Stablecoins to be ‘legal electronic money’ by 2025? Circle CEO says…

- Data suggest that stablecoin adoption has risen exponentially in the past four years.

- Circle CEO predicts stablecoins will become widely recognized as legal electronic money globally by 2025.

Amidst a broader market uptrend, stablecoins have become the talk of the town. Even countries like the United States, traditionally cautious about cryptocurrencies, are softening towards them.

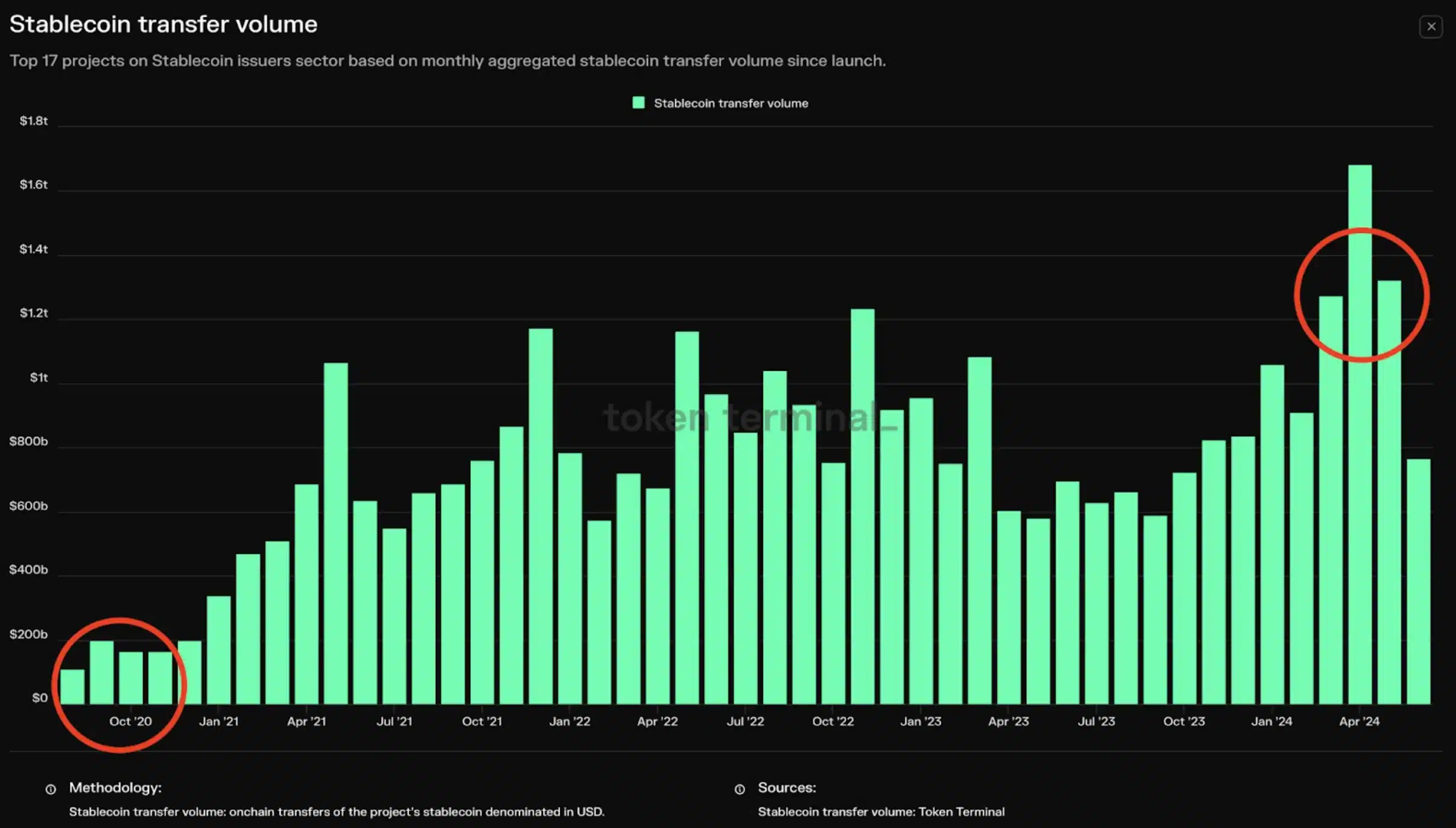

Reportedly, the volume of transfers involving stablecoins has skyrocketed, marking a substantial 1,600% increase over the past four years.

According to data from Token Terminal, monthly stablecoin transfer volumes surged from $100 billion in October 2020 to an unprecedented peak of $1.68 trillion in April 2024.

This surge underscores the remarkable growth and influence of stablecoins within the cryptocurrency sector.

Allaire’s positive outlook on stablecoins

Expanding on the topic, Circle CEO Jeremy Allaire took to X and highlighted,

“Stablecoins are becoming a legally defined and accepted form of digital money in nearly every major jurisdiction in the world. By the end of 2025, stablecoins will be “legal electronic money” almost everywhere, which sets them up to become a larger and larger portion of the $100T+ market for electronic money.”

This underscores the growing adoption of stablecoins and how they work like a bridge between traditional finance and cryptocurrencies.

Data sets show…

Further validating this trend, the Visa on-chain analytics’ stablecoin dashboard reveals that over the past 30 days, more than 31.2 million active users conducted a staggering 353 million transactions.

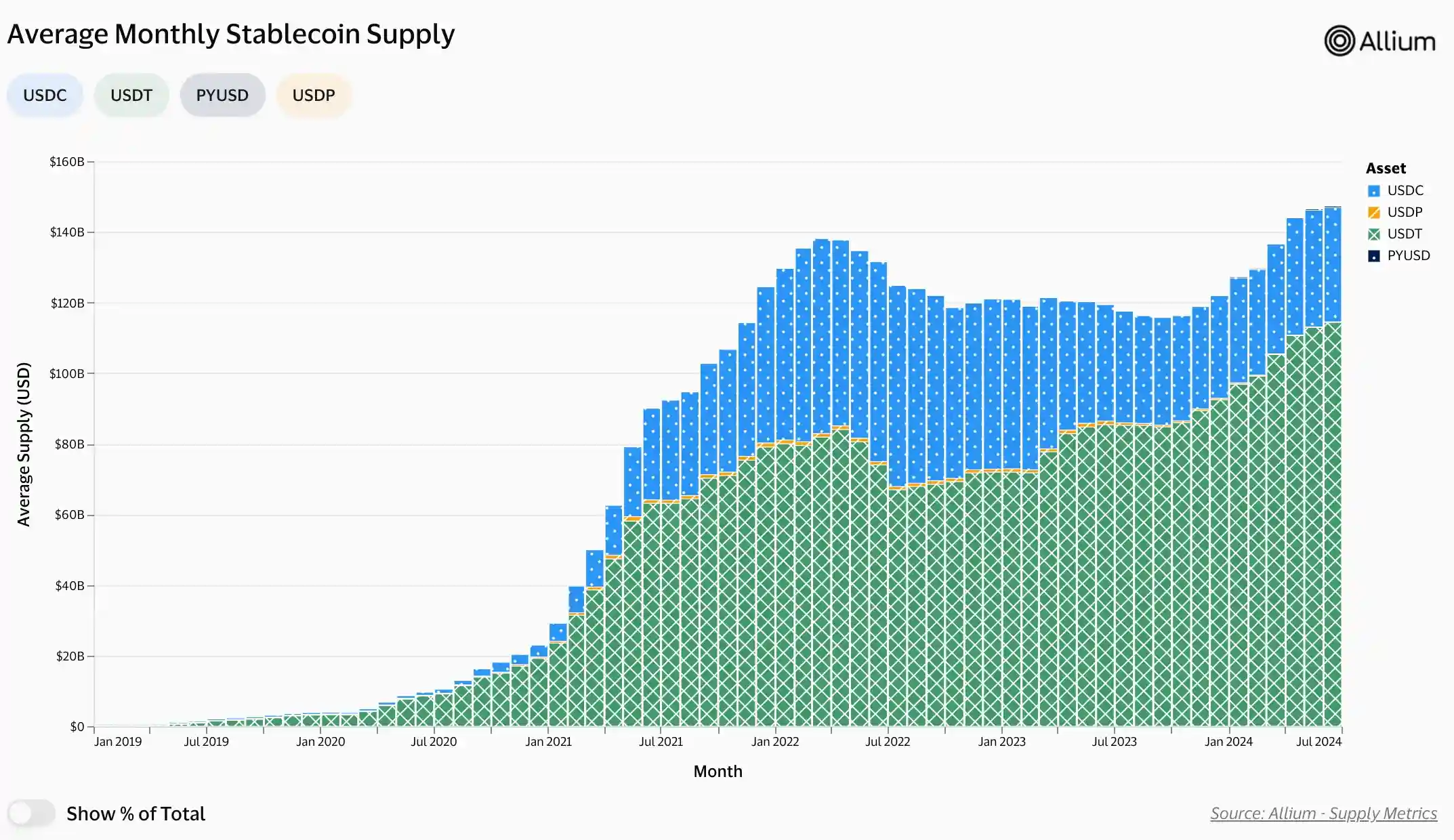

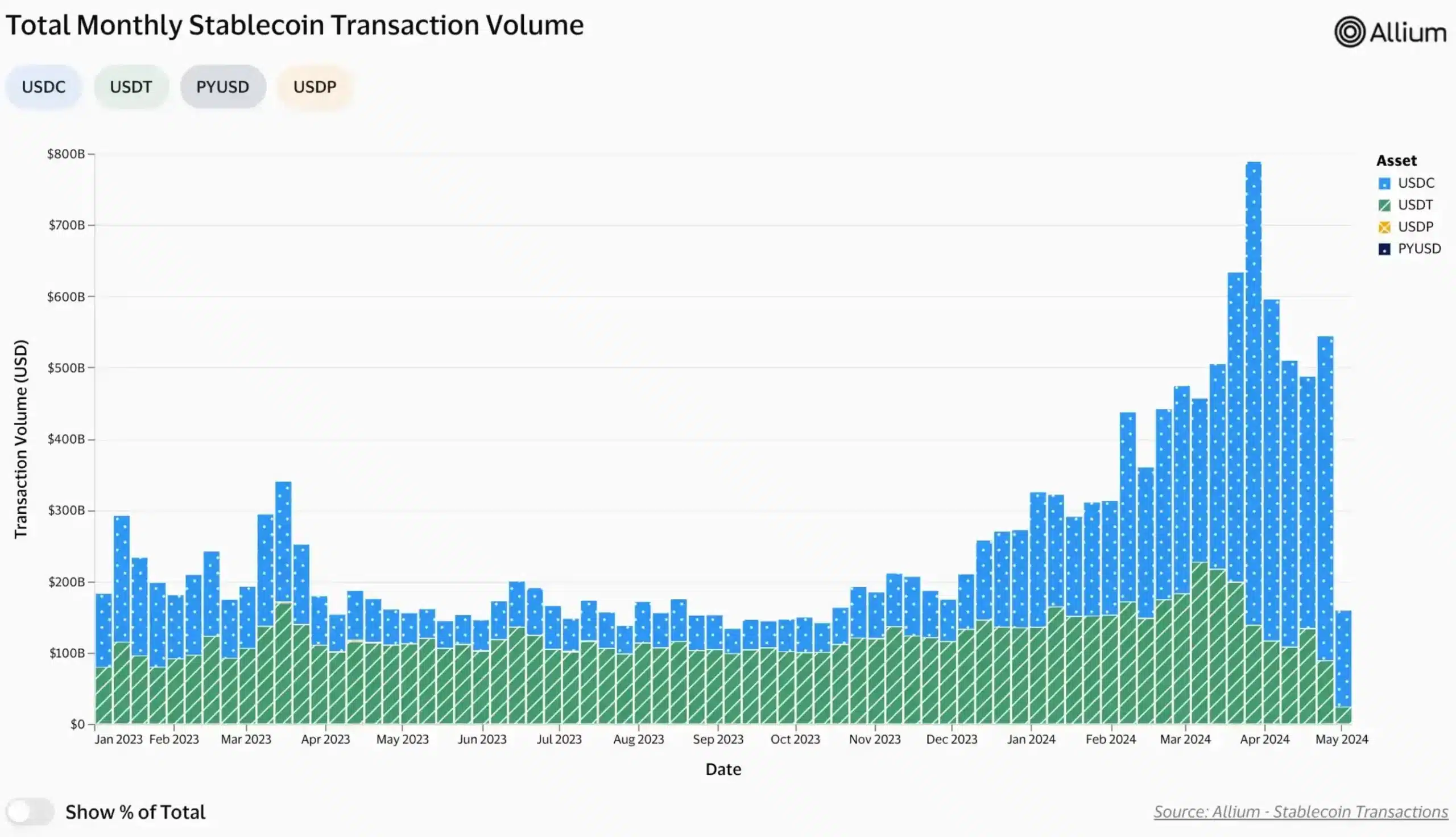

In fact, if we compare the performance of the two most prominent stablecoins i.e. Circel’s USDC and Tether USDT.

In April, USDC emerged as the stablecoin with highest transactions of 166.6 million, surpassing Tether USDT which stood at 163.6 million transactions.

However, as of the latest update, USDT is topping the charts with USDC following the trail.

Allaire further added,

“Stablecoins have exploded in scale and use, crypto clearest killer app, unleashing digital dollars in the world, bringing more people into the future onchain economy, and starting to fulfill the promise of banking the unbanked, lower the costs of remittances, and unlocking more seamless cross-border commerce.”

Stablecoins: A savior for crypto?

Cryptocurrencies such as Bitcoin are more volatile and thus, fluctuate significantly in value over short periods. To counter this instability, stablecoins emerged as the more reliable alternative.

This was also the reason why major industry players such as Stripe and PayPal have embraced stablecoins like USDC, integrating them into their payment systems.

The step not only makes digital payments more accessible but also confirms stablecoins’ role in global transactions.

As things unfold, the growing support for stablecoins signals a surge in their adoption and of the broader crypto market. In Allaire’s words,

“We’re still in the VERY EARLY STAGES in the adoption of crypto. That’s insanely bullish.”