Stablecoins yet to recover despite market rebound – Why?

- Stablecoin market cap was $129.5 billion at press time, compared to $139 billion in December 2022.

- Ethereum lost 27% of its stablecoin market cap since the beginning of the bear market.

Many experts believe that the ongoing rally, which began in mid-October, marks the beginning of an extended bull market for the crypto assets market.

Indeed, top cryptos, including Bitcoin [BTC], have been successful in reclaiming pre-bear market levels.

Generally, such a period is characterized by a strong influx of stablecoins. This is because most traders would use stablecoins to enter and exit trades on crypto exchanges.

However, the reality was a bit different. As per AMBCrypto’s analysis of DeFiLlama’s data, the overall value of stablecoins failed to increase appreciably despite a significant pump in the market.

Stablecoin supply remains suppressed

The total market cap of all stablecoins in circulation was $129.5 billion as of this writing, as compared to $139 billion in December 2022.

The stablecoin market began to decline after the dramatic collapse of Terra USD [UST] last year. With sentiment in the broader market turning bearish, trading activity declined, and with it, the demand for stablecoins.

To get a sense of the damage done, the stablecoin market value peaked at $188 billion in the weeks preceding the UST implosion. At press time, its value was 31% less than the peak.

Is capital not flowing from TradFi?

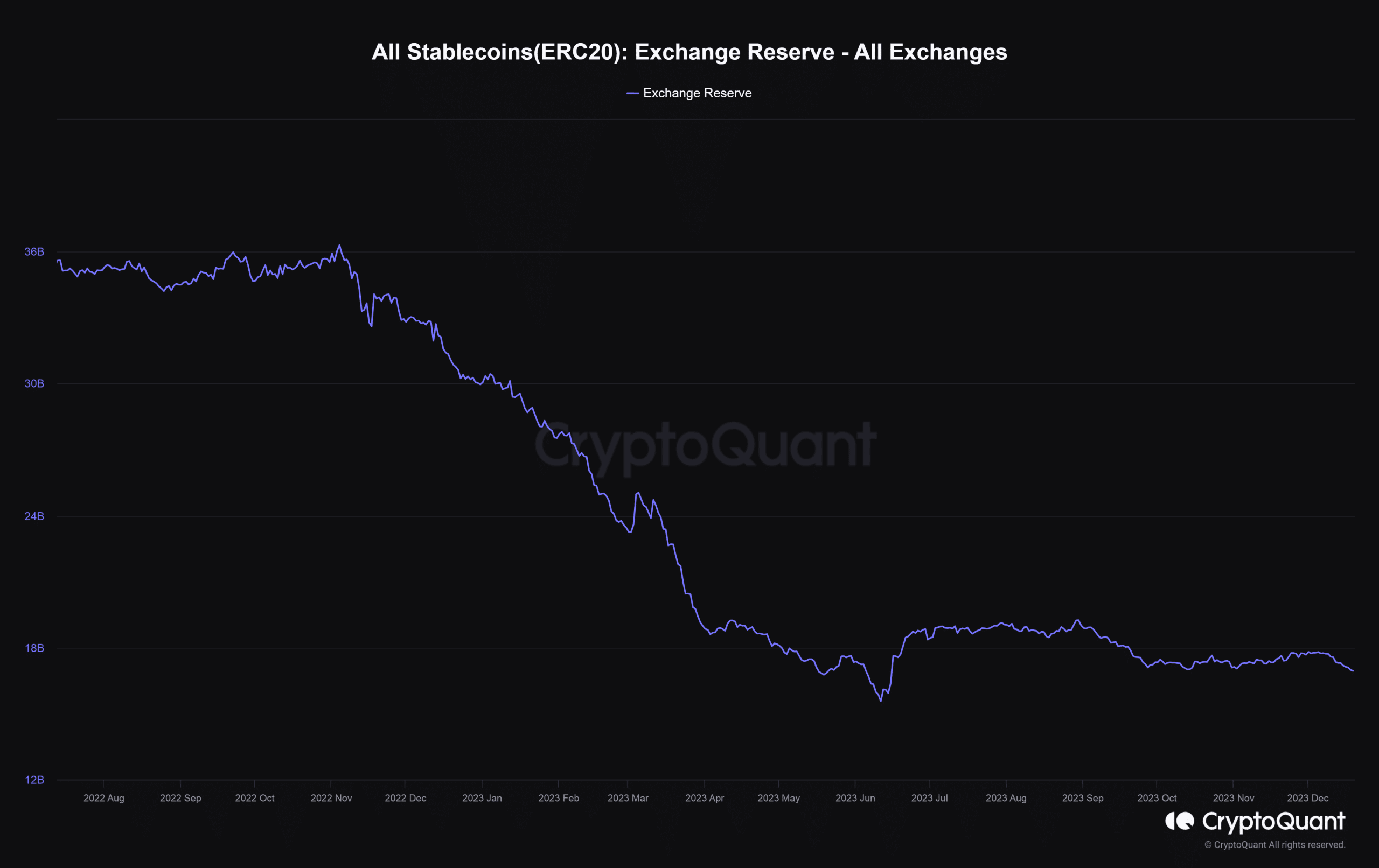

The total supply of stablecoins on crypto exchanges was still significantly lower when compared to last year.

As per AMBCrypto’s examination of CryptoQuant’s data, 16.9 billion ERC-20 stablecoins were held in exchange wallets as of this writing, compared to 30 billion during the same time last year.

Typically, a spike in stablecoin exchange reserves indicates strong buying pressure and bullish sentiment in the market.

The fact that stablecoins haven’t moved considerably towards trading platforms proved that the ongoing rally was not powered by capital from the traditional market.

As explained earlier, stablecoins act as the bridge between the crypto market and the traditional market.

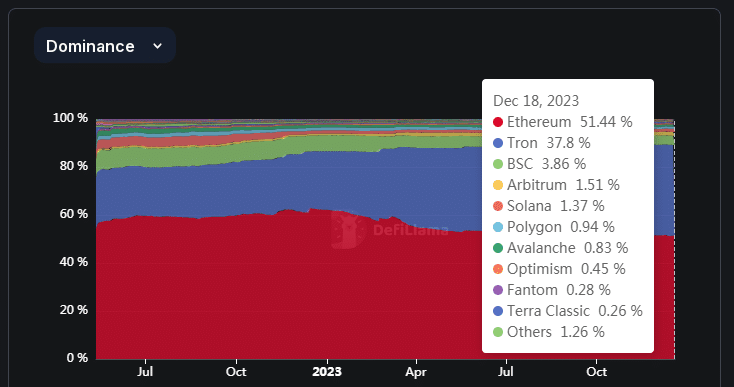

Upon further analysis, Ethereum [ETH] was found to be one of the biggest losers in stablecoins. The chain lost 27% of its stablecoin market cap since the beginning of the bear market in May 2022, data from DeFiLlama revealed.

On the other hand, Tron [TRX], witnessed a 37% increase in stablecoin supply in the same period.