to $0.58. The formation of a near three-week range after such a strong pump pointed towards a phase of accumulation or distribution.

There was evidence that this was accumulation, as demand was present behind the asset. However, the shift in sentiment after Bitcoin fell below $30k was too much for the bulls to cope with. And, they ceded the range lows.

Is your portfolio green? Check XRP Profit Calculator

The Awesome Oscillator did not yet show a bullish divergence, so we can expect the bearish momentum to continue over the weekend. The $0.45-support zone could stall the bears. The CMF highlighted heavy capital flows out of the market. Hence, further losses are likely for XRP. The next levels of support lay at $0.42 and $0.406.

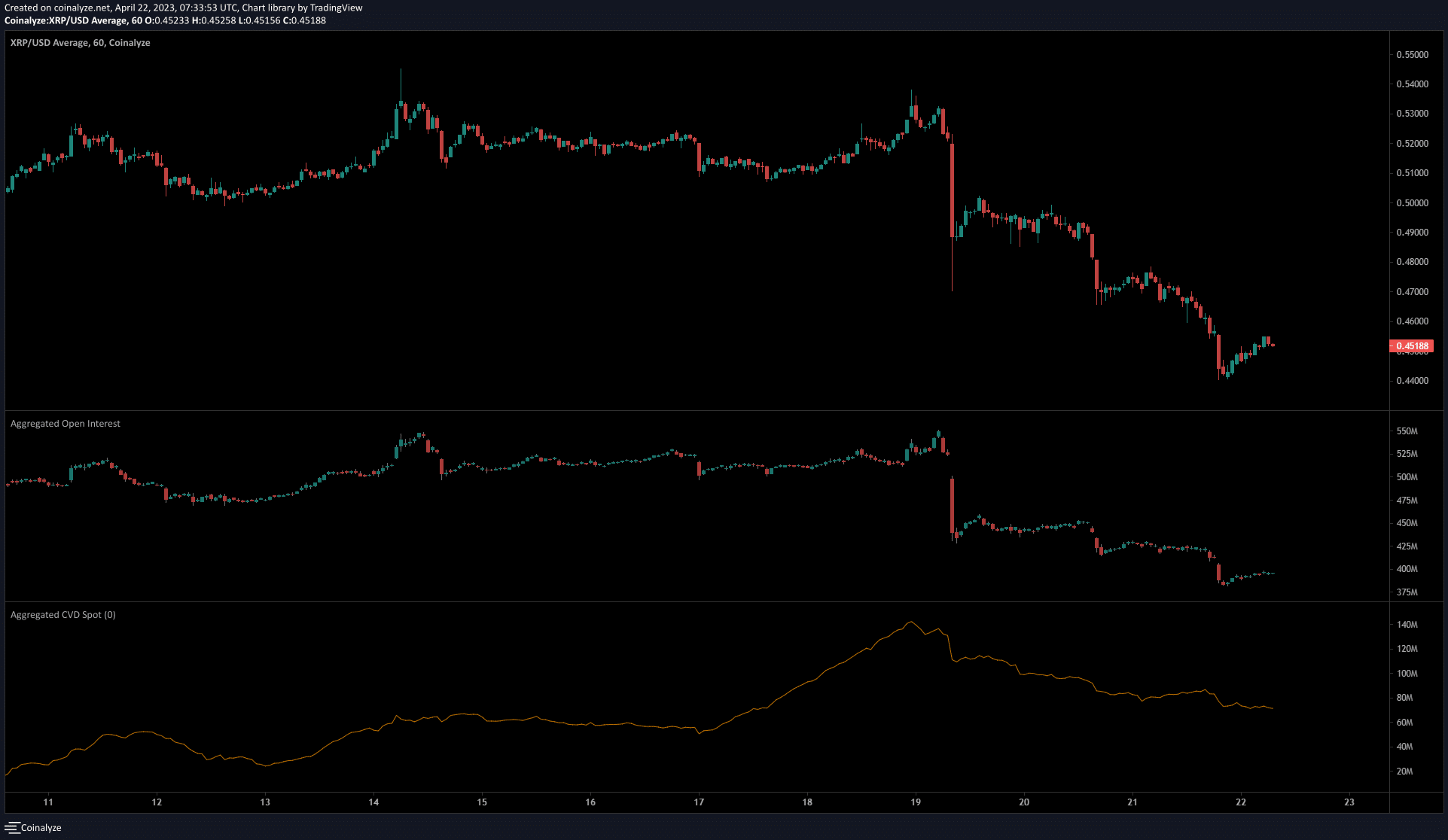

CVD took a U-turn after demand in mid-April

Source: Coinalyze

The Open Interest nosedived in recent days, alongside the price. The OI showed no signs of recovery when XRP saw a minor bounce from $0.48. This was a sign that bullish speculators chose to stay out of the market.

The spot CVD had been on the rise earlier this month. However, the past week’s selling activity brought this metric crashing down. With this decline, the bulls’ hopes of a rally past $0.6 were broken as well.