Stacks [STX] gains newfound attention from investors, but will its uptrend last

- Stacks’ social metrics increased, triggering a price hike.

- Buyers and sellers are in a heated bit for control.

As a new week begins, assets that were deprived of attention in the last seven days have been getting noticed by investors. Stacks [STX], the Bitcoin [BTC] layer for smart contracts, was one such token, as revealed by LunarCrush.

Read Stacks’ [STX] Price Prediction 2023-2024

According to the social intelligence provider for the crypto industry, Stacks’ social engagements, mentions, and dominance jumped over 100% in the last 24 hours. This hike implied that the community interaction, discussion, and traction were at incredibly top levels from a social perspective.

Combat between the nays and yeahs

Although the increase had subdued a little, the perception around the token had bullish tendencies. An in-depth assessment of LunarCrush showed that bullish sentiment had increased by 95% between 2 April and press time.

But the average bearish sentiment also had a similar trend. The metric specifically looked at posts that suggest cynicism over time. Therefore, STX was still subject to negative image despite its 316% 90-day price increase.

However, STX rode with the expectations of the bulls, increasing by 3.82% in the last 24 hours.

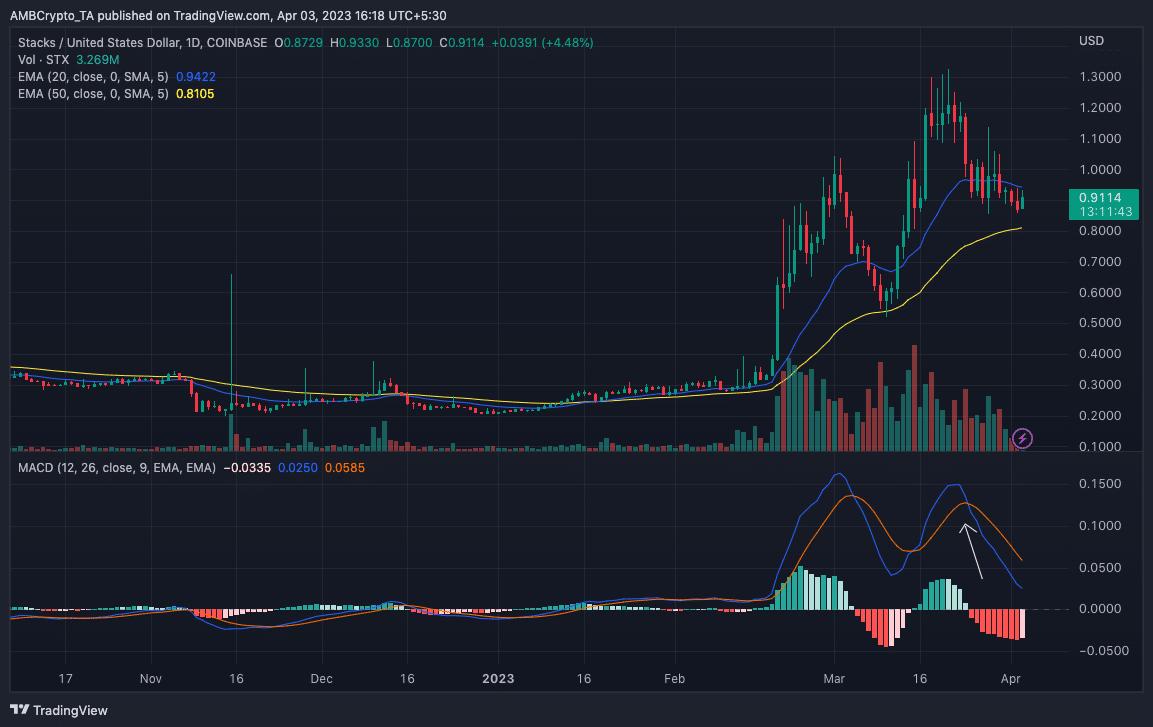

Based on the daily chart, the 20 EMA (purple), which had crossed the 50 EMA (yellow) on 23 January, had maintained the same position at the time of writing. This stance implied that traders were bullish on STX, and the cryptocurrency had the potential to establish a new uptrend.

Furthermore, the Moving Average Convergence Divergence (MACD) displayed a different trend from the EMAs. The MACD condition, as of this writing, showed that the orange dynamic lines rose above the blue.

Another notable part of the MACD trend was how it crossed the signal line (arrowed) into the downward path. Hence, this could serve as a confirmation of the corresponding bearish trend.

TVL is riding on the downtrend

Besides its price action, there has been significant change in Stacks’ Total Value Locked (TVL). The TVL measures the amount of unique smart contract deposits in a protocol. Up until 25 March, Stacks’ TVL was on a rapid increase.

Realistic or not, here’s STX’s market cap in BTC’s terms

However, since 26 March, the value had significantly dwindled, bottoming at $25.5 million. This decrease meant that Stacks was beginning to lack usability among investors. Moreover, these participants were no longer willing to lock up assets in the project’s linked contracts.

However, it seemed that STX remained one of traders’ top options, mostly in part due to its 24-hour 230% rise in volume. Such a high rate depicted that a lot of buying and selling was going on with the token at press time.

![Stacks [STX] social metrics](https://ambcrypto.com/wp-content/uploads/2023/04/Screenshot-2023-04-03-at-10.52.10.png)

![Stacks [STX] bullish and bearish sentiment](https://ambcrypto.com/wp-content/uploads/2023/04/Screenshot-2023-04-03-at-11.00.20.png)

![Stacks [STX] TVL](https://ambcrypto.com/wp-content/uploads/2023/04/Screenshot-2023-04-03-at-11.55.33.png)