Stablecoins surge as Western Union and MoneyGram struggle to keep up – Here’s why

- Stablecoins are redefining their role, moving beyond their traditional ‘safe-haven’ status.

- A major shift is underway that could transform the entire financial landscape.

When Bitcoin [BTC] stumbles, stablecoins often take the spotlight as the crypto market’s “safe-haven.” But their role has grown far beyond just protecting investors.

Today, stablecoins are making their mark in the real economy. In global trade, for example, they are becoming a popular alternative to the U.S. dollar, helping settle cross-border deals for major commodities like oil and crops. However, their influence extends beyond just finance.

Stablecoins are now doubling down on tech giants

Stablecoins are rapidly becoming the preferred option for international money transfers, and it’s easy to see why. Their ability to send funds instantly is outpacing traditional banking systems.

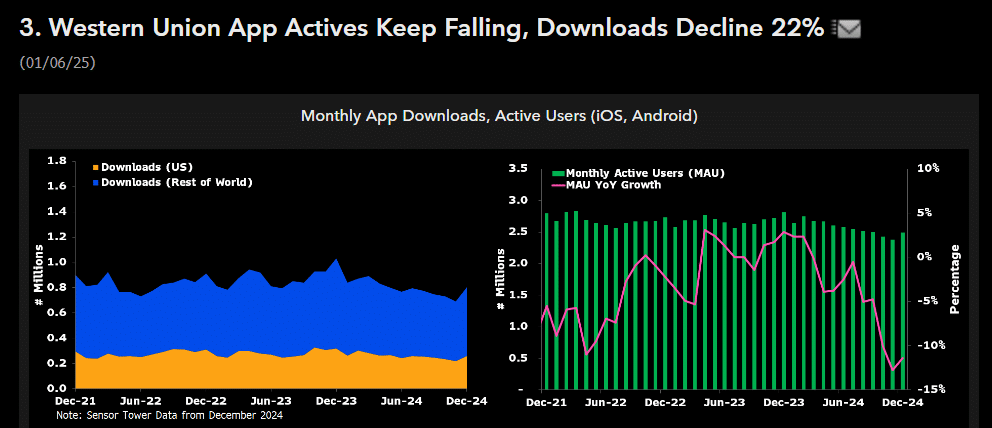

Matthew Sigel from VanEck recently highlighted a key shift. Major players like Western Union and MoneyGram are struggling, with Western Union seeing a 22% drop in app usage and MoneyGram facing a 27% decline.

Even more telling is that their monthly active users have been stuck under 3 million since 2021, indicating that fewer people are turning to their services.

And it’s not something to overlook. These companies dominate the remittance space, with market caps of $302 billion and $92 billion, respectively.

However, with stablecoins now surpassing $200 billion in market cap, they’re becoming serious competition. Clearly, it’s a shift that’s hard to ignore.

But what is driving this shift?

Stablecoins may be pegged to the U.S. dollar, but they’re far from a typical currency.

Thanks to blockchain technology, transactions are faster, cheaper, and more efficient, giving them a significant advantage over traditional remittance services, which often come with high fees and delays.

As the U.S. dollar wobble under rising interest rates, stablecoins are emerging as the preferred option for international payments.

Why? While the dollar’s volatility can make imports more expensive and fuel inflation, stablecoins remain stable, offering more predictable transactions for businesses, individuals, and countries.

Read Bitcoin’s [BTC] Price Prediction 2025-26

This shift is just beginning, as stablecoins are already proving their value beyond finance and technology.

With the Federal Reserve’s plans for higher interest rates, a soaring dollar index, and risky assets like Bitcoin and stocks under pressure, stablecoins are emerging as the ultimate safe-haven asset of the year.