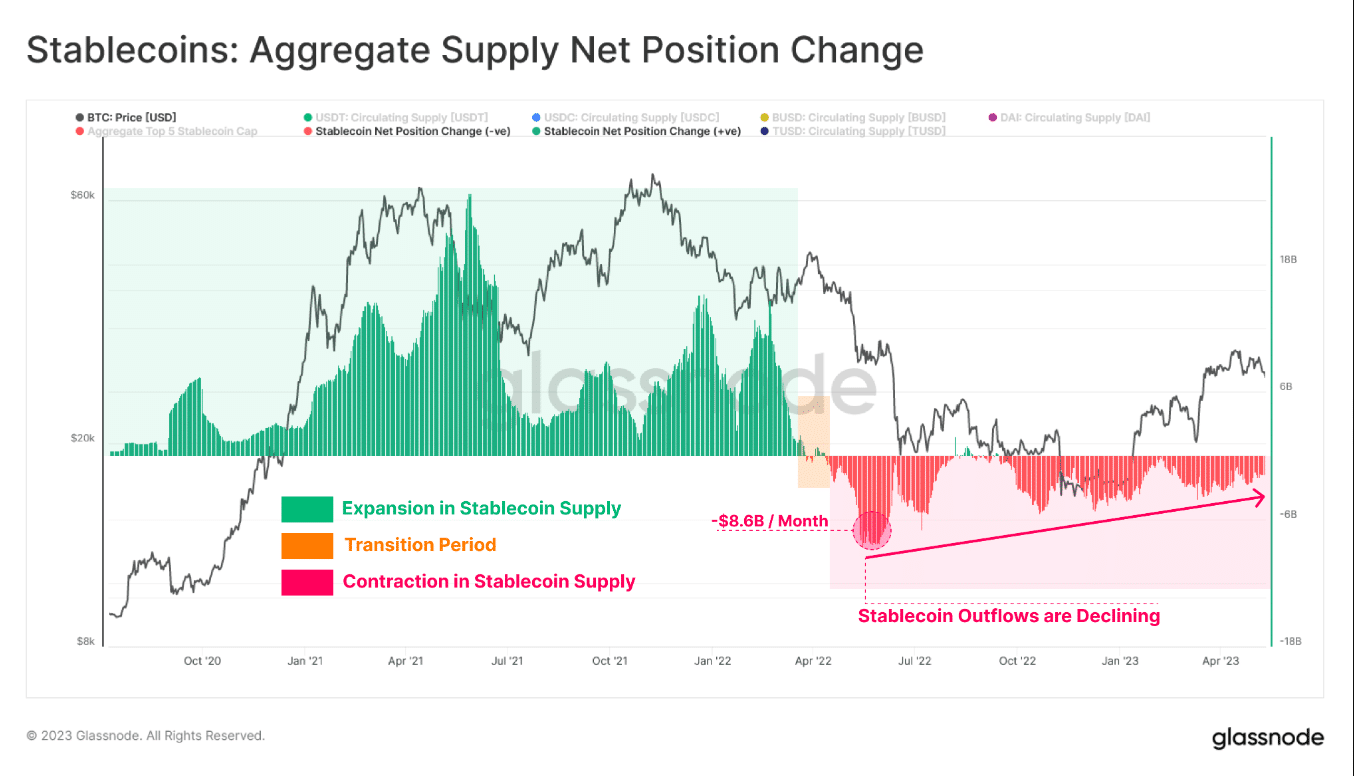

Stablecoin outflows diminish, signaling potential shift in market sentiment

- The Stablecoin market exhibited resilience amidst market turbulence, revealing true market sentiment.

- A decrease in outflows signalled a potential for a bullish turnaround, sparking hope for a market rebound.

The ebb and flow of stablecoins provide a captivating glimpse into the market’s mood at any moment. Though the market may appear tempestuous, the true sentiment lies in the intricate dance of stablecoins.

Recent data attests to their behavior, vividly depicting the market’s actual state.

Stablecoin inflow picks up steam

Examining the Netflow data provided by CryptoQuant offered valuable insights into the overall movement of stable assets. From a broad perspective, it became apparent that outflows prevailed, indicating a decrease in liquidity within the space.

However, 13 May data from Glassnode presented a different angle when considering the monthly supply change from a higher timeframe standpoint.

It revealed a decline in stablecoin outflows, signaling a glimmer of hope as demand and capital return to the digital asset landscape.

In the aftermath of the Luna collapse and the recent FTX crash, there was a significant exodus of stablecoins.

Market participants swiftly redeemed their tokens following the LUNA collapse, resulting in a peak monthly outflow of -$8.6 billion. This massive movement caused a severe depletion in supply.

Current strength of the stablecoin market

According to the latest data from CoinMarketCap, the stablecoin market boasted a market capitalization of over $130.5 billion.

Moreover, the trading volume surged to exceed $18.7 billion. Within this landscape, Tether [USDT] was in the lead in market capitalization and trading volume. As of this writing, Tether’s market cap exceeded $82.8 billion.

Also, it had a 24-hour trading volume of over $14.6 billion, surpassing more than half of the total trading volume recorded.

In the second position, USDC Coin [USDC] solidified its standing as the second-largest stablecoin, boasting a market cap of nearly $30 billion and a 24-hour trading volume of $1.7 billion.

Stable inflow incoming?

While we have not yet witnessed a resurgence of dominant stablecoin inflows, the recent decrease in outflows suggests that we may be gradually approaching that level.

As the outflow diminishes and capital begins to flow back into the space, there is a potential for a shift in overall sentiment towards a more bullish outlook. This, in turn, could pave the way for a market bounce, offering renewed hope and positive momentum.